Thread for News on CSE and SL Economy

ruwan326

ruwan326- Posts : 1744

Join date : 2016-09-29

Age : 46

Location : Horana

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

Monday, January 21

With the implementation of the National Export Strategy (NES), much work is left to be done in terms of winning confidence of the export community said Ramal Jasinghe, immediate Past President of National Chamber of Exporters (NCE) of Sri Lanka.

“NCE is now engaged as a participant to the implementation process of the NES, with seats on the Advisory and Working Committees.” Jasinghe told at the 17th Annual General Meeting of NCE, held at Galadari Hotel, Colombo.

He said that Chamber was continually in the forefront raising concerns of exporters related to the negotiations of the proposed Free Trade Agreements (FTAs) with larger countries who enjoy greater economies of scale, to mitigate difficulties to enter their territories due to non-tariff barriers, non-recognition of quarantine and laboratory test reports of Sri Lankan institutions, country of origin requirements, and items included in the negative lists which impact Sri Lankan manufacturers.

“However the Chamber recognizes the need to reach a wider global customer base through FTAs or a similar mechanism, to achieve inclusion to the global market place, on fair trading terms. “he said.

He also noted that the Chamber has presented to the Ministry of Finance a comprehensive set of budget of proposals following consultations with member exporters, and the conduct of a pre-budget workshop to identify issues. We trust that these proposals will be taken in to consideration following the resolution of the prevalent political issues, which the Chamber will follow up on behalf of our members”

With the real possibility of the GSP concession eventually being withdrawn to the growing Middle Income Status of the Country, emphasis on the export of Services would attract more focus of the Chamber.

“Having made positive through the initiatives of our ICT cluster, we recognize as a sustainable way forward the need to add on more service providers earning foreign exchange to augment the service sector portfolio of the Chamber, such as education , Tourism and Professional services, to develop a robust export economy.” he said.

He also stressed Sri Lanka’s competitor countries in the region such as Pakistan, Bangladesh, Vietnam, Cambodia, have overtaken Sri Lanka in apparel exports sector this year by a wide margin due to their gains during the period where Sri Lanka lost GSP+ benefits, with total exports from Bangladesh which is categorized as a least developed country reaching US$ 40 billion.

http://dailynews.lk/2019/01/21/business/174882/more-should-be-done-win-confidence-exporters-ramal-j

nihal123Top contributor

nihal123Top contributor

- Posts : 6327

Join date : 2014-02-24

Age : 58

Location : Waga

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

රු. බිලියන 30 ක විදෙස් ආයෝජන මාසයක දී ඉවතට

January, 22, 2019

ශ්රී ලංකා මහ බැංකුවේ නවතම වාර්තාවකට අනුව 2019 ජනවාරි 16 දිනට පවතින රජයේ සුරැකුම්පත්වල විදෙස් හිමිකාරීත්වය රුපියල් මිලයන 145,450 ක් ලෙසින් සටහන් වන අතර මෙය 2018 දෙසැම්බර් 19 දින වන විට පැවතියේ රුපියල් මිලියන 175,440 ක් වශයෙනි.

මේ අතර 2019 ජනවාරි 16 න් අවසන් සතියක කාලපරිච්ඡේදයක් තුළ දී රජයේ සුරැකුම්පත්වල විදෙස් හිමිකාරීත්වය රුපියල් මිලියන 154,202 සිට රුපියල් මිලියන 145,450 ක් දක්වා රුපියල් මිලියන 8,752 කින් පහළ ගොස් තිබේ.

ruwan326

ruwan326- Posts : 1744

Join date : 2016-09-29

Age : 46

Location : Horana

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

Jan 22, 2019

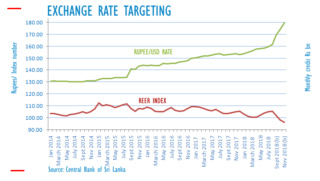

Sri Lanka's real effective exchange rate (REER) index has dropped below 100 amid a collapse of a soft-peg with the US dollar, forcing the central bank to spend 1.2 billion US dollars to prop up the currency while printing money.

A REER index calculated by the central bank dropped from 102.24 in September to 98.10 in October and 96.29 in November, as credibility of Sri Lanka's dollar peg was lost making exporters hold dollars and borrow printed money and foreign holders of rupee bonds to flee.

The rupee fell from 161 to the US dollar in August to 179 to the US dollar by end November. Meanwhile other currencies such as the Indian rupee appreciated. The rupee has fallen from 151 from the beginning of 2018.

A real effective exchange rate index is calculated by measuring the changes against a basket (usually trade weighted) and adjusted for inflation.

