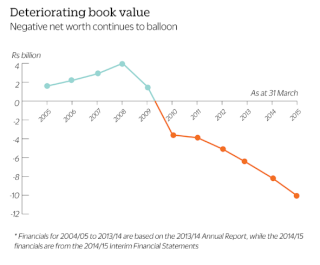

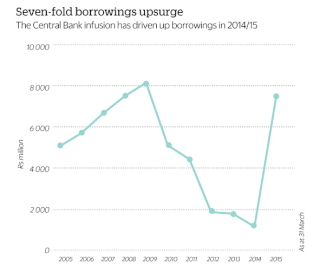

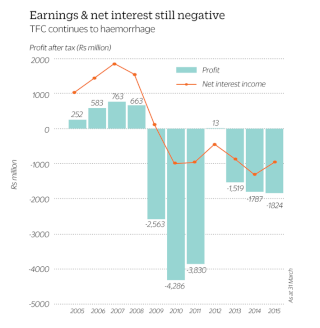

In December, the Central Bank loaned Rs6 billion to The Finance Company (TFC) utilizing funds from the Sri Lanka Deposit Insurance and Liquidity Support Scheme (SLDILSS). TFC has been struggling with liquidity stresses and regulatory non-compliance since the 2008 Ceylinco crisis debilitated the finance company’s operations. With this infusion’s support, TFC has started to turn things around, its management claims. But the Rs6 billion loan couldn’t stop TFC from losing shareholder value to report a book value of negative Rs10 billion as of March 2015, worse than negative Rs8.2 billion a year earlier. This was due to a Rs1.8 billion loss for 2014/15. TFC last had a positive book value in 2009 at Rs1.47 billion.

The Central Bank’s infusion followed a new management board’s appointment in mid-2014 to lead a restructuring of TFC and the board’s submission of a new restructuring plan. The bank also took into account TFC’s performance after the new management came on board. The new Managing Director, Aruna Prasad Lekamge, says that the board has already started to turn around the company. “We have managed to bring down operational losses by Rs7 to Rs10 million each month during the 2014/15 financial year,” he says. The unaudited financial statement filed with the Colombo Stock Exchange for 2014/15 supports his claim, with operating losses falling 17% from a year ago and net interest losses decreasing a sharp 33%. However, Lekamage also claims that, by May, top line losses had fallen to about Rs100 million a month.

The company reported a Rs1.8 billion loss for 2014/15. Due to a tax reversal in the previous year, the loss may seem to have increased, but last year, before the tax reversal, TFC reported a Rs2.2 billion loss. So the bottom line has turned a corner.

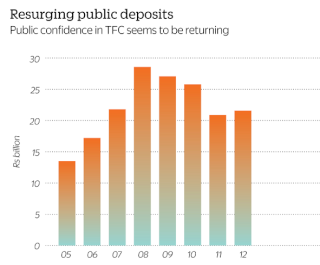

Lekamge also believes that he’s turned things around in terms of the company’s reputation. He says that the company is no longer facing any challenges in terms of attracting deposits. Public deposits increased by 13% to Rs27.7 billion in 2014/15, which is equal to pre-crisis levels.

He predicts that the top line will break even in 18 months. “But it will take five to six years to clean up the balance sheet and generate bottom line profits,” he adds. The effects of the Rs6 billion infusion will take time to kick in as well.

“The funds were received only in the last quarter and invested in government securities. This helped improve liquidity in the company. We will use the funds in our product mix (lending products) to generate more income, which will give us an improved financial performance in 2015/16,” he said.

This is not the first time that the Central Bank has used public money to support TFC. In the 2011/12 financial year, the bank used the Employees’ Provident Fund (EPF) to buy 593,000 TFC shares and increase the EPF’s 7.44% stake in the finance company to 8.43%. At this point, TFC had been struggling for years with its liquidity. It had also been violating Central Bank regulations, as pointed out by its auditors for successive years. The Central Bank’s use of public funds to invest in the company in spite of these conditions raised questions at the time.

Founded 75 years ago, TFC became part of the diversified Ceylinco Group in the 1960’s when Senator Justin Kotelawala was Chairman of the Group. At the time of the 2008 Ceylinco crisis, TFC was one of 300 companies in the Group. TFC was a registered finance company regulated by the Central Bank, but not all of the finance companies in the Group were registered thus.

At the time of the crisis, TFC was the market leader in the non-bank finance company sector. In March 2008, its book value was Rs4 billion, with total assets amounting to Rs40 billion. But a year later, following the Ceylinco crisis, the company’s worth had more than halved to Rs1.5 billion.

