Thread for News on CSE and SL Economy

NIRMALSG

NIRMALSG- Posts : 428

Join date : 2019-02-17

Location : Colombo

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

Accelerated economic recovery likely: First Capital

* Says improving macro stability and lower yields may strengthen equity returns

* Improvement in demand for stocks can lead to possible re-rating of the market

First Capital Research yesterday said accelerated economic recovery is likely for Sri Lanka, as the months after the Easter Sunday attacks had shown a faster return to normalcy, quicker removal of travel advisories, and unexpected signs of resilience.

Releasing its latest update, First Capital Research said despite the Easter Sunday attacks, Sri Lanka’s economic outlook has shown signs of resilience and ability to recover quickly, as economic activities were seen returning to normalcy while removal of travel advisories were faster than anticipated.

“Though the unfortunate attacks and the subsequent events are likely to have directly or indirectly impacted all sectors, affecting earnings of most companies, we believe that the impact has now been factored into the market and an accelerated recovery is more likely than not.”

The successful and early issuance of the $2 billion Sovereign Bond by the Central Bank was also a major confidence booster, and the heavy investor interest, which was reflected by the three times oversubscription, was seen as encouraging by First Capital Research.

With most economic indicators such as inflation, credit growth and liquidity suggests decline in yields, strong reserve position supports sustainability of the lower yields. In line with expectations Bank 1-Yr FD ceiling has fallen to 9.83% as of 1 Jul 2019.

“The heavy decline in interest rates is expected to lower finance costs, thereby improving earnings of most listed entities towards 4Q2019. In addition, lower Fixed Income returns may lead investors to hunt for alternative investment options with higher returns, of which equity investments is likely to be a more probable option considering the current attractive valuations. Thereby we expect an improvement in demand for stocks leading to a possible re-rating of the market.”

Following the Easter Sunday attacks, First Capital Research expected a major negative hit to the consumer sector which was on a gradual recovery path. The recovery was confirmed with GDP for 1Q2019 registering at 3.7% while it was also reflected by indices released subsequently. Consequent to the incident economic activity came to a near standstill which impacted day to day affairs of most businesses and severely impacting the SMEs.

“In line with our expectations, the Nielsen - Consumer Confidence Index slumped to 37 and

36 points in May and Jun 2019, new lows since inception of the index,” it added.

It also said that with the rights issue being fully subscribed, Sampath Bank is correctly cash heavy with the ability to maintain lending growth well above the industry while capturing market share. “We are bullish on SAMP and recommend investors to invest 25% of the balance cash allocation into SAMP increasing equity portion of the portfolio to 69%,” First Capital Research added.

ruwan326

ruwan326- Posts : 1744

Join date : 2016-09-29

Age : 46

Location : Horana

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

July 07, 2019

Foreign companies will soon be able to acquire and own freehold land in Sri Lanka as long as the entity is listed on the Colombo Stock Exchange (CSE).

The barrier imposed on land acquisitions done by foreign entities before 01-04-2018 will be removed through amendments to the Land (Restrictions on Alienation) Act No. 38 of 2014 previously amended in 2018.

The Cabinet of Ministers approved the proposal presented by Finance Minister Mangala Samaraweera to revise the 2018 amendments that provide provisions with respect to the land transactions after 01.04.2018. Accordingly this new amendment, which is with retrospective effect, all foreign companies listed in the CSE can acquire lands on 99-year lease basis thereby permitting such entities to obtain controlling stakes in projects and companies.

Previously foreigners including foreign companies with 50 per cent or over shareholding were allowed to purchase land outright by paying 100 per cent transfer tax in accordance with the 2014 Act enacted during the Rajapaksa regime.

Under the amendment Act of 2018 outright purchase has been prohibited for foreigners and they can only lease land up to even 99 years by paying a lease tax of 15 per cent on the total rent payable for the entire duration of the lease whether it is one year, 33 years or, 99 years.

This clause will remain in the proposed amendments as well, a senior official of the Finance Ministry said, adding that if the foreign company shareholding is increased to 50 per cent or over the ownership of the land will not become null and void under the new bill.

Foreigners are allowed to purchase apartments / condominiums from ground level up, however lands cannot be purchased on freehold and can only be leased up to 99 years.

The condominiums can be purchased provided that, the entire value shall be paid upfront through an inward foreign remittance prior to the completing of the relevant deed of transfer.

Local private firms with majority foreign holdings will be allowed to lease land on a long-term basis.

However, such companies should have invested at least Rs. 250 million excluding the value of land providing employment to at least 150 people, and have maintained this for at least three years, property dealer said. Any private company with minority foreign ownership can buy or lease property in Sri Lanka. Also a public company with over 50 per cent foreign ownership is now permitted to buy immovable property, they said.

http://www.sundaytimes.lk/190707/bus...nd-356781.html

NIRMALSG

NIRMALSG- Posts : 428

Join date : 2019-02-17

Location : Colombo

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

The Singapore formula

Many years ago, my first visit to Singapore was a long stopover at the Singapore Airport, which was a memorable one. I had to wait about half a day for my connecting flight to Melbourne.

Singapore Airport was big, and it never stopped becoming bigger and better in order to accommodate the ever-growing air-travel passenger movements; today it handles over 65 million passengers a year. Singapore has built its airport not only to accommodate millions of passengers, but also to provide them with pleasant and enjoyable environment and services within the airport.

A few decades ago, perhaps, Singaporeans came to Colombo to get their connecting flights. The late Prime Minister of Singapore, Lee Kuan Yew had mentioned in his book – The Singapore Story, how he had a stopover in Colombo “on his way to London.”

How to become No.1?

I walked here and there, spent time in duty free shops, and glanced at books at the bookshops. Airport bookshops are particularly interesting, because they serve only particular interests. One of the most common books that you find in airport bookshops is about “how to become No.1?”

Here is Singapore which became No. 1 in Asia. It started off with US$500 per capita income at the time of its “unwanted” independence from Malaysia, and became the “richest nation in Asia” with more than $50,000 per capita income today.

It was not only the richest in Asia, it was also the “fastest in Asia” to become rich! Therefore, the matured-adult and elderly Singaporeans who live today in Asia’s richest country, were actually born in a poor country.

When Singapore was separated from Malaysia in 1965 and was left helpless to be on its own, it had no hope of survival. With less than 2 million people living in a country which was smaller than the Colombo district, Singapore was considered to be “too small to survive.” On top of all that, there were ethnic conflicts among the people, divided on ethnicity and language.

Disciplinary boundaries

For transit passengers who are staying long hours at the Singapore Airport, there were “city tours” free of charge. I thought: “Why not keep sitting in a tourist coach looking around the city rather than wandering inside the airport?” Since I still had few more hours to spend, I joined it too.

The tourist guide – a smartly dressed, pleasant, and knowledgeable person -, welcomed the group of about 20 passengers to the coach, introduced himself and explained about the tour. Then he said: “You can ask any question on the way, except those which might be politically-sensitive!”

It must have surprised many in the group, but nobody dared to ask him why he said that. Perhaps, it might turn out to be politically-sensitive too!

But his request, or rather the advice, implied to me the “discipline” much more than anything else. The discipline is utmost important to lead Singapore to prosperity and to maintain its social and political stability.

