by Sriranga Sun May 11, 2014 1:59 am

by Sriranga Sun May 11, 2014 1:59 am

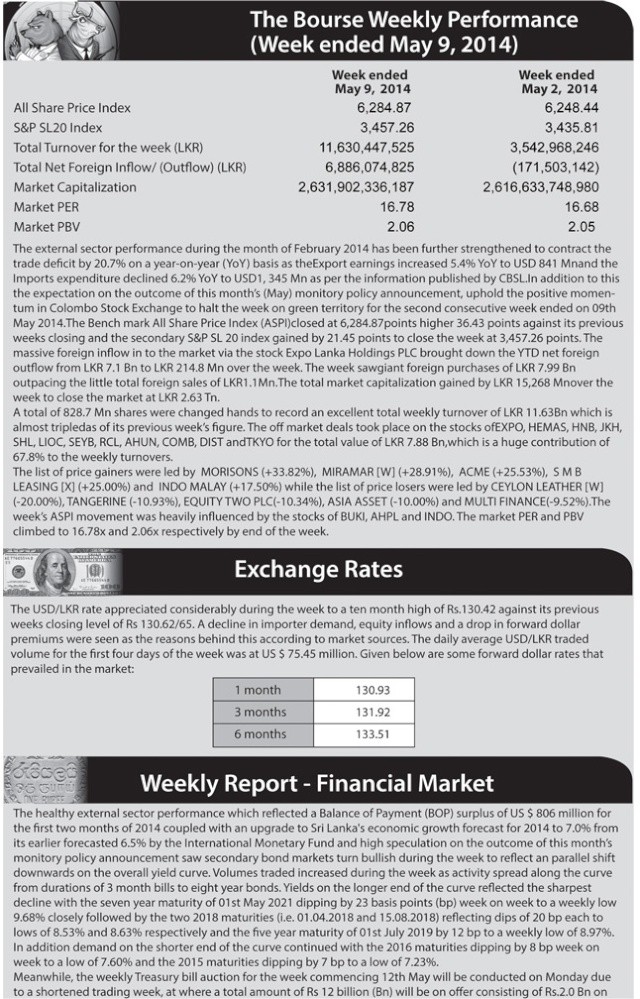

Colombo equities started a fresh week on Monday on positive note where both indices closed with marginal gains. All Share Price index marginally gained 0.99 points (+0.02%) to end at 6,249.43 while S&P SL 20 index gained 5.88 points (+0.17%) to end at 3,441.69. Daily market turnover was LKR 1.25bn. Expolanka (LKR 271mn) emerged as the top contributor to the market turnover underpinned by the crossing of 5mn shares at LKR 10.50 per share. Aitken Spence (LKR 156mn) and Commercial Bank (LKR 94mn) made next best contributions to the turnover.

Meanwhile shares of ACME printing & packaging, Textured Jersey and Expolanka were traded heavily. Foreign investors were net buyers with a net inflow of LKR 153mn. Foreign participation was 31%.

Colombo bourse snapped the five day winning streak on Tuesday, posting negative returns on both indices. ASI declined by 23.30 index points or 0.37% to end at 6,226.13 and simultaneously 20-scrip S&P SL index dropped by 17.57 index points or 0.51% to close at 3,424.12. Daily market turnover reached to LKR 1.3bn with the support of several crossings recorded in Seylan Bank non-voting, Expolanka and Lanka IOC.

Colombo stock market managed to regain lost ground on Wednesday as both indices witnessed positive returns. Benchmark All share price index advanced by 26.47 points (+0.43%) to close at 6,252.60 while 20-script S&P SL advanced by 9.83 points (+0.29%) to close at 3,433.95. Daily market turnover was LKR 1.0bn. John Keells Holdings (LKR 175mn) emerged as the top contributor to the market turnover followed by Royal Ceramic (LKR 154mn) and Seylan Bank (LKR 135mn). Further shares of Grain Elevators, Softlogic Holdings and

Three Acre Farms attracted heavy investor interest during the day. Foreign investors were net buyers with a net inflow of LKR 270mn. Foreign participation was 27%.

On Thursday Colombo bourse managed to maintain the momentum gained on Wednesday where both indices witnessed positive returns. Benchmark index gained 23.13 points (+0.37%) to end at 6,275.73 while 20-scrip S&P SL index gained 12.81 index points or 0.37% to close at 3,446.76.

Daily market turnover reached LKR 935mn with the backing of several crossings recorded in Distilleries, Royal Ceramic Lanka, Aitken Spence Hotels, Commercial Bank, John Keells Holdings and Lanka IOC. Distilleries topped the turnover list with LKR 193mn followed by Lanka IOC (LKR 117mn) and Commercial Bank (LKR 102mn) respectively. Moreover Lanka IOC, Acme Printing & Packaging and Softlogic Holdings attracted heavy investor participation. Foreign investors were net buyers with a net inflow of LKR 138mn. Foreign participation was 32%.

Colombo shares concluded weekly operations on Friday recording a 23-month high turnover of LKR 7.15bn. Approx. 586mn shares of Expolanka changed hands at LKR 10.70 per share at the beginning of today’s trading session which also resulted to a 29-month high daily volume of 630mn shares. The crossing was 88% of the daily market turnover.

According to the announcement made to CSE principle shareholders of Expolanka have disposed a total of 30% of the issued share capital to S.G Holdings Limited which is a holding company for the Sagawa Group, a leading freight & logistic company in Japan. The company further announced that S.G Holding will make a mandatory offer.

