Thread for News on CSE and SL Economy

nihal123Top contributor

nihal123Top contributor

- Posts : 6327

Join date : 2014-02-24

Age : 58

Location : Waga

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

බැංකු පද්ධතිය ඇද වැටේ. S&P දර්ශකයේ ඉතිහාසයේ වැඩිම කඩාවැටීමත් අද. වසර 5 කදී අඩුම තැනට සියලු කොටස් පැමිණෙයි

March, 1, 2019

මේ අතර අද දිනය තුළ සියලු කොටස් මිල දර්ශකය ද ඒකක 61.98 ක පහළ යාමක් වාර්තා කළ අතර ඒ අනුව දිනය අවසානයේ දී එහි අගය ඒකක 5,754.31 ක් ලෙසින් වාර්තා විය.මෙය පසුගිය වසර 5 ඇතුළත සියලු කොටස් මිල දර්ශකයේ වාර්තා වූ අවම අගය ලෙසින් වාර්තා වේ.

අද දින S&P SL 20 දර්ශකය ගණනය කිරීමට යොදා ගන්නා සමාගම්වලින් කොටස් මිල ගණන් ඉහළ ගොස් ඇත්තේ සමාගම් දෙකක පමණි. පහත දැක්වෙන්නේ ඒ පිළිබඳ සටහනකි.

කොටස් වෙළෙඳපොළේ අද දින මෙලෙස විශාල පහළ යාමක් වාර්තා වීමට ප්රධාන වශයෙන් හේතුවූයේ සම්පත් බැංකු සමාගමේ කොටස් මිල දැවැන්ත ලෙස පහළ යාමයි. දිනය තුළ දී සම්පත් බැංකුවේ ඡන්ද බලය හිමි සාමාන්ය කොටසක මිල රු. 36.20 කින් පහළ ගිය අතර එහි අවසන් ගනුදෙනු මිල රු. 195.70 ක් ලෙසින් සටහන් විය. මෙර පෙර දිනයට වඩා 15.61% ක කඩා වැටීමකි.

සම්පත් බැංකුව විසින් ප්රකාශයට පත් කරන ලද හිමිකම් නිකුතුව මේ සඳහා හේතු වූ බව කොටස් වෙළෙඳපොළ විශ්ලේෂකයින්ගේ අදහස වී තිබේ.

මේ තත්ත්වය තුළ කොටස් වෙළෙඳපොළේ ලැයිස්තුගත බැංකු සමාගම්වලින් යූනියන් බැංකුව, සෙලාන් බැංකුව හා අමානා බැංකුව යන සමාගම් හැර සෙසු සියලු බැංකු සමාගම්වල කොටස් මිල ගණන් අද දිනයේ දී පහළ යන ලදී.

ruwan326

ruwan326- Posts : 1744

Join date : 2016-09-29

Age : 46

Location : Horana

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

4 March 2019

As Sri Lanka continues to perform below the potential in making finance accessible to small and medium enterprises (SMEs), compared to the nations with similar economic status, the Asian Development Bank (ADB) last week pledged it would continue to support the island nation to improve access to financing for small businesses.

Having already rolled out a US $ 100 million financing programme for the Lankan micro, small and medium enterprises (MSMEs) over the last two years, ADB said it has allocated a fresh financial intermediation loan of US $ 75 million, for the year 2019.

Approved last year, US $ 25 million of the total loan amount has already been disbursed within the first quarter. The senior ADB officials shared that the remaining US $ 50 million would be disbursed by June.

In addition to the US $ 175 million allocation over the two years, ADB has also made available a grant of US $ 2 million for technical assistance. The said grant is supported by the Japan Fund for Poverty Reduction.

According to ADB, the objective of the loan is to provide long-term financing to the underserved MSMEs to help them develop their businesses. It in turn would lead to enhance economic activities, increase income and generate more employment through private sector development.

Speaking to reporters in Colombo, ADB Public Management, Financial Sector and Trade Division Director Bruno Carrasco asserted that Sri Lanka has much to improve in increasing access to finance, specially to the businesses that are established in rural areas.

“Sri Lanka’s position, in terms of supporting SMEs, does not correspond to what it should be, when looking into the overall income per capita levels.

The dilemma is largely missing markets, that is financial entities are continuing to serve repetitive customers, who are easily accessible, instead of looking to serve the businesses that are harder to reach,” said Carrasco.

He stressed that the objective of ADB support is to assist where typically credit does not flow into.

For this purpose, ADB is working in close partnership with the Finance Ministry and 10 banks in the country.

The joint effort intends to develop a model project that improves the MSMEs’ access to finance, specially targeting the first-time borrowers and women entrepreneurs in financially underserved areas.

In an effort to ensure the funds reach the relevant groups, ADB has structured behaviourally-driven models that provide incentives and penalties to banks.

ADB said in terms of development impact, the results have been positive, as the initial loan facility of US $ 100 million disbursed over 2.5 years supported over 1,700 small businesses.

http://www.dailymirror.lk/business-news/ADB-pledges-further-US---75mn-to-serve-Lankan-MSME-sector/273-163283

ruwan326

ruwan326- Posts : 1744

Join date : 2016-09-29

Age : 46

Location : Horana

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

Mar 05, 2019

Sri Lanka has hiked taxes on cigarettes, international credit card transactions, and gambling, but will phase out para tariffs on imports, Finance Minister Mangala Samaraweera said while delivering the 2019 budget.

Tobacco & Liquor

A Nation Building Tax (NBT) will be levied on cigarette production from June 01.

Accordingly, cigarettes longer than 60 millimetres will see excise duties increase by 12 percent.

The average increase will be 5 rupees per cigarette stick.

The minimum annual duty increase will capture inflation and economic growth, Samaraweera said.

A 2,500 rupee tax per kilo of beedi (a cottage industry) cggarette will be raised to 3,500 rupees, he said.

It will increase the price of a stick of beedi by 50 cents, Samaraweera said.

Excise duties on locally manufactured alcohol will increase annually, based on inflation and growth indices, Samaraweera said.

"Increase of Excise duty on hard liquor manufactured locally by 8 percent (Excise duty on Special Arrack remains without change) and malt liquor by 12% percent will be done based on indexation effective from March 06, 2019," he said.

Changes to excise duties on tobacco, liquor, and select goods will bring in 39 billion rupees in revenue, Samaraweera said.

Food & Beverage

The sugar tax has been revised.

Soft drinks with less than 4 grams of sugar per 100 millilitres and fruit-based drinks with less than 8 grams per 100 millilitres will be exempt from the sugar tax.

The sugar tax will now charge 40 cents per gram over the exempted limit, down from 50 cents earlier.

