The Bourse Weekly Performance (Week ended April 6, 2014)

The Bourse Weekly Performance (Week ended April 6, 2014)

LSL Weekly Market Focus

LSL Weekly Market Focus

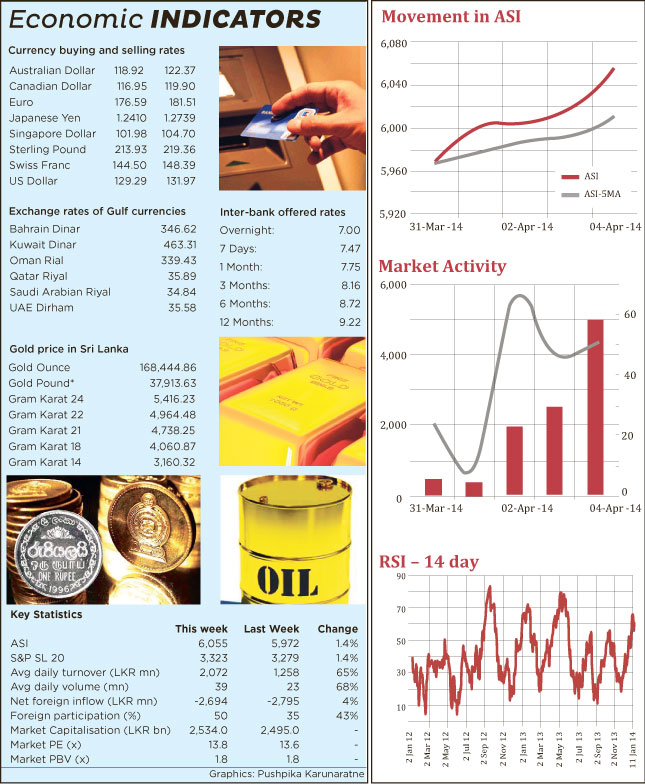

On Tuesday Colombo bourse regained lost ground as the ASI closed at 6,001.83, up by 33.52 index points (+0.56%) while 20-script S&P SL index closed at 3,299.90, up by 19.98 index points or 0.61%. Market turnover was LKR 341mn. Shalimar (LKR 117mn) topped the turnover list followed by John Keells Holdings (LKR 40mn) & Sampath Bank (LKR 24mn). Moreover John Keells Holdings main share and two warrants (warrant 22 & 23) attracted heavy investor participation. Foreign investors were net buyers with an inflow of LKR 181mn. Foreign participation was 32%.

Colombo shares ended with mixed results on Wednesday as indices closed in opposite directions. Bench mark All share price index marginally advanced by 2.95 (+0.05%) points to end at 6,004.78 and S&P SL 20 index declined by 17.96 (-0.54%) points to end at 3,281.94. Daily market turnover was LKR 1.95bn. John Keells Holdings (LKR 894mn) made the biggest contribution followed by Hotel Reefcomber (LKR 399mn) and Softlogic Holdings (LKR 231mn). Moreover, shares of Softlogic Holdings, John Keells Holdings, John Keells Holdings W0022 and W0023 traded heavily during the trading session. Foreign participation was 31% as net foreign investors continued to be foreign buyers with a net inflow of LKR 853mn. Meanwhile in T-bill auction, 3-month and 6-month treasury yields eased marginally while the 12-month yield was unchanged at 7.05%. The 3-month and 6-month rates dropped to 6.64% (-1bp) and 6.81% (-1bp) respectively.

On Thursday Colombo stock market managed to end positively as both indices closed with higher returns. ASI gained 19.77 index points or +0.33% to closed at 6,024.55 while 20 scrip S&P SL index gained 21.85 index points or +0.67% to closed at 3,303.79. Daily market turnover reached LKR 2.6bn with support of several off the board transactions recorded in John Keells Holdings (7.51mn shares at LKR 233.60-234.00) and Bairaha Farms (0.35mn shares at LKR 148.00). Accordingly John Keells Holdings reported the highest turnover of LKR 1.8bn followed by Bairaha Farms (LKR 52mn) and Piramal Glass (LKR 43mn). Moreover Softlogic Holdings, Primal Glass & Expolanka attracted heavy investor participation. Foreign Investors were net buyers with a net inflow of LKR 298mn. Foreign participation was 78%.

Equity market concluded weekly operations on Friday in a positive note, recording 21-month high turnover of LKR 5.04bn. Both indices closed with positive returns as All share price index advanced by 36.08 (+0.60%) points to close at 6,054.55 and S&P SL 20 index advanced by 27.60 (+0.84%) points to close at 3,323.10. Progression of share prices in counters such as Ceylon Tobacco (closed at LKR 1,075.00, +2.5%), Sri Lanka Telecom (closed at LKR 49.50, +3.6%) and Commercial Bank (closed at LKR 125.00, +2.4%) contributed favorably to the performance of the indices.

John Keells Holdings (LKR 4.4bn) topped the turnover list with a total volume of 18.8mn shares. JKH closed at LKR 233.00, +1.3%. Approx. 30.1mn shares of JKH, which accounts for nearly 3% of the total shares of the company, were traded during last three trading sessions. Further, Commercial Bank and Lanka IOC positioned as next best contributors to the market turnover with a contribution of LKR 224mn and LKR 64mn. Several negotiated deals were recorded in Lanka IOC (approx. 1.3mn shares at LKR 39.80 per share), Bairaha Farms (approx. 0.25mn shares at LKR 146.50 per share) and Commercial Bank (approx. 1.07mn shares at LKR 125.00 per share).

Gainers outweighed the losers 111 to 63, while 58 counters remained unchanged during the trading session. Cash map improved to 96% from previous day’s 78%.

Meanwhile PC House, Blue Diamond and John Keells Holdings W0023 managed to attract heavy investor interest during today’s trading session.

Foreign participation accounted for 48% of the market activity. Foreign investors were net sellers with a net outflow of LKR 4.1bn. Net foreign outflows were seen in John Keells Holdings (LKR 4.3bn), Aitken Spence (LKR 17.8mn) and Chevron Lubricants (LKR 17.7mn) whilst net inflow was mainly seen in Commercial Bank (LKR 222.4mn).

Moreover, according to the announcement made to CSE by Touchwood Investments, the court granted the company an opportunity to reply to the submission filed by petitioners on 23rd April 2014. The court has fixed the case for Order on 7th May 2014.

http://www.nation.lk

Home

Home