AEL Technical Analysis

Jimmy

Jimmy- Posts : 168

Join date : 2014-02-27

Location : Anuradapura

AEL Technical Analysis

AEL Technical Analysis

I am a AEL lover, with the current condition of the country, it is getting lover and lower. I panning to collect this share for long medium to long term as in my opinion, market could create positive trend towards the end of the year.

Have anybody done technical analysis on this share. Please share if there is an analysis.

Thank You

sereneTop contributor

sereneTop contributor

- Posts : 4850

Join date : 2014-02-26

Re: AEL Technical Analysis

Re: AEL Technical Analysis

Fundementally this is a good share with good dividend pay out.

But as of now all the decisions are taken on foward looking basis in the sector ; econony as a whole and the Performance of ASI it self.

With the possibility of EPF entering and the possibility of strong government in next year would be more appealing to AEL than it for some other shares in ny view

harieshaTop contributor

harieshaTop contributor

- Posts : 1329

Join date : 2014-04-09

Re: AEL Technical Analysis

Re: AEL Technical Analysis

Do not think the already initiated projects will stop or slow down due to what happened. Mostly the projects that are in the pipe line are with Chinese backing, including port city. China is continuing operations in more volatile regions. ie : Pakistan

This catastrophe happened when AEL was about to bank on the positive proposals in the last budget. So there's something that market didn't factored in yet.

Secondly, the collapse of MTD Walkers will have a positive impact on remaining contractors. It will be hard for MTD to recover now.

So as explained by serene investment horizon should be more than six months. I believe EPF will come in sooner than expected.

ruwan326

ruwan326- Posts : 1744

Join date : 2016-09-29

Age : 46

Location : Horana

Re: AEL Technical Analysis

Re: AEL Technical Analysis

hammurabi

hammurabi- Posts : 87

Join date : 2019-03-17

Location : Colombo

Re: AEL Technical Analysis

Re: AEL Technical Analysis

CKActive Member

CKActive Member

- Posts : 1393

Join date : 2015-11-01

Re: AEL Technical Analysis

Re: AEL Technical Analysis

nuwanmja

nuwanmja- Posts : 86

Join date : 2019-02-20

Age : 33

Location : Gampaha

Re: AEL Technical Analysis

Re: AEL Technical Analysis

NIRMALSG

NIRMALSG- Posts : 428

Join date : 2019-02-17

Location : Colombo

Re: AEL Technical Analysis

Re: AEL Technical Analysis

Hope this might help to understand about value of ACL

Asia-Securities-ACL-Cables-4Q-FY19-Earnings-Update-31-May-2019-1

xmartTop contributor

xmartTop contributor

- Posts : 732

Join date : 2015-01-17

Re: AEL Technical Analysis

Re: AEL Technical Analysis

harieshaTop contributor

harieshaTop contributor

- Posts : 1329

Join date : 2014-04-09

Re: AEL Technical Analysis

Re: AEL Technical Analysis

Will there be a issue? Ownership also might get change 10-20 years down the line.

My opinion and belief is we should not look at any company more than 2 years. We are in a very agile world. Things are changing very rapidly.

Ethical TraderTop contributor

Ethical TraderTop contributor

- Posts : 5568

Join date : 2014-02-28

Re: AEL Technical Analysis

Re: AEL Technical Analysis

ruwan326 wrote:If you planing to invest long term, buy 50% before xd and next 50% after xd. If price falls after xd you already got dividend and average the price. If price didn't go down still you can buy same price. This is my personnel suggestion.

harieshaTop contributor

harieshaTop contributor

- Posts : 1329

Join date : 2014-04-09

Re: AEL Technical Analysis

Re: AEL Technical Analysis

NIRMALSG wrote:Sorry for put in wrong thread.

Hope this might help to understand about value of ACL

Asia-Securities-ACL-Cables-4Q-FY19-Earnings-Update-31-May-2019-1

Does this URL works?

NIRMALSG

NIRMALSG- Posts : 428

Join date : 2019-02-17

Location : Colombo

Re: AEL Technical Analysis

Re: AEL Technical Analysis

- Attachments

Jimmy

Jimmy- Posts : 168

Join date : 2014-02-27

Location : Anuradapura

Re: AEL Technical Analysis

Re: AEL Technical Analysis

hariesha wrote:AEL ownership is well diversified. Single largest shareholder is only having 25%. Public shareholding 41%. Getting diversifying into other regions like Africa and Middle East, etc.