Secret formula

Why did Singapore become rich? Why did it become rich so fast? And why has it never stopped becoming richer by surpassing all the nations in Asia?

Being a student of economics, searching answers to a question as such never made me bored. Therefore, learning about “why some countries are rich, while others are poor” has always fascinated me. And the answers often run beyond economics.

Today, I also choose to answer the above question going beyond economics. The answer is based on the Singaporean Prof. Kishore Mahbubani’s “secret MPH formula” which he used to describe the success of Singapore. Prof. Mahbubani was a diplomat as well as an academic, who retired recently after serving 13 years as the Dean of the Lee Kuan Yew School of Public Policy, National University of Singapore.

I decided to reveal his secret MPH formula to answer not only the question of “Why Singapore became rich?” but also the question that “Why some others remain poor?”

Even if others adopt the same economic policies as Singapore did, the secret MPH formula would tell us that they are unlikely to succeed. Then, many would start condemning the “policies” with a wrong diagnosis, thinking that policies were responsible for keeping the nation poor!

Right people for the job

The MPH formula presents three elements that Singapore adopted in governing the nation: the abbreviation MPH stands for Meritocracy, Pragmatism, and Honesty.

Meritocracy is the “merit-based selection of right people” to run the country and the institutions. Many developing countries around Singapore had failed because the leaders used to pick up their family members, relatives, supporters, and buddies without any consideration to their competence to do the job.

But Singapore did the opposite: The political leadership of Singapore selected the “best” people with proven competence to fit the job: the Cabinet Ministers, the Parliamentarians, the bureaucracy, and the heads of public enterprises.

Someone might ask the question that then, how did Lee Kuan Yew select his elder son, Lee Hsien Loong, to be his successor as the Prime Minister. In spite of being the son, he was competent to be the head of country. He had a brilliant educational record at both Cambridge and Harvard universities as well as proven track record of competency to provide the leadership.

Singapore also adopted two important strategies to generate a “globally-competitive” labour force to contribute to its development. One is its education system which enabled Singapore to build one of the best educated population in the world with a global exposure. Second is the opening of the country to attract and retain talented foreign labour in Singapore.

Cat, made of wax or clay?

The second element in the MPH formula is the pragmatism – an application of solutions without being bonded with any doctrinal ideology. Ideologies seem dominating the policy-making in many developing countries, while some of these ideologies are leaders’ own imaginations. The policies based on ideologies always lead to “experiments”, and the experiments can either succeed or fail.

What was important for Singapore was that “if the cat catches mice, it doesn’t matter whether the cat was made of wax or clay”. Without trying to re-invent the wheel, Singapore “cut and pasted” the best practices from around the world. It didn’t matter, if such practices were from the capitalist world or the communist world.

Singapore also learnt from others’ mistakes in order to make sure that they were not imported to be implemented in Singapore. Lee Kuan Yew quoted ample such “mistakes” from many other countries in the neighbourhood, including

Sri Lanka.

Getting the “top” honest

The third element in the MPH formula is the honesty of leaders, aiming at building a “corrupt-free” society. “Corruption at the top level” is the biggest issue of many developing countries, which pulled them down. When the “top level” is corrupt, it is impossible to deal with “lower levels” of corruption so that the countries get entangled in it without a way out.

In this case too, Singapore did the opposite by punishing the “top level” first, before turning towards the “lower levels”. Once a Deputy Minister of Singapore government went on a holiday with his friend, as Prof. Mahbubani explained. On returning after the holidays, the Deputy Minister was arrested, made liable for corruption, and was sent to prison.

It became a question even to the defendant as to why was he arrested on baseless corruption charges. It was revealed that he went on a holiday with his friend who was a businessman and, who paid his hotel bills; that was corruption!

Singapore’s secret formula teaches us not only why Singapore became rich, but also why many other countries cannot become rich.

ruwan326

ruwan326- Posts : 1744

Join date : 2016-09-29

Age : 46

Location : Horana

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

Jul 08, 2019

A Sri Lankan parliament committee has accused the government’s finance ministry of seriously underestimating and providing incorrect budget estimates on the interest cost on foreign debt, in its reports to the legislature.

A parliament report in public finance said it was trying to improve the quality and decipherability of information provided to law makers by the ministry of finance (MoF).

It referred to what it called a “puzzling phenomenon” of the finance ministry providing “egregiously incorrect” budget estimates on the interest cost of foreign loans.

The estimates provided in the budget on. interest payments on foreign loans have been egregiously incorrect, over many years, it said.

The actual costs have been under-estimated by 61.2 percent in 2016 and 33.8 percent in 2017.

The report noted that parliament had previously pointed out that “such large discrepancies need a valid explanation as foreign debt and interest payment commitments are large, known in advance, the bulk of it accrued over decades, and easily calculated.”

It also noted that “the MoF explanation provided was that this is a result of unexpected level of treasury bond purchases after the budget estimates are prepared, that count as foreign debt” and that “this explanation lacks credibility”.

This was because it requires the parliament committee on public finance to accept that interest payments on foreign debt built up over decades, which is about 35 percent of GDP at present, are hugely overshadowed by unexpected changes in interest payments on very short-term foreign debt taken and paid within a single year.

The report noted that the parliament committee had asked for a written explanation last year on “the very large and systematic error in projecting foreign interest payment” to be tabled in parliament.

“Such a written explanation has not been received to-date,” the report said.

This year, to guard against such repeated errors in estimates, the parliament Committee on Public Finance asked the MOF to share the schedule it maintains on foreign debt and interest payments.

“It is only in May 2020, after the Central Bank Annual Report is published for 2019, that the COPF will be in a position to make a fresh assessment about the integrity of the information that has been provided in the current budget cycle,” the report said.

“This simple case study on the huge discrepancies in estimates provided to Parliament, against actual outcomes, reflects the very serious failure by the MOF to adhere to reasonable standards in the provision of information, and lack of due diligence in responding to the issues highlighted through COPF reports.”

https://economynext.com/Sri_Lanka_pa...3-15055-1.html

ruwan326

ruwan326- Posts : 1744

Join date : 2016-09-29

Age : 46

Location : Horana

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

July, 8, 2019

The National Movement for Consumer Rights Protection (NMCRP) yesterday revealed that petrol 92 octane sold in the market is not up to standard.

The Chairman of the National Movement for Consumer Rights Protection, Ranjith Vithanage stated that, following a complain received at the consumer affairs authority, a 92 octane sample was checked at the CPC lab and subsequently it was revealed that the real composition is 90.5 octane.

“in February 2019, we lodged a complaint with the Consumer Affairs Authority that the petrol being sold to consumers by Lanka IOC is substandard.Accordingly, the CAA had sent several samples of petrol being sold by Lanka IOC to the lab at the Petroleum Corporation Refinery for testing on March 23rd and it was confirmed that the Octane percentage of the petrol being sold by IOC was only 90.5%,” Vithanage stated.

However, he points out that although these samples had been obtained from IOC sheds, the petrol had been distributed to them by a Sri Lanka Petroleum Corporation distribution center.