Vehicles & Transport

Higher vehicle excise duties have been slapped, with small vehicles such as a Wagon R getting a 20 percent increase.

The tax rate applicable to electric cars was brought down from 12,500 rupees a kilowatt to 10,000 rupees.

axes on “buddy” trucks with a cargo capacity of less than 2,000 kilos was brought down, but it was not clear by how much.

Trucks are also due to be taxed at an unspecified lower rate.

Vehicle tax changes are expected to bring in 48 billion rupees in additional revenue to the state.

Tolls on expressways will be increased by 100 rupees during peak hours effective from 1st April 2019.

Fees for special number plates have been increased, Samaraweera said.

Personalized place with a name can now be obtained for 1 million rupees.

Embarkation Levy will be increased by 10 US dollars to 60 US dollars per passenger.

Passport issuance fee has been increased by 500 rupees to 1,000 rupees per passport.

One day service fee has been increased by 50 percent to 15,000 per passport.

Normal passport service fee has been increased to 3,500 rupees from 3,000 rupees per passport.

The Embarkation Levy and passport fee revision is expected to bring in 8 billion rupees in 2019.

Credit Cards

A 3.5 percent NBT will be charged on international credit card transactions.

"This tax will apply to foreign payments made using Electronic Fund Transfer Cards (both Debit and Credit cards) to purchase goods or services including offshore digital services," Finance Minister Samaraweera said.

An existing stamp duty on all credit card transactions will be lifted.

Gaming

Annual license fees of casinos will increase to 400 million rupees from 200 million rupees from April 01. Annual fees for rudjino games will increase to 1 million rupees.

A casino turnover levy will be charged at 15 percent.

A casino entrance fee of 50 US dollars per person will be charged, effective from June 01.

Para-tariffs

Para-tariffs on imports will be phased out over five years, while products related to tourism, manufacturing and construction will be free of para-tariffs over three years.

The Port and Airport Levy on boilers, machinery and electrical items will be cut to 2.5 percent.

The International Telecommunication Operators Levy will be removed, Samaraweera said.

The Treasury is expected to give up 6 billion rupees in revenue with the removal of para-tariffs.

"We will also ensure that 10 percent of all HS codes, considered to be sensitive items, will not be subject to a complete para-tariff phase-out," Samaraweera said.

[url= https://economynext.com/Sri_Lanka_key_tax_changes_in_2019_budget-3-13631-1.html] https://economynext.com/Sri_Lanka_key_tax_changes_in_2019_budget-3-13631-1.html[/url]

nihal123Top contributor

nihal123Top contributor

- Posts : 6327

Join date : 2014-02-24

Age : 58

Location : Waga

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

ලැයිස්තුගත සමාගම්වල කාන්තා නියෝජනයට නව නීති

March, 5, 2019

[list="box-sizing: border-box; margin-bottom: 10px;"]

[*]කොළඹ කොටස් වෙළදපොලෙහි ලැයිස්තුගත සියළුම සමාගම්වල අධ්යක්ෂ මණ්ඩලයන්හි කාන්තා නියෝජනය සියයට 30 ක් විය යුතු බවට ශී්ර ලංකා සුරකුම්පත් කොමිෂන් සභාව විසින් ස්වෙච්ඡා ඉලක්කයන් හඳුන්වා දෙනු ඇත. සියළුම ලැයිස්තුගත සමාගම් තම අධ්යක්ෂ මණ්ඩලයන්හි කාන්තා නියෝජනය ඔවුන්ගේ වාර්ෂික වාර්තාව අනාවරණය කළ යුතුයි.

[*]2020 දෙසැම්බර් 31 වන විට සියයට 30 ක ඉලක්කය සපුරාගත නොහැකිවන සියළුම ලැයිස්තුගත සමාගම් එසේ නොහැකිවීම පිළිබඳව හේතු අනාවරණය කළ යුතුය.

[*]2022 දෙසැම්බර් 31 වන විට සියළුම ලැයිස්තුගත සමාගම්වල අධ්යක්ෂ මණ්ඩල තනතුරු වල ින් අවම වශයෙන් සියයට 20ක් වත් කාන්තාවන් විසින් දැරිය යුතුයි.

[*]2024 දෙසැම්බර් 31 වන විට සියළුම ලැයිස්තුගත සමාගම්වල අධ්යක්ෂ මණ්ඩල තනතුරුවලින් අවම වශයෙන් සියයට 30ක්වත් කාන්තාවන් විසින් දැරිය යුතුයි.

[/list]

nihal123Top contributor

nihal123Top contributor

- Posts : 6327

Join date : 2014-02-24

Age : 58

Location : Waga

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

(අජන්ත කුමාර අගලකඩ)

මහ බැංකුවේ බැදුම්කර නිකුත් කිරීමේදී සිදුව ඇති පාඩුව ගණනය කිරීම සඳහා වෝහාරික විගණනයක් ජනාධිපති මෛත්රීපාල සිරිසේන මහතාගේ ප්රධානත්වයෙන් අද (06) පැවැති කැබිනට් රැස්වීමේදී තීරණය කර ඇත.

ඒ සඳහා ඉදිරිපත් කරන ලද කැබිනට් සංදේශයට අමාත්ය මණ්ඩල අනුමැතිය ලැබී ඇත.

ඒ අනුව වෝහාරික විගණනය කිරීම සඳහා විශේෂඥයින් පත් කිරීමටත් ඊට අවශ්ය මුදල් වෙන් කිරීමටත් මෙම කැබිනට් පත්රිකාය මගින් ඉන් සැලසෙන ඇත.

බැදුම්කර නිකුත් කිරීමේදී සිදුව ඇති පාඩු ගණනය කිරීම සඳහා 2007 වසරේ සිටම වෝහාරික විගණනයක් කළ යුතු බව මහ බැංකු බැදුම්කර ගනුදෙනුව සම්බන්ධයෙන් සොයා බැලීමට පත් කළ ජනාධිපති කොමිෂන් සභාව නිර්දේශ කර තිබිණි.

nihal123Top contributor

nihal123Top contributor

- Posts : 6327

Join date : 2014-02-24

Age : 58

Location : Waga

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

කොළඹ ඉඩම් මිල සියයට 18කින් ඉහළට

March, 7, 2019

නිශ්චල දේපළ අංශයේ වර්ධනයන් අධීක්ෂණය කිරීම සඳහා රජයේ තක්සේරු දෙපාර්තමේන්තුව විසින් නිකුත් කරනු ලබන පර්චසයක් සඳහා වන මිල ගණන් උපයෝගී කර ගනිමින් කොළඹ දිස්ත්රික්කයේ සියළුම ප්රාදේශීය ලේකම් කොට්ඨාස ආවරණය වන පරිදි ඉඩම් මිල දර්ශකය සම්පාදනය කරනු ලැබේ. මෙහිදී ඉඩම් භාවිතය සම්බන්ධයෙන් වන විවිධත්වය සැලකිල්ලට ගෙන සමජාතීත්වය පවත්වා ගැනීම සඳහා නේවාසික, වාණිජ සහ කාර්මික යන ඉඩම් කාණ්ඩ සඳහා අනු දර්ශක තුනක් ගණනය කරනු ලබන අතර, එම අනු දර්ශක තුනෙහි සාමාන්යය ඇසුරෙන් ඉඩම් මිල දර්ශකය ගණනය කරනු ලැබේ.