Will there be a issue? Ownership also might get change 10-20 years down the line.

My opinion and belief is we should not look at any company more than 2 years. We are in a very agile world. Things are changing very rapidly.

I am planning to make good investment that provide me a return at my retirement, and I want to forget the share(not paying attention on it in shorter periods) after the investment. As you said, if our investment could be confined to a limited time, how should I achieve my goals. Any opinion?

Note : I invested previously and currently I have no investment (almost zero). Market will definitely go up. I am panning to collect shares before market recovery starts and with the recovery.

slstockVeteran

slstockVeteran

- Posts : 6216

Join date : 2014-06-12

Re: AEL Technical Analysis

Re: AEL Technical Analysis

I recall you from past.

I see why you have been quiet as you wee no involved at CSE.

Anyway,

There are 2 kinds of people at CSE.

Short term people and Longer term people.

Short term people mind set , worries and thinking patterns

are very different to Long Term people.

This forum and most of CSE has so many Shorter term people

than long term people.

Hariesha is shorter term as we all know.

So will let him answer you shorter term question on AEL.

~~~~~~~~~~~~~~~~~~~~

If you goal is to go longer term , you need to analyze an talk to

people with such longer term goals.

As for AEL, if you go longer term remember these too

a) Construction industry has long way to go in SL but due to politics it is volatile

b) AEL specially gets more favors from one political party than the other

( you know which )

c) "I am planning to make good investment that provide me a return at my retirement"

I don't know how old you are. But if this is retirement

goal , I think there are less risker sectors than construction which also pays good dividends.

Though you didn't ask me specifically, am adding my 2 cents worth

as I recall you from past and saw this comment. Hope it has some use.

All the best

harieshaTop contributor

harieshaTop contributor

- Posts : 1329

Join date : 2014-04-09

Re: AEL Technical Analysis

Re: AEL Technical Analysis

I am a long term investor in CSE. I start buying shares in 1996 at a relatively young age and I am continuously holding my foot for last 23 years. Haycarb is my first purchase and if my memory is correct I purchased it at Rs.66/-. Not sure the price, but it was the first purchase. I learned a lesson in day one itself. Broker adviser screwed me on the 1st day itself. He advised me to purchase on the early morning which was actually the XD date. So by the days close, I was at a loss of Rs.4/- per share. I was thinking what happened and quickly realized guy screwed me. Broker was JKSB. There after I never rely on broker advisers.

Coming back to the interpretation of long term investing, it's definitely not holding continuously. You have to evaluate your investments in every three months or I would rather use the word continuously, as its more appropriate in today's world. It's changing rapidly. Business environment is changing, people are changing, products are changing, new services/products are coming in, etc. It's not the 70s, 80s, or even 90s. AGILE is golden word to remember in every morning.

Here again I will explain through a lesson. I had a considerable amount of EDEN by 2009. People thought hotels are the future and so am I. Some where in 2012 or 13 after the great crash, I was going through my portfolio. EDEN is there. I am holding it. It had touched even Rs.70/-. I haven't done any thing and again it's back close to my average price. I stop going down south on the Galle Road, I had the feeling the big gate of eden laughing at me. What a shame. There after I had few opportunities to trade on it, but do you think it will go pass Rs.70/- again under normal conditions?