“The CPC stopped selling petrol 90 octane due to its low quality. But it seems that we still buy octane 90,”Vithanage added

Meanwhile, the chairman continued to question that who could be held responsible for this matter and called for a proper investigation.

http://bizenglish.adaderana.lk/low-q...-of-92-octane/

කිත්සිරි ද සිල්වාTop contributor

කිත්සිරි ද සිල්වාTop contributor

- Posts : 9679

Join date : 2014-02-23

Age : 66

Location : රජ්ගම

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

ruwan326

ruwan326- Posts : 1744

Join date : 2016-09-29

Age : 46

Location : Horana

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

කිත්සිරි ද සිල්වා wrote:The link given is inaccessible.

Sorry Keith

http://bizenglish.adaderana.lk/low-quality-petrol-in-market-substandard-petrol-instead-of-92-octane/

ruwan326

ruwan326- Posts : 1744

Join date : 2016-09-29

Age : 46

Location : Horana

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

Jul 10, 2019

The Colombo Stock Exchange gained on Wednesday due to Carson Cumberbatch and its subsidiary Bukit Darah, while retail trading was seen on four stocks, brokers said.

Sri Lanka stocks closed 0.13 percent higher on Wednesday, pushed up by Carson Cumberbatch and Bukit Darah, brokers said.

Colombo's All Share Price Index (ASPI) closed 7.43 points up at 5,521.83. The index gained to a high of 5,533.50 in the mid-afternoon before shedding points towards end of trading.

The S&P SL20 index of more liquid stocks closed 0.24 percent or 6.14 points down at 2,594.60.

The market turnover was 548 million rupees with 77 stocks gaining and 48 stocks declining.

Retail activity was centred on buying in Lanka IOC, Access Engineering, Serendib Engineering and Tokyo Cement Company, brokers said.

Crossings (negotiated trades) were seen on John Keells Holdings which accounted for 33 percent of daily turnover, brokers said.

Carson Cumberbatch PLC gained 9.30 rupees to 169.30 rupees a share, Bukit Darah PLC was 9.90 rupees up at 219.90 rupees a share and Softlogic Life Insurance PLC was 1.90 rupees up at 36.70 rupees a share, contributing to ASPI gain.

https://economynext.com/Sri_Lanka_st...3-15088-3.html

NIRMALSG

NIRMALSG- Posts : 428

Join date : 2019-02-17

Location : Colombo

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

Sri Lanka bad loans grows 4.8-pct in June after soft-peg collapse

ECONOMYNEXT - Bad loan in Sri Lanka banking system grew to 4.8 percent of gross loans by June 2019, up from 4.2 percent in March, though the credit system has gone through much worse levels of non-performing loans in the past Central Bank Governor Indrajit Coomarasamy said.

"Clearly it is something we have to be cautious about and monitor very carefully," Governor Coomaraswamy said.

"It is not at crisis levels, we have had higher levels in the past. What we have to do is get growth growing again. We are trying to push lending rates down and push liquidity in to the system."

Bad loans spiked after the central bank triggered a currency collapse by printing money just as growth picked up in 2019 which left the rupee at 182 to the US dollar by end 2018 from 153 at the beginning of the year.

Monetary instability kills consumption, which hits revenues of companies, whose loans then go bad.

At the beginning of 2018, bad loans were at 3.0 percent, as tighter accounting rules forced banks to disclose bad loans early.

After the 2008 soft-peg crisis and capital flight bad loans peaked at 8.8 percent. After spiking during the 2015/2016 soft-peg crisis, bad loans fell to a low of 2.5 percent by the end of 2017.

The 2018 soft-peg crisis came quickly on top of a 2015/2015 crisis, but the currency fall is deeper, and liquidity shortages were prolonged.

Amber Light

Gross non-performing loans had grown to 323 billion rupees by the end of the first quarter of 2019, from 200 billion rupees a year earlier, according to central bank data, under tighter accounting rules.

"I do not think we are at the point where red lights are flashing." Governor Coomaraswamy said.

"It is probably in the amber light stage."

Sri Lanka is also considering giving a moratorium for about 100 billion rupees of tourism loans. Banks will not have to provide for loans suspended after the moratorium was announced. However the sector is expected to recover next year.

At the moment banks are well capitalized, with ratios generally above required levels, Deputy Governor Nandalal Weerasinghe said.

"If NPLs are rising banks will have to provide. That will have an impact on capital. At the moment capital is above even after making provisions NPLs."

But loans at finance companies were at 7.8 percent by March 2019 head. In March 2018 bad loans were at 5.82 percent of gross loans.

However in the finance company sector, there are several legacy companies dating back to the 2008 soft-peg crisis which ended a bubble which grew for several years.

At the time the central bank was battling fiscal dominance, with the Treasury apparently vetoeing attempts to raise policy rates. (Colombo/July15/2019)

nihal123Top contributor

nihal123Top contributor

- Posts : 6327

Join date : 2014-02-24

Age : 58

Location : Waga

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

ආර්ථික වර්ධනය 3%ට බසී

July, 12, 2019

“ඇත්තවශයෙන්ම 2019 වර්ෂයේ දෙවන කාර්තුවේ ආර්ථික වර්ධන වේගය පිළිබඳව අපට සෑහීමකට පත්වන්නට බැහැ. වසර ආරම්භයේ දී 4% ක වර්ධනයක් අපේක්ෂා කළත් එය 3% ක් දක්වා සංශෝධනය කර තිබෙනවා“, යැයි මහ බැංකු අධිපතිවරයා වැඩිදුරටත් කියා සිටියේය.

මේ අතර ශ්රී ලංකා මහ බැංකුව වැඩිදුරටත් පවසන්නේ පාස්කු ඉරිදා සිදුවූ ප්රහාරයේ පසු ශ්රී ලංකා ආර්ථිකය ක්රමයෙන් යථා තත්ත්වයට පත්වනු ඇති බවට අපේක්ෂා කරන බවයි.

“ජනලේඛන හා සංඛ්යාලේඛන දෙපාර්තමේන්තුව මගින් ප්රකාශිත තාවකාලික අස්තමේන්තු අනුව, 2018 වසරේ සිව්වන කාර්තුවෙහි වාර්තා කරන ලද වාර්ෂික ලක්ෂ්යමය පදනම මත සියයට 1.8ක වර්ධනය හා සැසඳීමේ දී, ශ්රී ලංකා ආර්ථිකය 2019 වසරේ පළමු කාර්තුව තුළ දී සියයට 3.7%කින් හිතකර ලෙස වර්ධනය විය. පාස්කු ඉරිදා සිදුවූ ප්රහාරයෙන් අනතුරුව සංචාරක හා ඒ ආශ්රිත සේවාවන්ගේ වර්ධනය වසර මුල දී අපේක්ෂිත මට්ටමට වඩා දුර්වල වීම තුළින් කෙටි කාලයේ දී ආර්ථික වර්ධනයට බලපෑම් ඇති කළ හැකි අතර, මන්දගාමී වූ ගෝලීය වර්ධනය ආර්ථිකයේ මැදිකාලීන වර්ධන අපේක්ෂා සඳහා බලපෑම් ඇති කරනු ඇත. කෙසේ වෙතත්, සමස්ත රාජ්ය මූල්ය හා මුදල් ප්රතිපත්ති මෙන්ම අදාළ අධිකාරීන් විසින් ගනු ලැබූ ක්රියාමාර්ගවල සහයෝගයත් සමඟ සංචාරක අංශය යථා තත්ත්වයට පත්වෙමින් පැවතීම මෙන්ම, අපනයන අංශයේ වර්තමාන ක්රියාකාරීත්වය තුළින් ආර්ථිකය කඩිනමින් යථා තත්ත්වයට පත්වීම පිළිබඳ විශ්වසනීයත්වයක් ඇති කර ඇත“, යි නිවේදනයක් නිකුත් කරමින් ශ්රී ලංකා මහ බැංකුව වැඩිදුරටත් කියා සිටී.