nihal123Top contributor

nihal123Top contributor

- Posts : 6327

Join date : 2014-02-24

Age : 58

Location : Waga

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

බොරතෙල් මිල දී ගන්න Swiss Singapore Oversea සමඟ දිගුකාලීන කොන්ත්රාත්තුවක්

March, 8, 2019

මීට පෙර 2018 අප්රේල් 01 සිට මාස අටක කාලයක් සඳහා මර්බන් බොරතෙල් බැරල් 7,000,000 ක් මිල දී ගැනීම සඳහා, අමාත්ය මණ්ඩලය විසින් පත්කරන ලද ස්ථාවර ප්රසම්පාදන කමිටුවේ නිර්දේශය පරිදි බොරතෙල් බැරලයක් ඇමරිකානු ඩොලර් 1.69 ක් බැගින් වන මුදලකට M/s Swiss Singapore Overseas Enterprises Pte. Ltd වෙත පිරිනැමීමට එවකට ඛනිජ තෙල් සංවර්ධන අමාත්යවරයා වූ අර්ජුන රණතුංග ඉදිරිපත් කළ යෝජනාවට කැබිනට් මණ්ඩල අනුමැතිය හිමිව තිබුණි.

කෙසේ වෙතත් මෙවර කොපමණ බොරතෙල් බැරල් ප්රමාණයක් කොන්ත්රාත්තුව සඳහා ඇතුළත් ද යන වග අනාවරණය කර නැත.

ලංකා ඛනිජ තෙල් නීතිගත සංස්ථාව සතු සපුගස්කන්ද තෙල්පිරිපහදුවේ පිරිපහදු ක්රියාවලිය අඛණ්ඩව පවත්වා ගැනීමට අවශ්ය බොරතෙල් සැපයුම සහතික කිරීම පිණිස දීර්ඝකාලීන කොන්ත්රාත්තු යටතේ බොරතෙල් මිල දී ගැනීමට ගෙන රජය ගෙන ඇති තීරණයෙහි ප්රතිඵලයක් ලෙසින් මෙම පියවර ගෙන තිබේ.

ruwan326

ruwan326- Posts : 1744

Join date : 2016-09-29

Age : 46

Location : Horana

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

Mar 10, 2019

Colombo Stock Exchange has been given the go ahead by central bank to list recently issued dollar denominated sovereign bonds, Sri Lanka's Securities and Exchange Commission said.

SEC Chairman Ranel Wijesinha has been informed by Central Bank Governor Indrajit Coomaraswamy that the 2.4 billion US dollars of sovereign bonds last week will be listed in Colombo.

"We are firm in our belief that the Capital Market in Sri Lanka should lend itself to facilitate the country’s initiatives to raise funds while at the same time leveraging the opportunities for the CSE to expand the depth, breadth, size and composition of equity and debt listings," Wijesinha said in a statement.

"Now that ISB 2019 will be listed on the LSE, future issuances have the potential to be traded on the CSE."

The 5 and 10 year international sovereign bonds were sold last week with a listing promised in London and Singapore.

Sri Lanka's CSE is planning to set up a multi-currency board in which firms from countries like the Maldives are also expected to be listed.

It is not yet clear how the bond deals would be settled or who would be permitted to buy.

Sri Lanka also sells dollar denominated bonds styled 'Sri Lanka Development Bonds' targeted at domestic investors, which can be bought only by those authorized to hold dollar bank accounts.

A deal that is settled by holders of existing US dollar deposits are cleared outside of the Sri Lanka's monetary base and has no effect on the exchange rate.

However rupee bonds in Sri Lanka's OTC markets sold by foreign investors to domestic buyers pressured on the exchange rate has the central bank intervenes in forex markets using one of its several convertibility undertakings to maintain an unstable peg with the US dollar and then prints money to prevent rates from going up (sterilized foreign sale).

https://economynext.com/Colombo_bourse_to_list_Sri_Lanka_international_sovereign_bonds-3-13681-3.html

ruwan326

ruwan326- Posts : 1744

Join date : 2016-09-29

Age : 46

Location : Horana

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

11 March 2019

The latest edition of LMD reports that the LMD-Nielsen Business Confidence Index (BCI) climbed 14 basis points to register 115 in February.

According to the leading business magazine, this follows an increase of 11 basis points in the previous month and also puts the index above its average of 101 for the last 12 months. However, it remains 12 basis points below where it stood a year ago, LMD points out.

Nielsen’s Managing Director Sharang Pant says: “The tailwinds behind the improvement in sentiment remain the same – political stability, low inflation, healthy tourist arrival numbers and a marginal appreciation of the rupee versus the dollar.”

LMD notes that political stability, the health of the economy and corruption are among the key national issues cited by businesspeople. Meanwhile, taxes, the value of the rupee and inflation are considered to be among the main concerns when it comes to business.

A spokesperson for LMD reiterates that the outlook for the index may be uncertain following the stabilisation of the political situation and prospect of one or more elections this year. “The index may continue to trend upward in the short term, given expectations that the Budget 2019 would be business friendly,” she observes.

The spokesperson continues: “For now, there seems to be a renewed sense of optimism about business prospects as well as the national economy.”

Media Services, which publishes LMD, says the latest edition of the magazine will be released to leading bookstores and supermarkets on 8 March (for the full BCI report, visit www.LMD.lk).

http://www.ft.lk/front-page/Business...rise/44-674420

nihal123Top contributor

nihal123Top contributor

- Posts : 6327

Join date : 2014-02-24

Age : 58

Location : Waga

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

සංචාරක පැමිණීම – මාස දෙකකදී හාරලක්ෂ අනූහයදහසක් ඇවිත්. පෙබරවාරියේ සියයට 7 ක වර්ධනයක්

March, 11, 2019

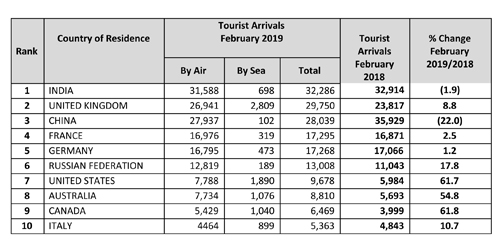

2019 පෙබරවාරි මාසයේ දී පැමිණි සංචාරකයින්ගෙන් වැඩි ප්රමාණයක් පැමිණ ඇත්තේ සුපුරුදු පරිදි අසල්වැසි ඉන්දියාවෙනි. එය 32,914 ක් ලෙසින් වාර්තා වුවද 2018 වසරේ පෙබරවාරි මාසයේ දී මෙරටට පැමිණ ඇති ඉන්දීය සංචාරකයින් ප්රමාණය හා සැසඳීමේ දී එය 1.9% ක පහළ යාමක් ලෙසින් වාර්තා වේ.