The Ceylinco crisis began when the Golden Key Credit Card Company, an unregulated specialist credit card issuer within the Group, collapsed when it had to repay “guaranteed return investments” to its customers. Golden Key had not been licensed to accept retail deposits. It subsequently went into court-administered insolvency in order to implement an investor repayment schedule. The resulting adverse public perception of the Group led to liquidity problems and a few collapses in other financial companies within the group. Liquidity issues also affected TFC. By March 2014, shortly before the current management took over, TFC’s net book value had eroded to negative Rs8.2 billion from a Rs4 billion high at the end of 2007/08. Net interest income had been in the negatives for five years running, falling from positive Rs1.8 billion in 2007/08. The 2013/14 financial year saw its worst performance, with negative net income at Rs1.3 billion. Lekamge says that when he took over the Management Board, TFC was making a revenue loss of Rs200 million monthly.

The new board of Directors is headed by Chairman Dr. S H A M Abeyratne. This is the latest in a series of management agents that the Central Bank has appointed to sort out TFC’s problems. In fact, Lekamge had sat on the previous board as a Non-Executive Director since 2011.

Three months into the new board’s tenure, the Central Bank’s Monetary Board studied the results that the board had achieved and asked it to submit a plan for TFC’s restructuring. Based on both factors, the Central Bank infused the Rs6 billion into the finance company from the SLDILSS. Operated by the Monetary Board, the SLDILSS was established in October 2010 to provide support to non-bank financial institutions with liquidity issues. It is made up of funds contributed by member financial institutions on a Central Bank directive, using the savings they made when the bank brought down financial taxes on these entities.

Questioned about this use of public funds to shore up a company that has been failing for years, Lekamge defends TFC’s right to these funds. “We’re part and parcel of the members of the Central Bank,” he says. “If a member company fails, this scheme looks after it. That is its mandate.”

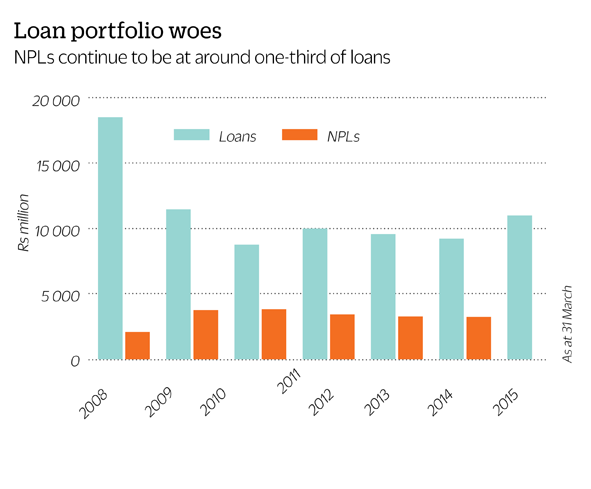

Lekamge calls his restructuring plan a bridge over troubled water. Its main aims are to turn the company’s non-yielding assets into yielding assets, grow its financial assets and lower its NPL levels. The company has put a hold on hiring new staff, and Lekamge has concentrated on optimizing TFC’s existing resources and mitigating risks like negative net worth.

Lekamge’s approach to easing TFC’s negative net worth has been two-pronged. The first task has been to make the day-to-day business profitable, thereby preventing the accumulation of further losses. The daily profit chips away slowly at the negative net worth. The second task has been recovering related party loans from the Ceylinco Group. Lekamge says that TFC has already put in a number of measures towards this and is trying to take over the assets held by some related parties so that non-yielding assets can be converted to yielding assets. However, most of these assets are linked to the Golden Key court case, as well as a few other pending cases, so TFC is forced to work with them. Asked about a time line, Lekamge says, “It’s actually not in my hands. We have to work with the other cases. We’re very patiently looking into these to take them over one by one. This is the reality. I have to work with the rest of the Group and with other depositors’ liabilities. We have to be fair by everybody. That’s why I call it a bridge over troubled water.”

Since 2009/10, TFC’s auditors have been unable to confirm the outstanding loans, although the company’s books disclosed their value. In March 2014, TFC reported related party loans amounting to Rs2.1 billion, with provision made for Rs1.3 billion. Outstanding related party loans were at Rs2.4 billion in March 2009, peaking at Rs3.1 billion in 2011.

Since 2009/10, TFC’s auditors have also repeatedly pointed out the company’s failure to comply with Central Bank directives and regulations. In March 2010, the auditors Tudor V Perera and Company pointed out that TFC’s capital funds had fallen to negative 11.32% of total deposit liabilities, although a financial institution is required to maintain this percentage at not less than 10%. TFC also couldn’t comply with a direction to transfer not less than 50% of profits to a reserve fund because the company reported a loss. It couldn’t maintain its liquid assets at 10% of fixed deposits and 15% of savings deposits, with its liquid assets of Rs398 million falling far short of the required Rs2.6 billion. It had no investments in government securities even though it was required to have holdings amounting to 7.5% of deposits. It also couldn’t maintain a regulatory minimum core capital ratio of 5% or a risk-weighted capital ratio of 10%, with its ratios at negative 18.01% and negative 18.25%, respectively. These would deteriorate to as low as negative 65.06% and negative 65.22% by March 2014.