NIRMALSG

NIRMALSG- Posts : 428

Join date : 2019-02-17

Location : Colombo

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

But still it would be good news since it would be an investment in Sri Lanka and will generate new job opportunities as well as income to the country.

China’s Sinopec sets up fuel oil unit in Sri Lanka

China Petroleum and Chemical Corp, known as Sinopec Corp, said on Monday it has set up a fuel oil company in Sri Lanka as it looks to supply fuel to ships along a major maritime route, the Reuters news agency reported.

The new unit, called Fuel Oil Sri Lanka Co Ltd, has been registered in Hambantota on the southern tip of the country, according to a report on the website of Sinopec Group, parent of Sinopec Corp.

Fuel oil is a refined product mostly used as bunker fuel for ships and is also burned in power stations.

The move marks the latest investment in Sri Lanka by China, which sees the South Asian island nation as a pivotal part of its Belt and Road Initiative infrastructure plan.

Sinopec stressed the strategic location of Hambantota port on the Indian Ocean along a key shipping route between the Suez Canal and the Malacca Strait, which is transited by two-thirds of global oil shipments. The market to supply fuel to ships had “huge” potential, it said.

In March, India’s Accord Group and Oman’s Ministry of Oil and Gas signed a $3.85 billion deal to build a 200,000 barrel-per-day oil refinery near Hambantota port, in the biggest single pledge of foreign direct investment ever made in Sri Lanka.

China Merchants Port Holdings, China Harbour Engineering Corp and other Chinese companies are investors in the port and industrial zone.

Sinopec has set a company-wide target of 10 million tonnes of production capacity by 2020 to supply low-sulphur bunker fuels that meet the cleaner emission standards set by the International Maritime Organization (IMO).

NIRMALSG

NIRMALSG- Posts : 428

Join date : 2019-02-17

Location : Colombo

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

Sri Lanka stocks close 1.04-pct up, back at pre-Easter attack level

ECONOMYNEXT – Sri Lanka stocks closed 1.04 percent higher on Wednesday, with the market recovering to the pre-Easter Sunday suicide attacks level, brokers said.

Colombo's All Share Price index (ASPI) closed 58.29 points up at 5,645.65.

The S&P SL20 index of more liquid stocks closed 2.31 percent or 61.15 points up at 2,704.17.

Index-wise the market hit the level that it was operating on before the Easter Sunday attacks, reaching a three-month high from 04 April 2019, brokers said.

The market turnover 738 million rupees with 125 stocks gaining and 35 stocks declining.

There were two crossings seen in Commercial Bank of Ceylon stocks amounting to 57 million rupees.

Retail activity was mainly centered on Access Engineering (746 trades) and Dialog Axiata (431 trades).

Dialog Axiata closed 60 cents up at 10.70 rupees a share contributing most to the gain of the ASPI.

John Keells Holdings closed 2.50 rupees up at 148.10 rupees a share and Commercial Bank of Ceylon closed 2.90 rupees up at 97.10 rupees a share, also pushing the ASPI up.

(COLOMBO, 17 July, 2019)

ruwan326

ruwan326- Posts : 1744

Join date : 2016-09-29

Age : 46

Location : Horana

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

Jul 18, 2019

Sri Lanka's stocks reached a 4-month high on Thursday.

Sri Lanka's stocks closed 0.69 percent higher on Thursday on buying interest in John Keells Holdings, Dialog Axiata and Ceylon Cold Stores, provisional data showed.

Colombo's All Share Price index (ASPI) closed 38.83 points up at 5,684.48, reaching a 4-month high since March 11.

The S&P SL20 index of more liquid stocks closed 1.40 percent or 37.73 points up at 2,732.26.

The market turnover was 391.7 million rupees with 113 stocks gaining and 51 stocks declining amid high retail investor activity.

There was moderate foreign participation, with net outflows of 17.3 million rupees from the market.

There was one crossing in Teejay Lanka for 45 million rupees and two crossings in Melstacorp totalling 45 million rupees.

John Keells Holdings PLC closed 2.90 rupees up at 151.00 rupees a share, Dialog Axiata gained 40 cents to 11.10 rupees a share and Colombo Cold Stores PLC was 30.00 rupees up at 600.00 a share, pushing the ASPI up.

Brokers said that stocks are gaining as an alternative investment on the back of price controls on fixed deposits, and due to expectations of elections this year.

However, some stocks may fall on profit taking, after the recent gains, brokers said.

The ASPI has gained for seven straight days, soaring past the levels seen just before the Easter Sunday bombings, which caused stocks to plunge.

"The earnings season is coming up in two weeks' time, and companies that did badly may witness some selling pressure," a broker said.

The June quarter was overshadowed by the terror attack, which has hit the tourism and related industries.

Economic activity slowed down with people staying at their homes for most of a month, due to traditional April holidays which were followed by a security crackdown.

https://economynext.com/JKH,_Dialog_...3-15186-3.html

nihal123Top contributor

nihal123Top contributor

- Posts : 6327

Join date : 2014-02-24

Age : 58

Location : Waga

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

මහ බැංකුව ණය පොළී අනුපාත තවදුරටත් පහළ දමයි

July, 19, 2019

ඒ අනුව බලපත්රලාභී බැංකු හා බැංකු නොවන මූල්ය ආයතන මගින් ඉතිරි කිරීමේ සහ මාස 3 ට අඩු අනෙකුත් තැන්පතු සඳහා ලබා දෙන පොලී අනුපාත නිත්ය තැන්පතු පහසුකම් අනුපාතය ( SDFR) මත පදනම් වන අතර එයට වඩා වැඩි කාලසීමාවකින් යුතු තැන්පතු සඳහා ගෙවන පොලී අනුපාත දින 364 භාණ්ඩාගාර බිල්පත් අනුපාතය මත පදනම් වේ.

ව්යවස්ථාපිත සංචිත අනුපාතය (SRR) පහල දැමීම මඟින් ද ශ්රී ලංකා මහා බැංකුව දේශීය මුදල් වෙළඳපොලට සැලකිය යුතු රුපියල් ද්රවශීලතාවයක් සැපයූ අතර එයට අමතරව 2019 මැයි 31 වන දින සිට සිය ප්රතිපත්ති පොලී අනුපාතික ද පදනම් අංක 50 කින් අඩුකළේය. එහි බලපෑම, නිත්ය තැන්පතු පහසුකම් අනුපාතය හා බැඳුණු ඉතුරුම් තැන්පතු පොලී අනුපාතයන්ගේ පහල යාම මඟින් සෘජුව පිලිබිඹු වේ.