මේ අතර එක්සත් රාජධානියෙන් පැමිණි සංචාරකයින් ගණන 8.8% කින් 29,750 ක් දක්වා 2019 පෙබරවාරි මාසයේ දී ඉහළ ගොස් තිබේ. මෙහිදී චීන සංචාරකයින්ගේ 22% ක පහළ යාමක් 2019 පෙබරවාරි මාසයේ දී වාර්තා වීම කැපී පෙනෙන සිදුවීමකි.

එක්සත් ජනපදය (61.7%), ඕස්ට්රේලියාව (54.8%), කැනඩාව (61.8%) යන රටවලින් පැමිණි සංචාරකයින්ගේ සුවිශේෂී ඉහළ යාමක් 2019 පෙබරවාරි මාසයේ දී වාර්තා වී ඇත.

nihal123Top contributor

nihal123Top contributor

- Posts : 6327

Join date : 2014-02-24

Age : 58

Location : Waga

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

The committee appointed for the monthly revision of fuel prices is scheduled to assemble today (11), a spokesperson from the Ministry of Finance stated.

This committee revises the prices of fuel according to the prices of the global oil market and the fuel price formula.

Accordingly, the fuel prices are to be revised from midnight today (11).

However, according to the spokesperson from the Finance Ministry, the crude oil prices have been continuously on the rise since February 01st.

On February 11th, the committee had increased the fuel prices in line with the fuel pricing formula. The prices of one litre of Petrol Octane 92 and the Auto Diesel were increased by Rs 6 and Rs 4 respectively.

Subsequently, Lanka IOC also increased the fuel prices in line with the price hike announced by the government.

ruwan326

ruwan326- Posts : 1744

Join date : 2016-09-29

Age : 46

Location : Horana

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

Single biggest investment of US $ 18.3mn in JKH

Banking sector accounts for fund’s 46% of investments

Norway’s trillion dollar sovereign wealth fund, the world’s largest, managed by the Norwegian Central Bank, Norges Bank, had investments to the tune of US $ 98.3 million in Sri Lankan stocks by end of last year.

According to the official website of Norges Bank Investment Management, the asset management unit of Norges Bank, the fund had investments in 16 Lankan companies, with the single largest investment of US $ 18.3 million in John Keells Holdings PLC.

About 46 percent of the fund’s Sri Lankan investments were in the banking sector, as the fund had US $ 16.7 million worth investments in both voting and non-voting shares of Commercial Bank of (Ceylon) PLC, US $ 14.7 million investment in Hatton National Bank PLC (HNB) voting and non-voting shares and US $ 10.7 million investment in Sampath Bank PLC shares.

The fund, which is often referred to as Norwegian oil fund, which manages the Norway’s Government Pension Fund Global, had total investment of US $ 85 million in 14 Lankan listed firms in 2017.

http://www.dailymirror.lk/business-news/Norges-Bank%E2%80%99s-investments-in-Lankan-stocks-top--US---98mn-in-2018/273-163692

nihal123Top contributor

nihal123Top contributor

- Posts : 6327

Join date : 2014-02-24

Age : 58

Location : Waga

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

කොටස් වෙළෙඳපොළ ගැන නිමල් නොසතුටින්

March, 12, 2019

එහිදී ඔහු කියා සිටින්නේ පස්වරු 12.15 වන විටත් කොටස් වෙළෙඳපොළ සමස්ත ගනුදෙනු පිරිවැටුම රුපියල් මිලියන 29 ක් පමණක් බවත්, ඒ අතර කොටස් වෙළෙඳපොළ හරහා ප්රාග්ධනය සම්පාදනය කර ගැනීමට පුවත්පත්වල දැන්වීම් පළ කර ඇති බවත්ය. මිල පහළ හෙළීමකින් තොරව කිසිදු කොටසක් අලෙවි කිරීම ඉතා අපහසු කටයුත්තක් බවත් පසුගිය වසර 4 තුළ සමාගම් කොපමණ ගණනක් මූලික කොටස් නිකුතු සිදුකර ඇති ද යන්නත් ඔහු මෙහිදී විමසා සිටී.

පහත දැක්වෙන්නේ එම ට්විටර් පණිවුඩයයි.

[ltr]

[/ltr]

[size][ltr]

Nimal perera@nimalhperera

[ltr]Turnover @CSE at 12.15 pm is only RS 29 Million and advertising for companies to raise capital using CSE. Hard to sell any share without bringing the price down. How many IPOs done for last 4 years@CSE_Media [/ltr]

29

12:34 - 6 Mar 2019

See Nimal perera's other Tweets

Twitter Ads information and privacy

[/ltr][/size]

මේ අතර අද (12) දින මධ්යහ්නය වන විට කොළඹ කොටස් වෙළෙඳපොළ දෛනික පිරිවැටුම රු. මිලියන 260.94 ක් ලෙසින් වාර්තා වී තිබුණු අතර ඒ වන විටත් සියලු කොටස් මිල දර්ශකය පෙර දිනයට වඩා ඒකක 26 කින් පහළ ගොස් තිබුණි.

මේ වන විට සියලු කොටස් මිල දර්ශක අගය ඒකක 5,600 සීමාවට පැමිණ ඇති අතර එය පසුගිය වසර 5 ½ ක් තුළ වාර්තා වූ අවම අගය ලෙසින් සටහන් වේ.

මේ අතර අද (12) දින මධ්යහ්නය වන විට කොළඹ කොටස් වෙළෙඳපොළ දෛනික පිරිවැටුම රු. මිලියන 260.94 ක් ලෙසින් වාර්තා වී තිබුණු අතර ඒ වන විටත් සියලු කොටස් මිල දර්ශකය පෙර දිනයට වඩා ඒකක 26 කින් පහළ ගොස් තිබුණි.

මේ වන විට සියලු කොටස් මිල දර්ශක අගය ඒකක 5,600 සීමාවට පැමිණ ඇති අතර එය පසුගිය වසර 5 ½ ක් තුළ වාර්තා වූ අවම අගය ලෙසින් සටහන් වේ.