The auditors continued to note similar infringements of regulatory requirements for the next three years. Additionally, in 2010/11, they raised concerns that they couldn’t find evidence that payments had been made from companies of the Ceylinco Group amounting to Rs985.9 million. In 2011/12, they pointed out that a land revaluation loss of Rs333.26 million hadn’t been accounted for in the books and that they couldn’t confirm the receipt of Rs886.3 million from debtors. They also charged that TFC had not prepared consolidated financial statements of subsidiaries TFC Homes Ltd and TFC Property Fund Company Limited and, as such, they couldn’t verify the assets and liabilities relating to these companies. In 2012/13, the auditors couldn’t confirm the loan receivables from the group amounting to Rs758.6 million.

After years of raising concerns about TFC’s ability to continue as a viable business, auditors Tudor V Perera and Company were replaced by in the 2013/4 financial year. But the new auditors raised similar concerns.

They couldn’t confirm outstanding loan repayments from the Ceylinco Group amounting to Rs2.1 billion. They also noted that a property transfer from subsidiary TFC Homes for Rs700 million had taken place without the transfer of the legal title. The new auditors also noted violations of Central Bank directives and regulations. Lekamge claims that the compliance situation has now improved at TFC, but asserts that a restructuring company cannot be expected to comply with every rule. “Compliance is the matter of a structured company,” he says. “A company that’s in a restructuring process can’t comply with everything. That’s why it’s restructuring. But day by day we’re adding compliance. I’m trying to make this company one of the best complying companies in the future. It’s easy to do that because we’re in the process of restructuring it and we’re putting in a good base and structure to have the proper compliance.”

The Lekamge-headed board is only one of several management agents that the Central Bank has successively appointed to take TFC out of its crisis. In the wake of the Golden Key collapse, the bank announced that it would take action under the Monetary Law Act if there was an imminent risk to any licensed or registered financial institution. Two months later, in February 2009, it announced a Rs4.2 billion stimulus to support liquidity at distressed registered financial institutions. A month later, it appointed state development bank Lankaputhra Bank to restructure TFC. Its Chairman at the time was A. Sarath de Silva. The Central Bank also appointed a few key executives to the finance company, removed the executive powers of some previous directors and provided administrative support through a government-approved expert panel.

Two months later, the Central Bank replaced Lankaputhra with state bank Merchant Bank of Sri Lanka (MBSL), led by Chairman Janaka Ratnayake. Kamal Yatawara was Managing Director on a new Director Board that included Chairman Lalith Kotelawala. Kotelawala had been the Chairman of the Ceylinco Group since he took over from his father in the 1970’s and had become a larger-than-life figure in the world of business and philanthropy by the time he fell from grace with the Golden Key crisis.

In November 2009, the directors decided to continue with operations despite the significant loss of capital. On the Central Bank’s directions, the company proposed to recapitalise by issuing 40 million shares at Rs40 each and issue 100 million non-voting shares to depositors at Rs20 each. The board believed that these funds would help keep the company afloat.

However, by the end of that financial year in March 2010, TFC’s net book value had crashed to negative Rs3.6 billion. The company’s auditors Tudor V. Perera and Company noted that TFC didn’t have cash to settle deposits maturing in the following financial year. They stated that conditions pointed towards the existence of a material uncertainty that could cast substantial doubt about TFC’s ability to continue as a going concern. In 2011, the Central Bank replaced MBSL with an independent board, with Preethi Jayawardena as Chairman. Kotelawala was removed from the board in February 2011. The new board went ahead with the company’s recapitalisation. A share issue brought in Rs1.6 billion, and the company converted deposits worth Rs2 billion into non-voting shares. The company used proceeds of the share capital to finance the company’s hire purchase, leasing, pawning and real estate portfolios. The company’s stated share capital increased ten-fold to Rs4 billion. But the auditors continued to raise doubts about the company’s ability to continue as a going concern. This was the company that Lekamge and the new management board inherited.

TFC has not had a rating since late 2009. In a January 2008 report before the Ceylinco crisis, Fitch Ratings Lanka had affirmed its BBB(lka) rating for TFC and its BBB minus(lka) rating for TFC’s subordinated debentures. Its outlook had been Stable. The rating agency had noted TFC’s substantial market share in the finance company sector – it was Sri Lanka’s largest finance company with a 27% share of sector assets at the end of 2006 – and the stability derived from its main shareholder, the Ceylinco Group. But the agency had also noted TFC’s low capitalization, weak asset quality and the inherent risks of finance companies. At the time, because of high interest rates and dampening domestic economic activity, TFC, along with other financial institutions, was experiencing weakening asset quality. In the first half of the 2008 financial year, non-performing loans (NPLs) accounted for almost 17% of loans, a jump from 14% at the end of 2006.