2019 ජුලි 01 දින සිට ක්රියාත්මක වන පරිදි 2019 වසරේ තුන් වන කාර්තුව සඳහා බැංකු සහ බැංකු නොවන මූල්ය ආයතනයන්ගේ තැන්පතු සඳහා බලපැවැත්වෙන පදනම් පොලී අනුපාත (reference rates) තවදුරටත් සංශෝධනය කරන ලදී. එමෙන්ම ඉතුරුම් හා ස්ථාවර තැන්පතු සඳහා ලබා දිය හැකි උපරිම ණය අනුපාත පිලිවෙලින් පදනම් අංක (basis points) 50 කින් සහ 171 කින් තවදුරටත් පහත දමනු ලැබූ නිසා බැංකු සහ බැංකු නොවන මූල්ය ආයතනයන්ගේ අරමුදල් පිරිවැය අඩුවෙනු ඇත. 2019 අප්රේල් 26 වන විට 12.24% ක් ලෙස පැවති බරිත සාමාන්ය ප්රමුඛ ණය පොලී අනුපාතිකය 2019 ජූලි 12 වන විට 10.97% ක් දක්වා අඩුවී ඇත.

මේ අනුව, බැංකු හා බැංකු නොවන මූල්ය ආයතනයන්ගේ ණය පොලී අනුපාත තවදුරටත් නුදුරු අනාගතයේදීම අඩුවනු ඇතැයි ශ්රී ලංකා මහ බැංකුව අපේක්ෂා කරන අතර විශේෂයෙන් සුළු හා මධ්ය පරිමාණ ව්යාපාරිකයන් ඇතුළු ණය ගැනුම්කරුවන් හට අඩු පොලී අනුපාත යටතේ ණය පහසුකම් ලබා ගැනීමට හැකිවනු ඇතැයි අපේක්ෂා කෙරෙයි. ශ්රී ලංකා මහ බැංකුව විසින් බැංකු පොලී අනුපාතිකයන්ගේ හැසිරීම සමීපව නිරීක්ෂණය කරන අතර මනා ලෙස පාලනය කර ඇති උද්ධමන පීඩනය සැලකිල්ලට ගනිමින් ආර්ථික වර්ධනයට රුකුලක් වන පරිදි සුදුසු අමතර ක්රියාමාර්ග ගැනීමට ද අනාගතයේ දී කටයුතු කරනු ඇත.

NIRMALSG

NIRMALSG- Posts : 428

Join date : 2019-02-17

Location : Colombo

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

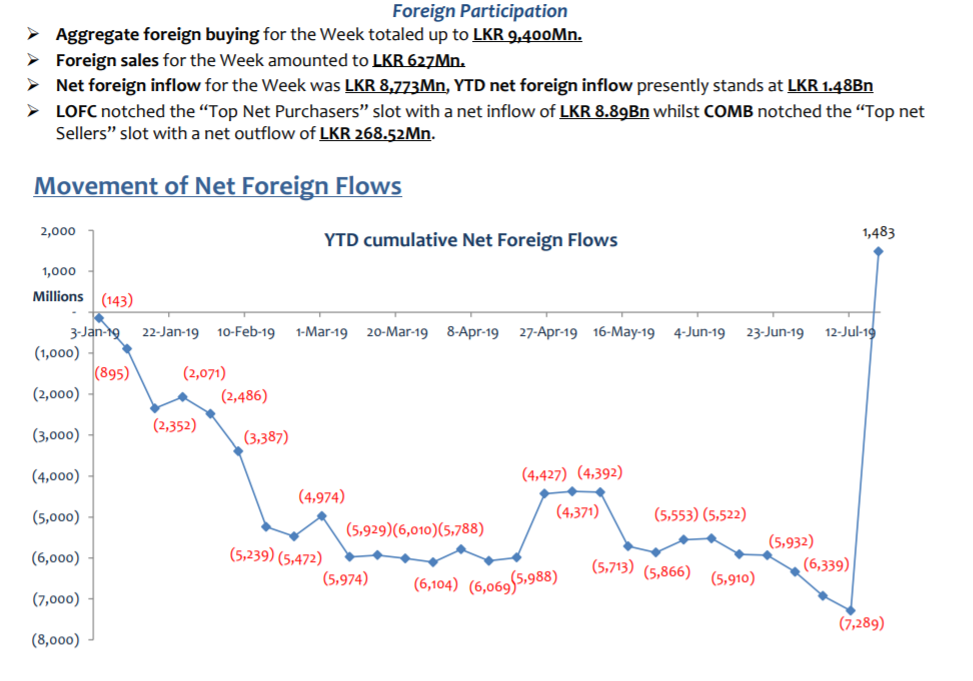

I believe after 1.5 or 2 years, Foreign investments in positive side on CSE.

It seams coming colors good for the investors in the market.

Stock market also gaining mainly due to hope of stability and it seams more money from fixed deposits coming to the market. I believe those are not manipulations since fundamentally attractive share also gaining last couple of days. Purely because of high demand. Hope this trend continue.

Envoy tells MR French investors keen on H’tota Port

French Ambassador to Sri Lanka Eric Lavertu yesterday said investors from France have shown keen interest in investments related to the Hambantota port and the plantation sector.

The French Ambassador expressed these views during a meeting held at Opposition Leader Mahinda Rajapaksa’s residence in Colombo.

In a statement, Opposition Leader's office said the Ambassador thanked the Opposition Leader for his presence at the French National Day during the previous week.

The Ambassador stated that there are many investment opportunities in Sri Lanka, if the political and economic policies provide more stability to create an environment conducive to attract foreign investors, the statement said.

He also stated that investors from France show keen interest in investments related to the Hambantota Port and the plantation sector.

The statement said the Ambassador highlighted the importance of the Hambantota Port and it is strategically located at the heart of global traffic, by default making it a great opportunity for any investor.

During the meeting Rajapaksa voiced his agreement to the statement by the Ambassador regarding the Hambantota Port and further went on to state that the taxation policies would also need to be revisited by a future government in order to make it investment friendly.

ruwan326

ruwan326- Posts : 1744

Join date : 2016-09-29

Age : 46

Location : Horana

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

‘S&P SL 20’ shares up over 10% within weeks

21 July, 2019

The improvement of the All-Share Price Index and the S&P SL 20 in recent weeks offers encouragement to the investor community and market stakeholders. “We are hopeful that these positive moves translate into a trend, where the ASPI continues into positive Year To Date returns but this would largely depend on how investors react to the recent performance as well as Macro developments in the coming weeks and months,” Chief Executive Officer Colombo Stock Exchange (CSE) Rajeeva Bandaranaike said.

“We certainly are watchful of these developments and welcome more activity in the market from both local and foreign investors,” he said.

During recent weeks, the All-Share Price Index and the S&P SL 20 have gained a fair amount of ground. Since the week starting 24th June and as at 18th July, the ASPI had gained 341.2 points or 6.4% and the ‘S&P SL 20’ had gained 250.5 points or 10.1%. “At the end of the present week, we may see the fourth straight week of trading where we have seen the indices make a weekly gain.

“During this week we also had the highest daily turnover figure so far in 2019 which was Rs.9.4 billion on Monday which was due to a large transaction . As of 18th July, foreigners are net buyers so far this year with Rs. 1.2 billion in net foreign inflows,” he said.