කොළඹ කොටස් වෙළෙඳපොළ වාර්තාවන්ට අනුව 2019 වසරේ මේ දක්වා කාලය තුළ සියලු කොටස් මිල දර්ශකය (ASPI) 6.15% කින් හා S&P SL20 දර්ශකය 10.11% කින් පහළ ගොස් ඇත.

ruwan326

ruwan326- Posts : 1744

Join date : 2016-09-29

Age : 46

Location : Horana

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

Mar 12, 2019

Sri Lanka has hiked the price of petrol (92 Octane) by 3 rupees to 132 rupees a litre and auto diesel by 1 rupee to 104 rupees, the finance ministry said.

High Octane petrol has been hike by 7 rupees to 159 rupees a litre and super diesel by 8 rupees to 134 rupees a litre.

Super diesel had been hiked by 8 rupees to 134 rupees a litre.

There was no mention of kerosene or furnace oil.

https://economynext.com/Sri_Lanka_petrol_hiked_to_Rs132-3-13705-8.html

ruwan326

ruwan326- Posts : 1744

Join date : 2016-09-29

Age : 46

Location : Horana

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

Tuesday, March 12, 2019

A concessionary loan agreement for JPY 30,040 million (approx. Rs. 48 billion) was signed yesterday between the Government of Sri Lanka and Japan International Cooperation Agency (JICA) for engineering services and construction of a Light Rail Transit (LRT) line between Malabe and Colombo Fort.

The loan will finance Sri Lanka’s first rail-based, electrified urban mass rapid transit line. It will serve to connect the Colombo’s commercial hub with the administrative capital, and significantly reduce travel time in the most congested transport corridor in the country, and the only major corridor currently not supported by railway.

The Malabe-Fort LRT line has a total length of approximately 16 km, with 16 stations. The stations are placed at frequently accessed locations and include Malabe-IT Park, Battaramulla, Rajagiriya, Cotta Road Railway Station, National Hospital up to current Fort/Pettah Railway Station. The entire rail track and stations will be on elevated viaducts to minimize requirement of land acquisition.

At peak travel times in the morning and evening, trains are planned to run every 2-3 minutes (headway). Each 4-carriage train will have a passenger capacity of over 800, which could be increased by adding more carriages in future when necessary. With a 80km/h top speed, travel time from Malabe to Fort will be approximately 30 minutes (incl. stopping time at stations) with the LRT.

The Government has requested for the cost of infrastructure, rolling stock and engineering services to be financed through a series of time-slice loans from JICA, in line with the annual fund requirement for the Project.

High quality Japanese technology would be used to establish Sri Lanka’s first urban electric light rail line. In order to promote technology transfer and economic cooperation between Sri Lanka and Japan, JICA’s loans for this Project are provided under Special Terms for Economic Partnership, with interest rates of 0.1% p.a. for civil works and equipment cost, 0.01% p.a. for engineering services cost and 40 year repayment period including 12 years’ grace period.

To facilitate inter-connectivity with other public transport modes, multi modal terminals are proposed at Malabe (together with bus terminal) and Cotta Road (connecting with railway). At Fort/Pettah the LRT line will connect to the planned Multi Modal Transport Hub accessible to both railway and bus.

Station facilities and LRT carriages will be designed to ensure accessibility to persons with disabilities, as well as passengers with small children and senior citizens. The feasibility study including the Environmental Impact Assessment (EIA) for the Malabe-Fort LRT line was conducted with grant financing from JICA. The EIA has been approved by the Central Environmental Authority.

Although the elevated viaduct will minimize the requirement, some land acquisition is needed at the Depot and some of the Station locations. The Ministry of Megapolis and Western Development, the executing agency for the Project, will conduct such acquisition in accordance with the National Involuntary Resettlement Policy, and JICA’s environmental and social considerations guidelines to ensure inclusive development through public projects.

Since the railway tracks and stations are constructed at high elevation and over national roadways with high traffic volume, appropriate safety measures during construction are critical to ensure the safety of the construction personnel and the general public. JICA will continue to pay special attention to safety aspects in implementation of the Project. The loan agreement for the Malabe-Fort LRT was signed by Dr. R. H. S. Samaratunge, Secretary, Ministry of Finance and Fusato Tanaka, Chief Representative of JICA Sri Lanka Office, with the participation of the Ambassador of Japan to Sri Lanka, Secretary of the Ministry of Megapolis and Western Development and other officials of the GoSL side. The project is executed by the Ministry of Megapolis and Western Development.

JICA is the implementing agency for Official Development Assistance from the Government of Japan, and is one of the largest contributors to the transport sector in Sri Lanka. JICA financed 66km of the Southern Expressway and Kottawa to Kadawatha section of the Outer Circular Expressway. JICA is also currently financing the new bridge across the Kelani River at Peliyagoda which is planned to be completed in 2020.

“JICA is proud to be the partner of the Government of Sri Lanka (GoSL) in establishing the very first urban LRT line in Sri Lanka. It will fundamentally change the face of public transport in this country, ease traffic congestion and improve the environment of Colombo city. We hope, the GoSL will take sustainable measures to ensure proper operation and maintenance, so that the benefits of Japanese technology and concessionary funding could be enjoyed by the public of Sri Lanka”, says Tanaka.

http://dailynews.lk/2019/03/12/business/179977/sl-gets-rs-48-bn-japan-light-rail-project

nihal123Top contributor

nihal123Top contributor

- Posts : 6327

Join date : 2014-02-24

Age : 58

Location : Waga

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

විදුලිබල මණ්ඩලයේ රු. බිලියන 1.78 ක කොන්ත්රාත්තුවක් ACL කේබල්ස් වෙත

March, 13, 2019

nihal123Top contributor

nihal123Top contributor

- Posts : 6327

Join date : 2014-02-24

Age : 58

Location : Waga

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

2018 දී අපනයන 4.7% කින් වැඩිවෙද්දී ආනයන 6% කින් ඉහළට. වෙළෙඳ හිඟය ඩොලර් බිලියන 10.3 ක් දක්වා ඉහළට

March, 14, 2019

2018 වසරේ දී මුළු භාණ්ඩ අපනයන එක්සත් ජනපද ඩොලර් බිලියන 11.9ක් දක්වා සියයට 4.7කින් වර්ධනය වූ අතර, ආනයන එක්සත් ජනපද ඩොලර් බිලියන 22.2ක් දක්වා සියයට 6.0ක ඉහළ යෑමක් වාර්තා කළේ ය. මේ අනුව, වෙළෙඳ හිඟය 2017 වසරේ දී වාර්තා වූ එක්සත් ජනපද ඩොලර් බිලියන 9.6ක සිට 2018 වසරේ දී එක්සත් ජනපද ඩොලර් බිලියන 10.3ක් දක්වා යම් ඉහළ යෑමක් වාර්තා කළේ ය.