Both benchmark indices managed to retain the positive momentum as All share Price Index gained 9.14 points (+0.15%) to close at 6,284.87 and S&P SL 20 index gained 10.50 points (+0.30%) to close at 3,457.26. Price appreciation in counters such as Bukit Darah (closed at LKR 650.10, +3.2%), Asian Hotels & Properties (closed at LKR 68.50, +1.9%) and Ceylinco Insurance (closed at LKR 1,350.00, +3.5%) contributed positively to the index performance. Gainers surpass the losers 141 to 58, while 66 equities remained unchanged. Cash map marginally improved to 55% from 54%.

Expolanka (LKR 6.5bn) emerged as the top contributor to the market turnover followed by John Keells Holdings (LKR 78mn) and Lanka IOC (LKR 77mn). Moreover, several negotiated deals were recorded in John Keells Holdings (0.2mn shares at LKR 235.00 per share) and Tokyo Cement (0.8mn shares at LKR 40.00 per share).

Meanwhile shares of Expolanka, Merchant Bank of Sri Lanka and Lanka IOC traded heavily during today’s trading session.

Foreign investors were further continued to be net buyers for the fifth consecutive day with net inflow of LKR 6.28bn. Foreign participation was 46% for the session. Foreign inflows were seen in Expolanka (LKR 5.9bn), John Keells Holdings (LKR 76mn) and Commercial Bank (LKR 21mn) while foreign outflow was mainly seen in Merchant Bank of Sri Lanka (LKR 7.5mn). Additionally, year to date (YTD) foreign outflows were decreased to LKR 527mn from LKR 6.8bn with the major foreign inflow recorded in Expolanka today.

Dipped Products declared a Final dividend of LKR 3.00 per share (closed at LKR 97.00, +2%) and Ceylon Hospitals (non-voting share closed at LKR 78.00, +0.8%) declared an interim dividend of LKR 2.00 per share yesterday and closed with higher returns in today’s trading session.

Further, Malwatte Plantation (First & Final dividend), Ceylon Tobacco (First Interim) and Alumex (Final dividend) declared dividends of LKR 0.10, LKR 10.80 and LKR 0.25 per share respectively.

Moreover, Kotagala Plantations made an announcement to CSE informing that they obtained the approval to raise LKR 1.0bn through 10mn rated, secured, redeemable debentures. The debentures will open for the subscription on 22nd May 2014.

http://www.nation.lk

LSL Weekly Market Focus

LSL Weekly Market Focus

Market maintains positive momentum

Market maintains positive momentum

» CCS.N0000 ( Ceylon Cold Stores)

» Sri Lanka plans to allow tourists from August, no mandatory quarantine

» When Will It Be Safe To Invest In The Stock Market Again?

» Dividend Announcements

» MAINTENANCE NOTICE / නඩත්තු දැනුම්දීම

» ඩොලර් මිලියනයක මුදල් සම්මානයක් සහ “ෆීල්ඩ්ස් පදක්කම” පිළිගැනීම ප්රතික්ෂේප කළ ගණිතඥයා

» SEYB.N0000 (Seylan Bank PLC)

» Here's what blind prophet Baba Vanga predicted for 2016 and beyond: It's not good

» The Korean Way !

» In the Meantime Within Our Shores!

» What is Known as Dementia?

» SRI LANKA TELECOM PLC (SLTL.N0000)

» THE LANKA HOSPITALS CORPORATION PLC (LHCL.N0000)

» Equinox ( වසන්ත විෂුවය ) !

» COMB.N0000 (Commercial Bank of Ceylon PLC)

» REXP.N0000 (Richard Pieris Exports PLC)

» RICH.N0000 (Richard Pieris and Company PLC)

» Do You Have Computer Vision Syndrome?

» LAXAPANA BATTERIES PLC (LITE.N0000)

» What a Bank Run ?

» 104 Technical trading experiments by HUNTER

» GLAS.N0000 (Piramal Glass Ceylon PLC)

» Cboe Volatility Index

» AHPL.N0000

» TJL.N0000 (Tee Jey Lanka PLC.)

» CTBL.N0000 ( CEYLON TEA BROKERS PLC)

» COMMERCIAL DEVELOPMENT COMPANY PLC (COMD. N.0000))

» Bitcoin and Cryptocurrency

» CSD.N0000 (Seylan Developments PLC)

» PLC.N0000 (People's Leasing and Finance PLC)

» Bakery Products ?

» NTB.N0000 (Nations Trust Bank PLC)

» Going South

» When Seagulls Follow the Trawler

» Re-activating

» අපි තමයි හොඳටම කරේ !

» මේ අර් බුධය කිසිසේත්ම මා විසින් නිර්මාණය කල එකක් නොවේ

» SAMP.N0000 (Sampath Bank PLC)

» APLA.N0000 (ACL Plastics PLC)

» AVOID FALLING INTO ALLURING WEEKEND FAMILY PACKAGES.

» Banks, Finance & Insurance Sector Chart

» VPEL.N0000 (Vallibel Power Erathna PLC)

» DEADLY COCKTAIL OF ISLAND MENTALITY AND PARANOID PERSONALITY DISORDER MIX.

» WATA - Watawala

» KFP.N0000(Keels Food Products PLC)

» Capital Trust Broker in difficulty?

» IS PIRATING INTELLECTUAL PROPERTY A BOON OR BANE?

» What Industry Would You Choose to Focus?

» Should I Stick Around, or Should I Follow Others' Lead?