The Stock Exchange in partnership with the Securities and Exchange Commission of Sri Lanka (SEC) and the stock broking community, are continuing with our efforts to create awareness among both local and foreign investors on the buying opportunity the market presents at-the-moment.

“In Colombo and in areas outside Colombo so far this year we have conducted over 160 educational and awareness-driven initiatives and we anticipate conducting another 100 more before the end of the year. The CSE and SEC has also conducted its regional investor day series and plans to host the 17th and 18th events in Tissamaharama and Polonnaruwa. These forums reach out to active investors, potential investors and inactive investors and look to re-engage them to the market,” he said.

“On the other hand, we are also continuing with our efforts to attract new listings on the exchange and have approached a number of companies regarding listing on the Main, Diri-Savi and Empower Board.

“We anticipate that these efforts will also result in listings in future. On the foreign investor front, the CSE and the SEC in partnership with the stock brokers hosted an ‘Invest Sri Lanka Forum’ targeting institutional investors based in Singapore in May this year.

“These series of investor forums offer foreign investors, (some of whom are large shareholders in Sri Lankan listed companies), an opportunity to meet senior representatives of listed companies and stock exchange officials, regulators and government representatives.

“The Singapore event, given its timing was also helpful in reassuring international investors following events on April 21. We expect to continue with our efforts to reach out to investors based in other key international markets in the future as well,” Bandaranaike said.

http://www.sundayobserver.lk/2019/07/21/new-stock-exchange-listings-anticipated

ruwan326

ruwan326- Posts : 1744

Join date : 2016-09-29

Age : 46

Location : Horana

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

Focus on sectors highlighted in National Export Strategy

21 July, 2019

Chairperson and Chief Executive, Sri Lanka Export Development Board, Ms. Indira Malwatte, as the Commissioner General for Sri Lanka of Expo 2020 Dubai and Executive Director of Bureau of Expo 2020 Dubai, Najeeb Ali sign the participation contract.

Sri Lanka is now an approved participant at the World Expo 2020 Dubai following the signing of the participation contract with the ‘Dubai Expo 2020 Bureau’ recently.The Expo is a mega exposition held in the UAE on the theme ‘Connecting minds, Creating the future’ that welcomes more than 190 participating countries and over 25 millions of visitors from across the world to create, collaborate and innovate to generate a sustainable future. It hosts the world for 173 days starting from October 20, 2020 to April 10, 2021 and is spread on a land area of 438 hectares close to Dubai city.

The delegation to the UAE to sign the contract was led by Deputy Minister of Development Strategies and International Trade, Nalin Bandara.

Chairperson and Chief Executive, Sri Lanka Export Development Board, Ms. Indira Malwatte, as the Commissioner General for Sri Lanka of Expo 2020 Dubai, signed the participation contract on behalf of Sri Lanka with Executive Director of Dubai Expo 2020 Bureau, Najeeb Mohammed Al-Ali. Mrs. Malwatte outlined the comprehensive ground work that has been done so far by the Sri Lankan side in preparation for its participation. She said that Sri Lanka’s pavilion will be organised on a public-private partnership model on the ‘Water’ theme, designed by the students of the Moratuwa University.

She said that throughout the six months of the Expo, Sri Lanka will represent the main sectors highlighted in the National Export Strategy (NES) on the larger theme of ‘Island of Ingenuity’ and there will be events that will be coordinated with the ‘Water’ theme.

On the sidelines of the contract signing ceremony, the delegation visited the Expo site including the Sri Lankan pavilion which is under construction. The delegation also took the opportunity to meet with Expo technical teams to discuss specific activities. Najeeb Ali briefed the delegation on the extent of the progress of the construction and arrangements for hosting Expo Dubai 2020. He further explained that 192 countries have already confirmed participation and it will be the most diverse Expo in the world with dedicated pavilions for each individual country.

http://www.sundayobserver.lk/2019/07...xpo-2020-dubai

The Invisible

The Invisible- Posts : 3116

Join date : 2016-11-28

Age : 44

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

ECONOMYNEXT - Sri Lanka's nationwide inflation slowed down to 2.1 percent in June 2019 from 3.5 percent in May 2019, the lowest in five months, the central bank said.

The fall in the National Consumer Price Index compiled by the Census and Statistics Department in June 2019 was owing to the high base in the same month of the previous year, a statement said.

In the food category prices contracted by 2.9 percent in June 2019 from a year ago while non-food inflation was 6.2 percent.

A statement said that when the monthly change is considered, the National Consumer Price Index (NCPI) increased by 0.4 percent in June 2019 with increases in prices of items in both food and non-food categories.

Core inflation, which reflects the underlying inflation in the economy, slowed to 6.1 percent in June 2019 from 6.3 percent in May 2019.

(COLOMBO, 22 July, 2019)

The Invisible

The Invisible- Posts : 3116

Join date : 2016-11-28

Age : 44

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

Jul 23, 2019 06:51 AM GMT+0530 | 0 Comment(s)

ECONOMYNEXT - Sri Lanka's Securities and Exchange Commission is meeting with the senior leadership of listed companies to interact with the regulator, allowing two way feedback to work towards common interests.

"This is also an opportunity to help the regulator build capacity and be more aware, as well as to provide an opportunity for the Chair, CEO and senior Directors of regulatees to build capacity within new board members and key management personnel such as the Chief Internal Auditor, Chief Risk Officer and the Head of Compliance," SEC chairman Ranel Wijesinha said in a statement.

"Over time, we hope these will help to bridge the gap between the regulator and regulatee, such that we align interest."

The session on July 23 will focus on the role of chief executive and chairman and a controversial rule on minimum public holdings, which is driving firms out of the stock market.

"In order to provide each stakeholder group with adequate opportunity to engage the capital market regulator, we intend to have dates dedicated to each stakeholder group in future," Wijesinha said.

"These fora will be scheduled frequently and the idea of having such fora is to enable the Director General and directors to meet and interact with regulatees and stakeholders regularly whilst yet retaining their Independence and objectivity and at the same time providing the regulatee an opportunity to seek clarifications.

"Over time, we hope these will help to bridge the gap between the regulator and regulatee, such that we align interest. This is also an opportunity to help the regulator build capacity and be more aware, as well as to provide an opportunity for the Chair, CEO and senior Directors of regulatees to build capacity within new board members and key management personnel such as the Chief Internal Auditor, Chief Risk Officer and the Head of Compliance." (Colombo/July23/2019)

nihal123Top contributor

nihal123Top contributor

- Posts : 6327

Join date : 2014-02-24

Age : 58

Location : Waga

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

ලැයිස්තුගත සමාගමක සභාපති සහ ප්රධාන විධායක තනතුරු තනි පුද්ගලයෙකු අතට නොයන්නට සුරැකුම්පත් කොමිසමෙන් නව නීති

July, 23, 2019

වර්තමානයේ දී මෙරට ලැයිස්තුගත සමාගම් සම්බන්ධයෙන් එවැනි නීතියක් ක්රියාත්මක වන්නේ නැත. ඒ අනුව ලැයිස්තුගත සමාගම්වල සභාපති සහ ප්රධාන විධායක නිලධාරී/ කළමනාකාර අධ්යක්ෂ යන තනතුරු එක් පුද්ගලයෙකු විසින් දරනු ලබන අවස්ථා නිරීක්ෂණය වී ඇති බව සුරැකුම්පත් හා විනිමය කොමිසම වැඩිදුරටත් කියා සිටී.