2018 වසරේ දෙසැම්බර් මාසයේ දී සංචාරක ඉපැයීම් පෙර වසරේ අනුරූප කාල පරිච්ඡේදයට සාපේක්ෂ ව සියයට 4.8ක වර්ධනයක් වාර්තා කරමින් ශක්තිමත් මට්ටමක පැවති අතර, එම නිසා, 2018 වසරේ මුළු සංචාරක ඉපැයීම් එක්සත් ජනපද ඩොලර් බිලියන 4.4ක් දක්වා 2017 වසරට සාපේක්ෂ ව සියයට 11.6කින් වර්ධනය විය.

2018 වසරේ දෙසැම්බර් මාසයේ දී විදේශ සේවා නියුක්තිකයන්ගේ ප්රේෂණ සියයට 13 කින් පහළ යෑමත් සමඟ 2018 වසරේ දී එක්සත් ජනපද ඩොලර් බිලියන 7.0ක් දක්වා සියයට 2.1ක සුළු අඩුවීමක් වාර්තා කළේය.

2018 වසරේ දෙසැම්බර් මාසයේ දී මූල්ය ගිණුම තුළ, රාජ්ය සුරැකුම්පත් වෙළෙඳපොළෙහි සහ කොළඹ කොටස් වෙළෙඳපොළෙහි ගෙවීම් වාර්තා විය.

ප්රධාන වශයෙන් වෙළෙඳ ශේෂයේ ඇති වූ හිතකර වර්ධනය පිළිබිඹු කරමින් විනිමය අනුපාතිකය වෙත වූ පීඩනය 2018 වසරේ දෙසැම්බර් මස අවසානයේ දී සාපේක්ෂ ලෙස අඩු විය.

දළ නිල සංච්ත 2018 වසර අවසානයේ දී එක්සත් ජනපද ඩොලර් බිලියන 6.9 ක් විය.

ruwan326

ruwan326- Posts : 1744

Join date : 2016-09-29

Age : 46

Location : Horana

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

Mar 14, 2019

Japan based Belluna group. which is investing 450 million US dollars in Sri Lanka's tourism and property sectors, said that the country's real estate industry will shift into high gear once the current economic slowdown ends.

"We expect the current economic slowdown to be of a temporary nature and once the business picks up an upward trend, the real estate market too will shift into high gear," Belluna Lanka (Pvt) Ltd Managing Director Hiroshi Yasuno said in Colombo.

The current conditions are ripe for buying, Yasuno said.

Local firms have said that the real estate market is currently stabilizing, after experiencing rapid growth over the past two years.

A slowdown in the economy, along with a political crisis had dented market confidence in large investments such as real estate, local firms said.

Belluna, a listed firm in Japan is investing in Sri Lanka through the local subsidiary Belluna Lanka.

It has invested 450 million US dollars on a 300-room city hotel, a 190-unit luxury apartment project and a mixed-development project in the capital Colombo, and a 57-room seaside resort in Galle.

Yasuno said the recent rupee depreciation against the dollar has hit many developers who are pricing their apartments in dollars, while its '447 Luna Tower' apartment project is priced in rupees and has not seen a price escalation.

Colombo still has room for apartment development, despite lower demand from locals compared to other countries, he said.

"As investors, we see potential in developing luxury apartments in Colombo," Yasuno said.

"Compared to other regional capitals, Colombo is yet to see people considering apartments as their home."

He said as urban migration intensifies, and Sri Lanka attracts more expatriates with the development of the Colombo Financial Centre, demand for apartments will grow.

https://economynext.com/Japan_s_Belluna_expects_Sri_Lanka_property_pick_up-3-13732-4.html

nihal123Top contributor

nihal123Top contributor

- Posts : 6327

Join date : 2014-02-24

Age : 58

Location : Waga

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

2018 දී මෙරටින් ගෙනගිය ආයෝජනවල ශුද්ධ වටිනාකම ඩොලර් බිලියනය ඉක්මවයි

March, 14, 2019

දෙසැම්බර් මාසය තුළ රාජ්ය සුරැකුම්පත් වෙළෙඳපොළ වෙතින් එක්සත් ජනපද ඩොලර් මිලියන 188 ක ශුද්ධ ගෙවීමක් වාර්තා වූ අතර, එහි ප්රතිඵලයක් ලෙස 2018 වසර තුළ සමුච්ඡිත ශුද්ධ ගෙවීම් ප්රමාණය එක්සත් ජනපද ඩොලර් මිලියන 990 ක් විය.

ද්විතියීක සහ ප්රාථමික වෙළෙඳපොළ ගනුදෙනු අන්තර්ගත කොළඹ කොටස් වෙළෙඳපොළෙහි විදේශීය ආයෝජන 2018 දෙසැම්බර් මාසයේ දී එක්සත් ජනපද ඩොලර් මිලියන 26 ක ශුද්ධ ගෙවීම්ක වාර්තා කළේය.

ඒ අනුව 2018 වසරේ කොළඹ කොටස් වෙළෙඳපොළ වෙතින් වූ සමුච්ඡිත ශුද්ධ ගෙවීම් ප්රමාණය එක්සත් ජනපද ඩොලර් මිලියන 55 ක්වූ අතර, එය ද්විතීයික වෙළෙඳපොළ වෙතින් වූ එක්සත් ජනපද ඩොලර් මිලියන 133 ක ශුද්ධ ගෙවීමකින් සහ ප්රාථමික වෙළෙඳපොළ වෙත වූ එක්සත් ජනපද ඩොලර් මිලියන 77 ක ලැබීමකින් සමන්විත විය.

2018 දෙසැම්බර් මාසයේ දී රජය වෙත වූ දිගුකාලීන ණය, එක්සත් ජනපද ඩොලර් මිලියන 192ක ශුද්ධ ගෙවීමක් වාර්තා කළේය. කෙසේ වුවත්, 2018 වර්ෂය සඳහා රජය වෙත වූ දිගුකාලීන ණය එක්සත් ජනපද ඩොලර් මිලියන 558ක සමුච්ඡිත ශුද්ධ ලැබීමක් වාර්තා කළේය.

ruwan326

ruwan326- Posts : 1744

Join date : 2016-09-29

Age : 46

Location : Horana

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

Friday, March 15, 2019

“The Colombo Stock Exchange (CSE) has already upgraded the back end systems of the brokers and is in the process of upgrading the stock exchange system which is expected to be operational by 2020,” CEO, CSE, Rajeeva Bandaranaike said.