Sri Lanka is targeting the exchange rate to maintain a REER peg of around 100.

Central Bank Governor Indrajit Coomaraswamy said earlier in January that the rupee had depreciated almost 20 percent in 2018 and it was a 'disorderly depreciation,' of the currency.

"The real effective exchange rate is well below 100, so it is undervalued," Coomaraswamy said.

"So now we have to intervene. The depreciation of the currency is no longer aligned with fundamentals in terms of current account flows. It is being driven by capital outflows from the government securities market."

Analysts had warned that a soft-pegged central bank which prints large volumes of money to offset interventions in forex markets through open market operations to target interest rates (sterilizing outflows), allowing banks to give loans (or buy securities) without raising deposits, cannot hope to target an exchange rate with any degree of success.

Analysts have said that targeting the REER index requires currency board like tools (hard peg), such as a floating policy rate to limit or eliminate outflow sterilization with new money and a variable target reduces the credibility further.

Cont... https://economynext.com/Sri_Lanka_rupee__undervalued__with_REER_at_96_amid_soft_peg_collapse-3-13203-1.html

nihal123Top contributor

nihal123Top contributor

- Posts : 6327

Join date : 2014-02-24

Age : 58

Location : Waga

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

DFCC බැංකුවෙන් අඩු මිලට කොටස්

January, 23, 2019

රුපියල් බිලියන 7.63 ක ප්රාග්ධනයක් සම්පාදනය කර ගැනීම වෙනුවෙන් මෙම හිමිකම් කොටස් නිකුතුව සිදුකිරීමට නියමිතය.

ඒ අනුව කොටස් 106,039,075 ක්. එකක් රු. 72.00 බැගින් නිකුත් කිරීමට සැලසුම් කර ඇති අතර මේ සඳහා සමාගමේ වත්මන් කොටස් හිමියන්ට ඉල්ලුම් කිරීමට අවස්ථාව හිමිවේ. එහිදී සමාගමේ වත්මන් කොටස් හිමියන්, සෑම කොටස් 5 කටම කොටස් 2 ක් බැගින් වන පරිදි ඉල්ලුම් කිරීම සඳහා සුදුසුකම් ලබනු ඇත.

මේ සඳහා කොළඹ කොටස් වෙළෙඳපොළෙන් සහ අති විශේෂ මහා සභා රැස්වීමක දී සමාගමේ කොටස් හිමියන්ගෙන් අනුමැතිය ලබා ගත යුතුවේ.

මෙය සමාගමේ Tier 1 ප්රාග්ධන මට්ටම ඉහළ නංවා ගැනීම වෙනුවෙන් කරනු ලබන හිමිකම් නිකුතුවක් බව බැංකුව වැඩිදුරටත් කියා සිටී.

කෙසේ වෙතත් මෙම නිවේදනය ප්රකාශයට පත් වීමත් සමඟ අද (23) පෙරවරුවේ දී DFCC බැංකුවේ කොටසක් ගනුදෙනු මිල පෙර දිනයට සාපේක්ෂව 6.85% කින් පහළ ගොස් තිබිණි. එහිදී කොටසක මිල රු. 83.00 ක් ලෙසින් සටහන් වූ අතර එය පූර්ව දිනයට වඩා රු. 6.10 ක අඩු වීමකි.

Ethical TraderTop contributor

Ethical TraderTop contributor

- Posts : 5568

Join date : 2014-02-28

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

lanka

lanka- Posts : 624

Join date : 2014-11-26

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

ruwan326

ruwan326- Posts : 1744

Join date : 2016-09-29

Age : 46

Location : Horana

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

Jan 23, 2019

The United States Navy is doing a cargo transfer operation at Sri Lanka’s main international airport under a plan to use the island’s location to make it a military logistics hub, the U.S embassy in Colombo said.

Under the initiative, several U.S. naval aircraft are scheduled to land and depart from the Bandaranaike International Airport outside Colombo, a commercial airport, bringing in a variety of non-lethal supplies, a statement said.

The supplies will be transferred between planes and then flown to the U.S.S. John C. Stennis aircraft carrier at sea from January 21 to 29.

Supplies may include personal mail for sailors, paper goods, spare parts and tools, and other items, the embassy said.

No cargo, military equipment, or personnel associated with this initiative will remain in Sri Lanka after the completion of the cargo transfer.

“This is part of a larger temporary cargo transfer initiative that promotes Sri Lanka's efforts to become a regional hub for logistics and commerce,” the statement said.

The January transfers will contribute about 25 million Sri Lankan rupees to the country’s economy.