දැනට කොටස් වෙළෙඳපොළේ ලැයිස්තුගත සමාගම් 293 ක් ඇති අතර මෙයින් සභාපති/ ප්රධාන විධායක නිලධාරී/ විධායක සභාපති තනතුරු තනි පුද්ගලයින් විසින් දරන සමාගම් 49 ක් ඇති අතර සමාගම් 244 ක අදාළ බලතල වෙන්වෙන් පුද්ගලයින් විසින් දරනු ලබයි.

මේ සම්බන්ධයෙන් ශ්රී ලංකා සුරැකුම්පත් හා විනිමය කොමිෂං සභා උපදේශන පත්රයේ පළවන සටහනක් පහතින් දැක්වේ.

ruwan326

ruwan326- Posts : 1744

Join date : 2016-09-29

Age : 46

Location : Horana

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

Jul 24, 2019

Sri Lanka's stocks closed 1.10 percent up on Wednesday, reaching the highest levels since early March, boosted by banking stocks, brokers said.

Colombo's All Share Price Index closed 62.50 points up at 5,745, after reaching an intra-day high of 5,760.35 in the final half hour of trading.

The more liquid S&P SL20 Index closed 2.32 percent or 63.73 points up at 2,813.28.

The market is now at a four and a half month high, rising past 5,722 recorded on March 08, having fully recovered the losses of the Easter Sunday bombings.

Political plays are underway, with President Maithripala Sirisena's Sri Lanka Freedom Party and the opposition Sri Lanka Podujana Peramuna today attempting to strike an alliance ahead of the Presidential polls at the end of the year.

Market turnover on Wednesday was 1.1 billion rupees, with one negotiated deal (crossing) worth 175 million rupees in Melstacorp.

The country's three largest privately-held banks contributed to the ASPI gain.

Sampath Bank closed 7.10 rupees up at 160.90 rupees a share while Commercial Bank ended trading 2.50 rupees up at 103.90 rupees a share,and Hatton National Bank closed 5.30 rupees up at 150.20 rupees a share.

The largest listed firm, John Keells Holdings closed 1.80 rupees up at 151.80 rupees a share, also pushing the ASPI up.

The banking sector index gained 1.9 percent on Wednesday on a third of the day's turnover.

The earnings season for the June quarter started on Monday, and Union Bank was one of the first to release its financials on Tuesday, showing a growth in profit.

However, non-performing loans have risen in the banking sector in the June quarter to 4.8 percent of total loans, from 4.2 percent three months earlier, the central bank has said.

https://economynext.com/Banks_push_Sri_Lanka_stocks_to_four_and_a_half_month_high-3-15252-3.html

NIRMALSG

NIRMALSG- Posts : 428

Join date : 2019-02-17

Location : Colombo

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

http://www.travelvoice.lk/sri-lanka-tourist-arrivals-recovery-continues-with-boost-from-india/

Sri Lanka’s tourist arrivals have increased to an average 4,000 a day in the second week of July from 3,200 arrivals a day a week earlier, recovering further from the Easter Sunday attack with more visitors from India, a top official said.

“There’s a significant increase in arrivals now, and we are averaging about 4,000 arrivals per day,” Sri Lanka Tourism Promotions Bureau (SLTPB) Chairman Kishu Gomes told EconomyNext.

This is a 45 percent fall from the 7,026 average daily arrivals from July 2018.

Arrivals had plunged 71 percent in May 2019, immediately after the Jihadist terror attack on churches and hotels, to around 1,200 a day.

It had then recovered to 2,102 arrivals a day in June, which was a 57 percent fall.

Gomes said that tourists from neighbouring India have contributed most towards the growth seen in the second week of July.

In June too, the highest number of tourists (15,048) came from India, which has traditionally been Sri Lanka’s largest tourism market.

The industry is expecting more Indian visitors, after Indian Prime Minister Narendra Modi’s state visit to Sri Lanka in June, the launch of budget promotional packages and Air India restarting its third daily flight to Colombo from the second week of July in a show of solidarity for its neighbour.

A festival in August, which will include participation of Bollywood actors and Indian cricket stars is expected to boost arrivals further, Gomes had earlier said.

SLTPB is about to spend 416 million rupees on a public relations campaign and 500 million rupees on a short-term marketing campaign to drive global arrivals to Sri Lanka.

The cabinet has also approved a cut in aviation fuel sale prices, ground handling charges and an embarkation tax to reduce air fares to Sri Lanka.

The Easter Sunday attacks had targeted three luxury hotels in Colombo, while an attack on a fourth had failed.

Of the 259 persons killed in the attacks, 45 were foreigners.

Tourism advisories recommending against travel to Sri Lanka which were implemented immediately after the attacks had been relaxed in May and June, faster than many expected, helping the country recover faster, the central bank has said.

ruwan326

ruwan326- Posts : 1744

Join date : 2016-09-29

Age : 46

Location : Horana

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

25 July 2019

Sri Lankan shares jumped more than one percent yesterday to hit their highest close in nearly 20 weeks, led by gains in banking and diversified stocks, while the rupee weakened on higher importer dollar demand.

The country’s benchmark stock index ended 1.1 percent up at 5,745.97 its highest close since March 7.

The index is down about 5.06 percent so far this year.

The country’s stock market had a turnover of Rs.1.1 billion, well above this year’s daily average of about Rs.610.1 million so far. Last year’s daily average came in at Rs.834 million.

Foreign investors bought a net Rs.362,201 worth of shares, extending year-to-date net buying to Rs.1.47 billion worth of equities so far this year, index data showed.

Shares of Sri Lanka Telecom PLC jumped 3.9 percent, Sampath Bank PLC rose 4.6 percent, conglomerate John Keells Holdings PLC climbed 1.2 percent and the country’s biggest listed lender Commercial Bank of Ceylon ended 2.5 percent firmer.

Meanwhile, the currency ended 0.06 percent weaker at 176.10/25 per dollar, compared with Tuesday’s close of 176.00/10, as importer demand for the greenback outpaced the dollar selling by banks.

The rupee is up 3.69 percent so far this year.

The central bank left key interest rates unchanged on July 11 as expected, after cutting them in May to support the economy as tourism and investment plummeted in the wake of deadly suicide bombings in April.

Foreign investors bought a net Rs.1.22 billion worth of government securities in the week ended July 17, but the market has seen a year-to-date net foreign outflow to Rs.18.46 billion, the Central Bank data showed.

http://www.dailymirror.lk/business-n...lls/273-171698

The Invisible

The Invisible- Posts : 3116

Join date : 2016-11-28

Age : 44

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

REUTERS: Shares rose for a fourth straight session to hit their highest close in over five months on Friday, led by a rally in beverage and banking stocks along with healthy purchases by domestic investors. The rupee ended flat as inward remittances offset importer dollar demand.

The country's benchmark stock index ended 1.35% up at 5,872.89, its highest close since 20 February.

The bourse rose 2.76% during the week. It is still down about 4.26% so far this year.