He was speaking at the Capital Markets Conference organized by UTO EduConsult on Wednesday. “Delivery vs. Payment (DVP) is a fundamental change to the market. Though it is simple to explain there is a lot of work that has to been done,” he said during his presentation. The talk was broken into three segments; The SME Board, the Multi-Currency Board, and the Delivery vs Payment reform.

SME Board

Bandaranaike outlined the Empower Board as a means to get smaller companies listed on the capital markets. Bandaranaike envisioned a system whereby “companies can enter on the empower board, graduate to the Diri Savi Board, and finally end up on the main board”. He said “many companies are interested in listing on the empower board. There are a lot of requests to increase the maximum stated capital above Rs 100 million.”

Bandaraike revealed, “5 or 6 companies are interested in listing”. Bandaranaike conceded “it is still difficult to convince some companies to list with the Price to Earnings ratio.”

Multi-Currency Board

Commenting on the multi-currency board Bandaranaike explained “this was targeted at the Maldivian Exchange and its eight listed companies. We have signed an MoU with the Maldivian exchange. There is potential there as exchange requires better technology and liquidity.”

Commenting on the factors that will make the board successful he said, “currently 50% of our (CSE) volumes are foreign. We have large foreign institutional investors in our markets. Our professional services like banking can be accessed to get a better capital structure. Our markets are better and our governance structures are good.”

“Maldivian professional services tend to be already holding Sri Lankan qualifications.”

Delivery vs. Payment

Bandaranaike prefaced his statements by saying “this is a fundamental change in our system. The way we operate our market is currently an anomaly.” He explained that with the t+3 payment system “sellers lose custody and only get money three days later. No one guarantees payment. Though we have set in safeguards this is fundamentally flawed.”

Commenting on the need for change Bandaranaike said, “Foreign investors are very uncomfortable with this. All of the other markets use delivery vs payment. Exchange of shares and cash should take place at the same time,” he said.

Fundamental Changes

Illustrating the technical changes to the system Bandaranaike said, “We will delink the depository and the trading system. You have freedom with the trading system. This technically allows you to go short.” He said, traders will have to “square their positions at day end.” He went on to state based on international experience on the implementation of DVP that “this will create better liquidity and more opportunity.” Bandaranaike concluded his statements focusing on DVP. “This is a fundamental change to our market. Though it is simple to explain there is a lot of work that has been done. We have already upgraded the back end systems of the brokers and are in the process of upgrading the stock exchange system. We expect to be operational by 2020.”

[url= http://dailynews.lk/2019/03/15/business/180365/new-capital-market-developments-fundamental-change-2020] http://dailynews.lk/2019/03/15/business/180365/new-capital-market-developments-fundamental-change-2020[/url]

Ethical TraderTop contributor

Ethical TraderTop contributor

- Posts : 5568

Join date : 2014-02-28

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

ruwan326

ruwan326- Posts : 1744

Join date : 2016-09-29

Age : 46

Location : Horana

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

March 15, 2019

Banking institutions over the last few months seem to be making an aggressive push to raise capital through rights and debenture issues. Almost all banks in Sri Lanka are in the midst of some capital raising exercise.

LBO has reported extensively on the subject of rights issues in the following articles:

http://www.lankabusinessonline.com/rock-bottom-rs12bn-rights-issue-pricing-crashes-sampath-bank-samp-shares/

http://www.lankabusinessonline.com/another-cash-call-dfcc-to-tap-the-markets-for-rs7-6bn-in-strikingly-low-priced-rights-issue/

http://www.lankabusinessonline.com/ndb-rights-issue-60-subscribed-rs3-8bn-raised/

The recent flood of capital raises have come amidst economic weakness and an uptick in non-performing loan ratios of Sri Lanka’s largest financial institutions.

Bank stocks have also seen significant recent weakness as a result of all the new supply of stock that will have to be absorbed by a chronically weak stock market.

In Colombo Stock Exchange disclosures, the unifying chorus of the need to raise capital has been to bolster Basel III capital levels and fund growth/expansion of the loan book.

Amidst a constant flow of earnings results in Sri Lanka showing highly leveraged companies struggling to cope with their debt load, the feeling amidst corporate Sri Lanka is that non-performing loans will be on the rise.

When banks are asking for billions of rupees from investors through rights and debenture issues, their managements have a duty to disclose any major changes that have occurred in the conditions of their businesses since the last published quarterly results published December 31, 2018.

If bank managements have seen a significant increase in non-performing loan ratios and expect further deterioration since the last published financials, they have a moral if not legal duty to disclose this to investors who would be would be purchasers of their securities.

If banks do sell these large amounts of securities, and then only shortly after announce significant deterioration of their business conditions in the March quarter, their regulators should be blamed for not doing their job. Sri Lanka’s banks and its stock market are all highly regulated entities.

If investors in the securities offered by the banks in Sri Lanka suffer losses due to lack of adequate disclosure, the Securities and Exchange Commission (SEC) and the Central Bank of Sri Lanka (CBSL) will share some of the responsibility with the institutions that they have a responsibility to regulate.

http://www.lankabusinessonline.com/opinion-are-sri-lankas-banks-aggressively-raising-capital-without-adequate-disclosure/

ruwan326

ruwan326- Posts : 1744

Join date : 2016-09-29

Age : 46

Location : Horana

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

Sunday, March 17, 2019

The Colombo share market is (stuck at) ‘exactly where it should be’, a top capital market and investment professional opined.

Reasoning out this take on the Colombo Stock Exchange (CSE), National Agency for Public Private Partnership Chairman Thilan Wijesinghe, Chief Guest for the 7th Capital Markets Conference mid this week noted in his keynote address that there are serious shortcomings by ‘all’ stakeholders which propelled the CSE to such a disastrous state.

Stressing that remarks are his own and not in his official capacity, Mr. Wijesinghe placed politicians on top as those ‘responsible’ for the gloom the CSE is now facing. “Policy makers, regulators including stock broking houses, stockbrokers and clients all have serious shortcomings which thrust the capital market to such a state.”

He ranked poor enforcement, poor research, poor ethics by stockbrokers and greedy investors and poor economic growth in that order for the CSE’s failure. He and other panellists during the discussion that ensued agreed that the ‘poor’ sentiment in the CSE is ‘self inflicted’. Mr. Wijesinghe put up some statistics which showed Sri Lanka at the lowest end – only sometimes just behind Bangladesh.

While the stark statistics puts the CSE to shame, shares fell for a third straight session on Tuesday as investors expected a budget vote that will be a litmus test for the political stability of the government led by Prime Minister Ranil Wickremesinghe. The final budget vote is on April 5.

Finance Minister Mangala Samaraweera last week presented the 2019 budget which wasn’t specifically aimed at elections to be held later this year.