What is important is evaluating your portfolio, environment and your strategies frequently and take buy/sell/hold decisions. In today's world this frequency should never go beyond three months. For me it's every week and in some cases daily.

In this forum there was a thread discussing/promoting long term investing. I read some of the posts here and there when I am on the public transport. I do not agree with most of the posts. We have to learn from our mistakes. Last few years are good examples.

Do you think Warren Buffet has not seen a Sell Note?

I can describe another example, LLUB. I was interesting in LLUB when it came to 90s. When it came to 80s bought some. Quickly realize that it's business model cannot sustain in the new environment. When it came to 60s bought again, But after seeing Dec. results I exited quickly @ 72/73, but this time at a profit. Why? Results didn't match the valuing algorithm. LLUB was struggling in facing to new realities. What if management couldn't come out of it? After looking at 1st quarter results I bought back again at more than 20% less than I sold. Is it bad?

For new comers : Study how business environment of LLUB was changed during last couple of years and how market reacted to it. What if Malaysian plant was allowed to setup? This is a classic example to learn for a long term investor, in setting up his strategy.

OK, came to write few lines. But gone well beyond.

Since this discussion is with a new comer at the center, will discuss other long term ideas and the core topic AEL in my next contribution.

So for the beginners, think about companies which are relatively young in their business cycle, if you want to hold continuously for couple of years. Love if you can point out some.

xmartTop contributor

xmartTop contributor

- Posts : 732

Join date : 2015-01-17

Re: AEL Technical Analysis

Re: AEL Technical Analysis

well, there is no right or wrong answers when it comes to this topic. in my view, CSE is immature and at the early age of its development.

value investing is the key to longer-term sustainability. if the business model and corporate governance are intact, even though you may see seasonal variations in shorter terms, in the longer term the value will prevail. in CSE short term people shall refer weekly chart but long term people may refer monthly charts but in other markets, short term people refer sometimes 15 min charts and trade. they consider daily charts users to be long term. average holding period of NYSE has come down to 14 months due to high liquidity.

so shorter or longer term is relative to the market we are talking about. for me, 2 year is short term in CSE.

slstockVeteran

slstockVeteran

- Posts : 6216

Join date : 2014-06-12

Re: AEL Technical Analysis

Re: AEL Technical Analysis

"As you said, if our investment could be confined to a limited time, how should I achieve my goals. Any opinion?"

I believe Jimmy is asking this question on Shorter term basis ( interested on AEL too) and would help him to answer his particular question.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

1) To me 2 years is Shorter Term. I answered on Longer term view on AEL.

2) We do not need to prove who we are or what we are. How the world will see us will mostly depend on our actions, thoughts over long term and whom we side with.

( This is not my statement but generally how the world will see us)

3) Below is the thread Started by Pantomath on titled

"Never to Sell Stategy" which is of course on long term strategy.

One can refer to that.

If one does not agree with longer term ideas mentioned by Various contributors there , one can put their ideas there itself. No point putting it on here.

http://forum.lankaninvestor.com/t11239-never-sell-strategy

3) One can follow our own style which suits us. Investing with longer term view or Trading within shorter term . It our money .