The country's stock market had a turnover of Rs. 1.2 billion ($6.81 million), nearly twice of this year's daily average of about Rs. 615.5 million so far.

Stock...

Last year's daily average came in at Rs. 834 million.

Foreign investors sold a net Rs. 187.4 million worth of shares on Friday; the year-to-date net buying stood at Rs. 1.2 billion, index data showed.

Shares of Ceylon Cold Stores PLC jumped 19.1%, the country's leading fixed line telephone operator Sri Lanka Telecom PLC rose 11.5%, Hatton National Bank PLC climbed 7.5%, and Nestle Lanka PLC ended 4% higher.

Meanwhile, the currency ended flat at 176.15/25 per dollar.

The rupee fell 0.23% during the week but is up 3.66% so far this year.

The Central Bank left key interest rates unchanged on 11 July as expected, after cutting them in May to support the economy as tourism and investment plummeted in the wake of deadly suicide bombings in April.

Foreign investors bought a net Rs. 1.22 billion worth of government securities in the week ended 17 July, but the market has seen a year-to-date net foreign outflow to Rs. 18.46 billion, the Central Bank data showed.

ruwan326

ruwan326- Posts : 1744

Join date : 2016-09-29

Age : 46

Location : Horana

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

July 28, 2019

Dr. Howard Nicholas from the International Institute of Social Studies, the Netherlands had informed me of his visit to Colombo. Whenever, he comes here, I usually ask him if he has time to visit the University of Colombo and give a lecture. Usually, he doesn’t say no.

Born in Sri Lanka, I knew his affectionate heart to Sri Lanka as well as to Colombo University where he served about 10 years since the mid-1980s. Together with Emeritus Prof. W.D. Lakshman who was the Head of the Department of Economics at that time, he was instrumental in capacity building in the Department of Economics and laying the foundation for its postgraduate studies.

Howard’s world view is beyond the conventional theoretical abstracts so that we always considered it a privilege to listen to his real-world economics based on his own research.

The big wave in 2008

It was in 2004 – four years before the outbreak of the global financial crisis in the US, that Howard was here in Colombo. I never forget his lecture that day, which inspired me to study business cycles.

As usual I had invited him to deliver a special lecture for economics postgraduate students at the university. He agreed and, said that he would speak on the same issue that he was interested in and delivered lectures in some other places in Europe.

The title of the lecture was “The Coming US Crisis: Nature, Causes and Consequences.” The lecture was about the inevitability of a forthcoming economic crisis from the US, as an inherent feature of long-term business cycles in the world economy!

Predicting the crisis

The world has been reaching the bottom of a long-term business cycle over the past few decades after the 1980s. The changes in the world economy – all were pointing towards one thing, as Howard revealed in his special lecture: The coming US crisis, which would be inevitable now.

As a result of the downward path of the US economy, one of the fascinating outcomes was the unprecedented escalation of the total US debt: It increased to over 260 per cent of GDP during the time of the Great Depression in the 1930s; now it has already increased to over 330 per cent of GDP by 2003, and was still rising. What does it mean?

The US economy was at the verge of a crisis which would be inevitable within the next couple of years, and the world economy has to face with its negative repercussions. And here comes the big wave in 2008, as we all saw it – the US financial crisis, as Howard predicted it four years before.

While the US lost about US$ 360 billion real income from its GDP, the entire world lost over $3,000 billion in just one year – 2009.

Flood gates of money

This time, Howard’s special lecture which was held on July 13, was on “the great monetary experiment” – a source of another big wave in the world economy. In fact, even a bigger wave than the previous global financial crisis. In other words, the world is heading towards a big financial crash.

I thought of elaborating today on some important factors that form the source of the forthcoming financial crisis, as revealed in Howard’s lecture.

And, this is a “man-made” crash with a foundation in a monetary policy experiment, unlike the previous global financial crisis.

The great monetary experiment is the unprecedented increase in money in the world, led by the loose monetary policies and “quantitative easing” in advanced countries. The central banks in advanced countries have been injecting massive amounts of cash into their economies. They lower the short-term interest rates through repurchase agreements, drive down the long-term interest rates through buying bonds, and further pressurise the interest rates through direct lending to commercial banks.

All of the above lead to more and more money – a strategy that was adopted to stimulate growth and job creation in the aftermath of the 2008 global financial crisis. Consequently, the financial assets of the major four central banks in the world – Federal Reserve Bank, European Central Bank, People’s Bank of China, and Bank of Japan, increased three times during 2008-2018. The total assets of the all four banks together increased from 15 per cent of GDP in 2008 to over 40 per cent of GDP in 2018.

Interest rates were already down during the financial crisis. As a result of injecting more money by the central banks in the four biggest economies in the world, in fact the interest rates decreased further and, in some countries turned to negative. Under negative interest rates, borrowers are rewarded and savers are penalized!

Contrary to anticipation

What do we expect by opening the flood gates of money flows by the four big economies in the world? We would expect some inflation, by ending the deflationary pressures especially in the aftermath of the global financial crisis. There is more money and lower interest rates so that theoretically there should be more borrowings and more purchases causing the prices to go up. But there is no inflation!

We would also expect stimulation in investment and businesses, because there is plenty of money to borrow at lower or negative interest rates.

Banks got plenty of money to lend for investment and businesses but there is no borrowing for productive purposes.

Simply, more money should lead to higher growth and higher prices, particularly during a downturn of the world economy. But it is strange enough that neither growth accelerated nor prices increased. But money is still flowing in 2019 through opened flood gates, leaving an important question with us: Where did all that money go?

Speculative investment

Increased money would lead to inflation or higher growth, if that money ends up in the hands of the people who constitute consumers and producers or households and business firms. But the bulk of money did not go to their hands.

Money went into the hands of speculative investors: They borrow at lower or even negative interest rates, and invest in stock markets and bond markets! As a result, the money flows have boosted stock prices and bond prices. When such assets prices rise, usually it makes the rich richer and hurt the poor.

As financial assets are held by a smaller group of rich people, when the asset prices rises the rich become richer. The flip side of the coin is the decline in interest rates, perhaps, even to negative rates, hurting the ordinary people whose savings and pension funds generate little interest income.

Asset bubble

All ended up in a blowing asset bubble! It is not only in advanced countries, but also in China and emerging economies as part of the money originated in advanced countries flowed globally.

Still everything begins in the US economy: The value of the US financial assets amounted to 350 per cent of GDP at the time of the Dot-Com crisis in 2001; it was 375 per cent of GDP at the time of the Global Financial crisis in 2008. Now it is already over 425 per cent of GDP as of 2018.

What does this mean? An inflated financial bubble with “the great monetary experiment” in advanced countries. The future of the global economy is about a massive “financial collapse” with continued quantitative easing. This will be followed by a major economic stagnation in advanced countries.

By the way, there is always a silver lining in a dark cloud: The economic recessions are also accompanied by capital outflows from advanced countries to developing countries. The developing economies which are ready to accommodate foreign direct investment flows will be the beneficiaries of productive capital outflows in the world.

(The writer is a Professor of Economics at the University of Colombo and can be reached at sirimal@econ.cmb.ac.lk).

http://www.sundaytimes.lk/190728/bus...st-360144.html

Home

Home