Mr. Wijesinghe pointed out the country’s dismal economic growth saying that during the past 5-year period the GDP growth was averaging 4 per cent while during the war it was 5.2 per cent. This, many at the conference agreed, was not a pretty statistic.

He charged that pump and dump between 2010 to 2013 negatively impacted the market sentiment and acknowledged that a Rs. 30 share was pursued till it was Rs. 52 and dumped on the EPF. “Why aren’t stockbrokers being taken to task, I absolutely don’t know!”

He also charged that issuing nine new licences in 2011 was a ‘mistake’ as it effectively cannibalised market share of the existing stockbrokers. “After issuing these you question why there’s pump and dump!”

he said noting that pump and dump was a desperate, yet fraudulent attempt at trying to survive and added, “I blame a particular chairman for giving so many licences.”

He added that still the ‘hora hora’ sentiment prevails, but no one has been brought to book. “But we ‘still’ talk about it.” He also charged that the country is ‘still’ awaiting demutualisation.

Sarvodaya Development Finance Chairman Channa De Silva, who was a panellist at the conference noted that the interest rates are so high and that there isn’t an effort to bring them down. He added that the bureaucracy, the Central Bank and the Ministry of Finance have to bring the rates down. CSE Chairman Ray Abeywardena added that there’s no rocket science to bringing the (pump and dump) culprits to justice as it’s a matter of finding out the buyer and the seller and then chasing the money trail. “We need to close this chapter once and for all as we are paying for someone else’s sins.”

Mr. Wijesinghe agreed noting that the ‘simplest’ criminal prosecution can be effected on the pump and dump fraudsters. Many at the conference also questioned as to the ‘delay’ in bringing culprits to justice. Mr. Wijesinghe added that (the SEC) might need to have a ‘truth and reconciliation’ commission for the pump and dump era. He further added that there is much to be desired on the ethics of some stockbrokers.

The capital market is a curial link in mobilising private sector financing, he said but added that limited availability of long term debt, single borrowing limits, limited liquidity, under developed derivatives market, high transactions costs, and legal and regulatory impediments are some the main barriers that hamper the growth of the market.

http://www.sundaytimes.lk/190317/business-times/stock-market-still-in-the-doldrums-340763.html

spw19721Active Member

spw19721Active Member

- Posts : 683

Join date : 2015-08-22

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

malanp

malanp- Posts : 518

Join date : 2014-03-04

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

The 2011 Bull market is so high that it is equivalent to two bull markets, so we should not expect another Bull market till 16 years passed..so next prediction is in 2027..

having said that I think we do not need to wait that long, but for surely it will take another couple of years before we see another bull market.

The two main criteria for a bull market is not to be seen in Sri lanka..

1.country/economy has no DIRECTION,

2.people have no HOPE.

without these two there is no point talking about a Bull market..

other way to create a bull market is when people hear the news that MS,MR,and RW will retire from politics and new leadership will be given the country...

that will bring a new hope and there is a possibility of a minor bull market..

ruwan326 wrote:Stock market still in the doldrums

Sunday, March 17, 2019

The Colombo share market is (stuck at) ‘exactly where it should be’, a top capital market and investment professional opined.

Reasoning out this take on the Colombo Stock Exchange (CSE), National Agency for Public Private Partnership Chairman Thilan Wijesinghe, Chief Guest for the 7th Capital Markets Conference mid this week noted in his keynote address that there are serious shortcomings by ‘all’ stakeholders which propelled the CSE to such a disastrous state.

Stressing that remarks are his own and not in his official capacity, Mr. Wijesinghe placed politicians on top as those ‘responsible’ for the gloom the CSE is now facing. “Policy makers, regulators including stock broking houses, stockbrokers and clients all have serious shortcomings which thrust the capital market to such a state.”

He ranked poor enforcement, poor research, poor ethics by stockbrokers and greedy investors and poor economic growth in that order for the CSE’s failure. He and other panellists during the discussion that ensued agreed that the ‘poor’ sentiment in the CSE is ‘self inflicted’. Mr. Wijesinghe put up some statistics which showed Sri Lanka at the lowest end – only sometimes just behind Bangladesh.

While the stark statistics puts the CSE to shame, shares fell for a third straight session on Tuesday as investors expected a budget vote that will be a litmus test for the political stability of the government led by Prime Minister Ranil Wickremesinghe. The final budget vote is on April 5.

Finance Minister Mangala Samaraweera last week presented the 2019 budget which wasn’t specifically aimed at elections to be held later this year.

Mr. Wijesinghe pointed out the country’s dismal economic growth saying that during the past 5-year period the GDP growth was averaging 4 per cent while during the war it was 5.2 per cent. This, many at the conference agreed, was not a pretty statistic.

He charged that pump and dump between 2010 to 2013 negatively impacted the market sentiment and acknowledged that a Rs. 30 share was pursued till it was Rs. 52 and dumped on the EPF. “Why aren’t stockbrokers being taken to task, I absolutely don’t know!”

He also charged that issuing nine new licences in 2011 was a ‘mistake’ as it effectively cannibalised market share of the existing stockbrokers. “After issuing these you question why there’s pump and dump!”

he said noting that pump and dump was a desperate, yet fraudulent attempt at trying to survive and added, “I blame a particular chairman for giving so many licences.”

He added that still the ‘hora hora’ sentiment prevails, but no one has been brought to book. “But we ‘still’ talk about it.” He also charged that the country is ‘still’ awaiting demutualisation.

Sarvodaya Development Finance Chairman Channa De Silva, who was a panellist at the conference noted that the interest rates are so high and that there isn’t an effort to bring them down. He added that the bureaucracy, the Central Bank and the Ministry of Finance have to bring the rates down. CSE Chairman Ray Abeywardena added that there’s no rocket science to bringing the (pump and dump) culprits to justice as it’s a matter of finding out the buyer and the seller and then chasing the money trail. “We need to close this chapter once and for all as we are paying for someone else’s sins.”

Mr. Wijesinghe agreed noting that the ‘simplest’ criminal prosecution can be effected on the pump and dump fraudsters. Many at the conference also questioned as to the ‘delay’ in bringing culprits to justice. Mr. Wijesinghe added that (the SEC) might need to have a ‘truth and reconciliation’ commission for the pump and dump era. He further added that there is much to be desired on the ethics of some stockbrokers.

The capital market is a curial link in mobilising private sector financing, he said but added that limited availability of long term debt, single borrowing limits, limited liquidity, under developed derivatives market, high transactions costs, and legal and regulatory impediments are some the main barriers that hamper the growth of the market.

http://www.sundaytimes.lk/190317/business-times/stock-market-still-in-the-doldrums-340763.html

Home

Home