~~~~~~~~~~~~~~~~~~~~~~~~~

Disclosure:

But I ( SLS) wrote on this forum with a different goal. I generally wrote with educational mindset to make CSE/Sri Lanka more stable so every member can reap benefits without having to worry about shorter term issues or competing with each other. I too do short term trading . It also does not mean I will not completely sell my portfolio soon.

~~~~~~~~~~~~~~~

I have no personal issues with anyone ( unless I am targeted).

My comments are usually driven on points or facts.

harieshaTop contributor

harieshaTop contributor

- Posts : 1329

Join date : 2014-04-09

Re: AEL Technical Analysis

Re: AEL Technical Analysis

So it's appreciative if Admin can move my reply to there along with related posts.

harieshaTop contributor

harieshaTop contributor

- Posts : 1329

Join date : 2014-04-09

Re: AEL Technical Analysis

Re: AEL Technical Analysis

In replying to first para, though it's contradictory with the second, there are no shares that you can buy and forget and expect you to give continuous returns. That era has gone. I have explained it in my previous answer.

Your second para explains the opportunist inside you.

AEL is one of the best shares for election time. In Sri Lanka the perception is MR era is good for construction sector, but I do not agree. But when the opportunity is there why should we try to prove the perception is wrong?

If an election is called AEL will start flying.

This year we may get several trading opportunities.

ie: Expectation of election, news on postponement/attempt to postpone, reality.

Jimmy wrote:hariesha wrote:AEL ownership is well diversified. Single largest shareholder is only having 25%. Public shareholding 41%. Getting diversifying into other regions like Africa and Middle East, etc.

Will there be a issue? Ownership also might get change 10-20 years down the line.

My opinion and belief is we should not look at any company more than 2 years. We are in a very agile world. Things are changing very rapidly.

I am planning to make good investment that provide me a return at my retirement, and I want to forget the share(not paying attention on it in shorter periods) after the investment. As you said, if our investment could be confined to a limited time, how should I achieve my goals. Any opinion?

Note : I invested previously and currently I have no investment (almost zero). Market will definitely go up. I am panning to collect shares before market recovery starts and with the recovery.

xmartTop contributor

xmartTop contributor

- Posts : 732

Join date : 2015-01-17

Re: AEL Technical Analysis

Re: AEL Technical Analysis

sereneTop contributor

sereneTop contributor

- Posts : 4850

Join date : 2014-02-26

Re: AEL Technical Analysis

Re: AEL Technical Analysis

Thanks SLS and Hariesha.

The strategy has lot to do with someone's risk appetite, prior experience and time he can allocate to CSE with other commitments.

To me the golden rule i learnt is no one is wrong and no one is right. We should respect each of the genuine advises.

Make it your own and have both of the strategies of SLS and Hariesha in you.

Be thankful to everyone who take time to contribute here and enjoy your investment and trading.

Only Mr.market is right and he has nothing to do with whethetr you are long term , Short term , Trading , Investment.

Jimmy

Jimmy- Posts : 168

Join date : 2014-02-27

Location : Anuradapura

Re: AEL Technical Analysis

Re: AEL Technical Analysis

NIRMALSG

NIRMALSG- Posts : 428

Join date : 2019-02-17

Location : Colombo

Re: AEL Technical Analysis

Re: AEL Technical Analysis

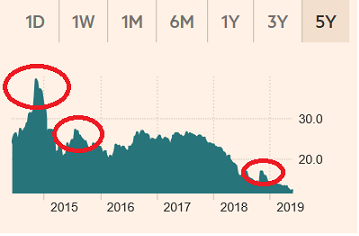

Access Engineering (AEL) director sells Rs400mn worth of stock

June 22, 2019 (LBO) – Colombo Stock Exchange (CSE) listed Access Engineering (AEL) in a stock market disclosure reported that a non-executive director had sold a significant amount of his shares.

Ranjan Gomez has sold 30,000,000 shares at a price of Rs13.2/share. Total proceeds from the sale of shares is approximately Rs400mn.

As of March 31, 2019, Gomez had reported a total shareholding of just over 75,000,000 shares. The insider sale is roughly 40% of his total holdings. Gomez has been a seller of significant amounts of stock over the years, however this recent large sale is at a strikingly low price.

As of March 31, 2019, AEL reported a net asset value of Rs21.4/share. Gomez’s sale at Rs13.2/share represents a valuation of just over 60% of book value.

AEL’s last quarterly results were solid reporting net income of just under Rs700mn for the quarter, however the construction industry is being badly affected by the recent economic downturn.

Most stocks on the CSE are trading at low valuations due to a confluence of negative catalysts which include a slowing economy, a constitutional crisis, and one of the worst incidents of global terrorism in recent history.

hammurabi

hammurabi- Posts : 87

Join date : 2019-03-17

Location : Colombo

Re: AEL Technical Analysis

Re: AEL Technical Analysis

NIRMALSG wrote:Be careful about these movements specially for short term traders, just feeling bad quoter for AEL. But still its valuable opportunity for long term perspectives.

Access Engineering (AEL) director sells Rs400mn worth of stock

June 22, 2019 (LBO) – Colombo Stock Exchange (CSE) listed Access Engineering (AEL) in a stock market disclosure reported that a non-executive director had sold a significant amount of his shares.

Ranjan Gomez has sold 30,000,000 shares at a price of Rs13.2/share. Total proceeds from the sale of shares is approximately Rs400mn.

As of March 31, 2019, Gomez had reported a total shareholding of just over 75,000,000 shares. The insider sale is roughly 40% of his total holdings. Gomez has been a seller of significant amounts of stock over the years, however this recent large sale is at a strikingly low price.

As of March 31, 2019, AEL reported a net asset value of Rs21.4/share. Gomez’s sale at Rs13.2/share represents a valuation of just over 60% of book value.

AEL’s last quarterly results were solid reporting net income of just under Rs700mn for the quarter, however the construction industry is being badly affected by the recent economic downturn.

Most stocks on the CSE are trading at low valuations due to a confluence of negative catalysts which include a slowing economy, a constitutional crisis, and one of the worst incidents of global terrorism in recent history.

Did he cross it at 13.20??? Friday?

Home

Home