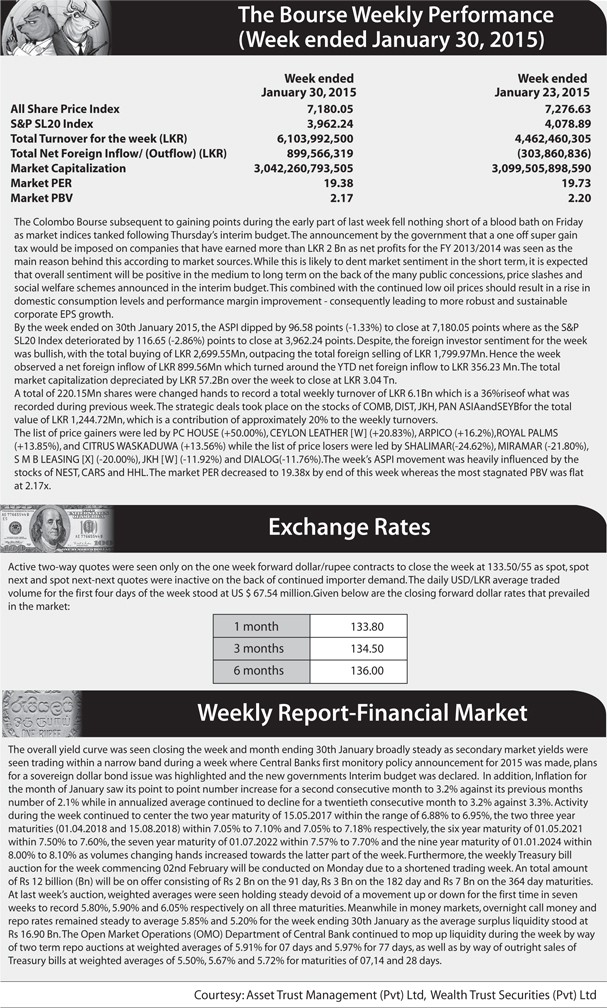

The markets closed the week on a negative note with the ASPI declining a 96.58 points (or 1.33%) to close at 7180.05 while the S&P SL 20 Index lost 2.86% or (or 116.65 points) to close at 3962.24 points.

Turnover & Market Capitalization

JKH was the highest contributor to the week's turnover value with a contribution of LKR 1.10bn that accounted for 18.10% of total turnover. Commercial Bank followed suit accounting for 13.13% of turnover (value of LKR 801.23mn) while Peoples Leasing contributed LKR 419.08mn to account for 6.87% of the week's turnover.

Daily average turnover value over the week amounted to LKR 1.22bn (+36.79% W-o-W) compared to last week's average of LKR 892.49mn.

Total turnover value for the week amounted to LKR 6.10bn relative to last week's value of LKR 4.46bn. Market capitalization decreased 1.85% (or LKR 57.25bn) to LKR 3042.26bn relative to last week's value of LKR 3099.51bn.

The Banking & Finance sector was the highest contributor to the week's total turnover value, accounting for 43.71% (or LKR 2.67bn) of market turnover.

Sector turnover was driven primarily by Commercial, Peoples Leasing, HNB,Seylan, Pan Asia & DFCC which cumulatively accounted for 70.59% of the sector's total contribution.

The second highest sectoral contribution stemmed from the Diversified sector, which contributed 26.88% (or LKR 1.64bn).

The sector was helped by JKH which accounted for 67.38% of the sector's total turnover value. The Manufacturing sector was also amongst the top sectoral contributors to the market, accounting for 12.34% (or LKR 752.60mn) of the week's total turnover value. The sector was helped by Piramal Glass which contributed 19.59% to total sector turnover.

Liquidity (in Volume Terms)

The Banking & Finance sector dominated the market in terms of sharevolume too, accounting for 32.13% (or 70.74mn shares) of total volume, with a value contribution of LKR 2.67bn.

The Manufacturing sector followed suit as 57.69mn shares (or 26.20%), amounting to LKR 752.60mn changed hands.

The Diversified sector meanwhile, contributed 13.36% to the week's total turnover volume as 29.40mn shares were exchanged. The sector's volume accounted for LKR 1.64bn of total market turnover value.

Week's Top Gainers & LosersPC House was the week's highest price gainer, increasing 50.00% from LKR 0.20 to close at LKR 0.30. Arpico gained 16.20% W-o-W to close at LKR 165.00. Royal Palms meanwhile, gained 13.85% W-o-W to close at LKR 41.10.

Citrus Waskaduwa and Finlays Colombo were also amongst the week's top price gainers with W-o-W gains of 13.56% and 13.12%, respectively.

Shalimar was the week's highest price loser as the stock declined 24.62% W-o-W to close at LKR 1650.00, relative to LKR 2189.00 last week.

Miramar recorded a W-o-W price decline of 21.80% to close at LKR 51.30 while SMB Leasing (NV) closed at LKR 0.40, representing a W-o-W decline of 20.00%.

Foreign investors closed the week in a net buying position of LKR 0.90bn, relative to last week's net selling position of LKR 0.30bn (+396.05% W-o-W); daily average net inflows consequently amounted to LKR 0.18bn compared to last week's daily average net outflows of LKR 0.06bn.

Total foreign purchases increased 226.10% W-o-W to LKR 2.70bn from last week's value of LKR 0.83bn, while total foreign sales amounted to LKR 1.80bn relative to LKR 1.13bn recorded last week (+59.05% W-o-W).

In terms of volume Renuka Agri and Peoples Leasing led foreign purchases, while Union Bank and Commercial Bank led foreign sales.