A little over a year later, following the Ceylinco crisis, Fitch Ratings Lanka downgraded TFC’s rating to BB plus(lka) and its subordinated debentures to BB minus(lka). In a March 2009 report, the rating agency cited the company’s liquidity stresses as the reason for its downgrade. Three months earlier, the agency had revised TFC’s outlook from Stable to Negative due to the company’s deteriorating profitability as a result of higher funding costs and the lack of a corresponding rise in real estate related income.

Fitch Ratings Lanka issued the downgrade report after the Central Bank’s early-2009 announcement of the series of actions to shore up TFC, including the appointment of Lankaputhra as the first management agent. Fitch Ratings Lanka noted that, while it was somewhat comforted by these measures, the trajectory of deposit renewals might require further liquidity and capital support. The agency also noted TFC’s deteriorated profitability due to constrained lending as a result of liquidity considerations and its challenging asset quality as a result of the macro conditions.

In November 2009, Fitch Ratings Lanka downgraded TFC to a C rating, which implied that the company carried exceptionally high levels of credit risk and that a default was imminent or inevitable, or that the issuer was in a standstill. The agency then withdrew its rating of the finance company. It has not had a rating since.

Lekamge says that restructuring companies don’t work with rating agencies. He says that TFC will obtain a rating after it starts generating top line profits, which he expects to occur in about 18 months. This is his main goal right now. “It’s not easy,” he says. “But I have the steering wheel. The challenge is to learn to drive it.”

- See more at: http://www.echelon.lk/home/the-six-billion-rupee-question/#sthash.EI5uuFXn.dpuf

» CCS.N0000 ( Ceylon Cold Stores)

» Sri Lanka plans to allow tourists from August, no mandatory quarantine

» When Will It Be Safe To Invest In The Stock Market Again?

» Dividend Announcements

» MAINTENANCE NOTICE / නඩත්තු දැනුම්දීම

» ඩොලර් මිලියනයක මුදල් සම්මානයක් සහ “ෆීල්ඩ්ස් පදක්කම” පිළිගැනීම ප්රතික්ෂේප කළ ගණිතඥයා

» SEYB.N0000 (Seylan Bank PLC)

» Here's what blind prophet Baba Vanga predicted for 2016 and beyond: It's not good

» The Korean Way !

» In the Meantime Within Our Shores!

» What is Known as Dementia?

» SRI LANKA TELECOM PLC (SLTL.N0000)

» THE LANKA HOSPITALS CORPORATION PLC (LHCL.N0000)

» Equinox ( වසන්ත විෂුවය ) !

» COMB.N0000 (Commercial Bank of Ceylon PLC)

» REXP.N0000 (Richard Pieris Exports PLC)

» RICH.N0000 (Richard Pieris and Company PLC)

» Do You Have Computer Vision Syndrome?

» LAXAPANA BATTERIES PLC (LITE.N0000)

» What a Bank Run ?

» 104 Technical trading experiments by HUNTER

» GLAS.N0000 (Piramal Glass Ceylon PLC)

» Cboe Volatility Index

» AHPL.N0000

» TJL.N0000 (Tee Jey Lanka PLC.)

» CTBL.N0000 ( CEYLON TEA BROKERS PLC)

» COMMERCIAL DEVELOPMENT COMPANY PLC (COMD. N.0000))

» Bitcoin and Cryptocurrency

» CSD.N0000 (Seylan Developments PLC)

» PLC.N0000 (People's Leasing and Finance PLC)

» Bakery Products ?

» NTB.N0000 (Nations Trust Bank PLC)

» Going South

» When Seagulls Follow the Trawler

» Re-activating

» අපි තමයි හොඳටම කරේ !

» මේ අර් බුධය කිසිසේත්ම මා විසින් නිර්මාණය කල එකක් නොවේ

» SAMP.N0000 (Sampath Bank PLC)

» APLA.N0000 (ACL Plastics PLC)

» AVOID FALLING INTO ALLURING WEEKEND FAMILY PACKAGES.

» Banks, Finance & Insurance Sector Chart

» VPEL.N0000 (Vallibel Power Erathna PLC)

» DEADLY COCKTAIL OF ISLAND MENTALITY AND PARANOID PERSONALITY DISORDER MIX.

» WATA - Watawala

» KFP.N0000(Keels Food Products PLC)

» Capital Trust Broker in difficulty?

» IS PIRATING INTELLECTUAL PROPERTY A BOON OR BANE?

» What Industry Would You Choose to Focus?

» Should I Stick Around, or Should I Follow Others' Lead?