In terms of value meanwhile, Peoples Leasing and JKH led foreign purchases while Commercial Bank and Chevron led foreign sales.

Point of ViewMarket sentiment took a dive this week with an approx. 196 point drop on Friday wiping off Index gains earlier in the week.

Uncertainty surrounding the Government's newly proposed tax structures and levies, pushed the ASPI below the crucial support level of 7200 points with selling pressure on a number of heavy-weight blue-chips dragging the overall Index lower.

Newly proposed taxes & levies include a one-off 25% 'super-gains' tax on Corporate earnings over a threshold of LKR 2.0Bn and higher levies on Mobile telecom services, Casinos, and Liquor manufacturing.

Key index mover JKH in particular lost approx. 5% off its price as concerns surrounding its "Waterfront Project" weighed on sentiment. Despite the overall negative sentiment though, turnover levels hit a two week high on Friday helped by a strong recovery in net foreign inflows.

Net inflows to equities over the week rose to LKR 899.6Mn (cf. net outflows of LKR 303.9Mn last week) with net buying on Friday accounting for approx.

50% of the week's total as foreign investors sought buying opportunities. If the index continues to fall in the week ahead, large institutionals and HNIs may join the buying as many of the new taxes & levies are perceived as one-offs unlikely to affect more medium term prospects.

The prospective buying support is likely to check the current decline in the Index.

New Govt. Revises Down Deficit TargetThe newly appointed Government of Sri Lanka presented its interim budget on Thursday, revising the down the country's fiscal deficit to 4.4% for 2015E from the previous estimate of 4.6%.

Under the newly proposed budget, total revenue for the year is estimated to be LKR 1,594Bn, of which 88% is expected from tax revenues.

Total fiscal expenditure meanwhile, is estimated at LKR 2,990Bn helping lower the target budget deficit to 4.4% of GDP (the lowest level since 1977).

Given the populist nature of the budget - particularly, price reductions of 13 essential goods, public sector wage and pension revisions, reductions in fuel and energy costs, an interest rate cap of 8% on credit cards - the retail sector is likely to be impacted positively.

Motors and Construction related sectors too are likely to be benefitted positively through measures such as a 15% tax reduction on the motor vehicles with engine capacity <1,000cc and the removal of custom duty on cement and steel imports.

However, a one-off 'Super Gains Tax' of 25% on corporates earning over LKR 2bn in profit is likely to impact a number of sectors, particularly Banks and Diversifieds.

Telecom sector profits are also likely to be impacted by a one- off levy of LKR 250mn on mobile operators.

www.dailynews.lk

» CCS.N0000 ( Ceylon Cold Stores)

» Sri Lanka plans to allow tourists from August, no mandatory quarantine

» When Will It Be Safe To Invest In The Stock Market Again?

» Dividend Announcements

» MAINTENANCE NOTICE / නඩත්තු දැනුම්දීම

» ඩොලර් මිලියනයක මුදල් සම්මානයක් සහ “ෆීල්ඩ්ස් පදක්කම” පිළිගැනීම ප්රතික්ෂේප කළ ගණිතඥයා

» SEYB.N0000 (Seylan Bank PLC)

» Here's what blind prophet Baba Vanga predicted for 2016 and beyond: It's not good

» The Korean Way !

» In the Meantime Within Our Shores!

» What is Known as Dementia?

» SRI LANKA TELECOM PLC (SLTL.N0000)

» THE LANKA HOSPITALS CORPORATION PLC (LHCL.N0000)

» Equinox ( වසන්ත විෂුවය ) !

» COMB.N0000 (Commercial Bank of Ceylon PLC)

» REXP.N0000 (Richard Pieris Exports PLC)

» RICH.N0000 (Richard Pieris and Company PLC)

» Do You Have Computer Vision Syndrome?

» LAXAPANA BATTERIES PLC (LITE.N0000)

» What a Bank Run ?

» 104 Technical trading experiments by HUNTER

» GLAS.N0000 (Piramal Glass Ceylon PLC)

» Cboe Volatility Index

» AHPL.N0000

» TJL.N0000 (Tee Jey Lanka PLC.)

» CTBL.N0000 ( CEYLON TEA BROKERS PLC)

» COMMERCIAL DEVELOPMENT COMPANY PLC (COMD. N.0000))

» Bitcoin and Cryptocurrency

» CSD.N0000 (Seylan Developments PLC)

» PLC.N0000 (People's Leasing and Finance PLC)

» Bakery Products ?

» NTB.N0000 (Nations Trust Bank PLC)

» Going South

» When Seagulls Follow the Trawler

» Re-activating

» අපි තමයි හොඳටම කරේ !

» මේ අර් බුධය කිසිසේත්ම මා විසින් නිර්මාණය කල එකක් නොවේ

» SAMP.N0000 (Sampath Bank PLC)

» APLA.N0000 (ACL Plastics PLC)

» AVOID FALLING INTO ALLURING WEEKEND FAMILY PACKAGES.

» Banks, Finance & Insurance Sector Chart

» VPEL.N0000 (Vallibel Power Erathna PLC)

» DEADLY COCKTAIL OF ISLAND MENTALITY AND PARANOID PERSONALITY DISORDER MIX.

» WATA - Watawala

» KFP.N0000(Keels Food Products PLC)

» Capital Trust Broker in difficulty?

» IS PIRATING INTELLECTUAL PROPERTY A BOON OR BANE?

» What Industry Would You Choose to Focus?

» Should I Stick Around, or Should I Follow Others' Lead?