“Sri Lanka's leaders have outlined their vision for the country’s regional engagement that reflects its location at the nexus of the Indo-Pacific and seizes the opportunities that this unique position presents,” said U.S. Ambassador Alaina B. Teplitz.

“We are happy to support this vision through a range of mutually beneficial initiatives, such as contracting Sri Lankan services and goods to support U.S. military and commercial vessels that often transit the Indo-Pacific’s busy sea lanes.”

This is the third iteration of the temporary cargo transfer initiative.

It follows two successful transfers that took place in August 2018 at Bandaranaike International Airport and Trincomalee and in December 2018 at Bandaranaike International Airport.

The statement said U.S.-Sri Lanka security cooperation encompasses a variety of joint exercises and training that has developed the skills and interoperability of both countries.

https://economynext.com/U.S._Navy_doing_cargo_transfer_at_Sri_Lanka%E2%80%99s_main_airport-3-13221-10.html

ruwan326

ruwan326- Posts : 1744

Join date : 2016-09-29

Age : 46

Location : Horana

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

25 Jan 2019

The dealers of the Lanka Indian Oil Cooperation (LIOC) yesterday requested the Ministry of Petroleum Resources Development to increase the Ceylon Petroleum Corporation (CPC) fuel prices to the same price level of the fuel sold by the IOC.

The Ministry said that a special meeting was held between the IOC dealers and Deputy Minister Anoma Gamage at the ministry yesterday.

The filling station owners informed the deputy minister that due to the higher fuel prices at fuel stations, the IOC is incurring huge losses and that their sales had decreased by 75%. They also said consumers regularly accuse them of selling fuel for higher prices than that of the CPC.

Currently, the LIOC is selling a litre of 92 Octane petrol for Rs.131 and petrol 95 Octane for Rs. 150 per litre, which is Rs.8 and Rs. 3 respectively higher than the selling prices of the CEYPETCO.

During the meeting, it was revealed that at least 400 employees are working under more than 200 LIOC dealers. The dealers proposed the deputy minister to sell the fuel at the same prices in each fuel station after regulating the fuel prices through the Consumer Affairs Authority.

In addition to their proposals, they requested to name the petrol and diesel as essential commodities and also to protect the consumers’ rights by bringing the LIOC under the supervision of the Petroleum Ministry.

The Deputy Minister told the dealers that she would discuss the matter with the LIOC management and also with the Treasury.

The filling station owners informed the deputy minister that due to the higher fuel prices at fuel stations, the IOC is incurring huge losses and that their sales had decreased by 75%

https://www.pressreader.com/sri-lank...81767040432631

ruwan326

ruwan326- Posts : 1744

Join date : 2016-09-29

Age : 46

Location : Horana

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

Jan 28, 2019

Sri Lanka's rupee was quoted at 181.50/70 to the US dollar in the spot market in mid-morning trade Monday, while bond markets were flat, dealers said.

The rupee closed at 182.60/65 levels to the US dollar Friday, dealers said.

Bond were quoted mostly around the levels seen at closing time Friday, with active trading yet to start, dealers said.

A bond maturing on 15.12.2021 was quoted at 10.85/95 around Friday's level.

A bond maturing on 15.12.2023, was quoted at 11.35/45 percent.

A 7-year bond maturing 01.08.2016 was quoted at 11.52/62 percent.

A bond maturing on 01.06.2026 was quoted at 11.55/65 percent.

A bond maturing on 01.09.2028 was quoted at 11.58/68 percent.

At the Colombo Stock Exchange, the All Share Price Index was down 0.05 percent or 3.06 points to 5975.24 in the first half hour of trading compared to Friday's close.

The more liquid stocks in the S&P SL20 Index were up 0.44 percent or 13.32 points to 3059.55.

Market turnover was 23.5 million rupees.

Lanka IOC stock was down 1 rupee to 22.00 rupees, while HVA Foods was down 10 cents to 4.40 rupees, and Cargills Ceylon was down 3.70 rupees to 200 rupees.

Stocks of plantation companies were also down after getting hit by higher minimum wages.

https://economynext.com/Sri_Lanka_rupee_wider,_bond_market_quiet_in_early_trading-3-13263-3.html

කිත්සිරි ද සිල්වාTop contributor

කිත්සිරි ද සිල්වාTop contributor

- Posts : 9679

Join date : 2014-02-23

Age : 66

Location : රජ්ගම

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

කිත්සිරි ද සිල්වාTop contributor

කිත්සිරි ද සිල්වාTop contributor

- Posts : 9679

Join date : 2014-02-23

Age : 66

Location : රජ්ගම

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

ruwan326

ruwan326- Posts : 1744

Join date : 2016-09-29

Age : 46

Location : Horana

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

29 January 2019

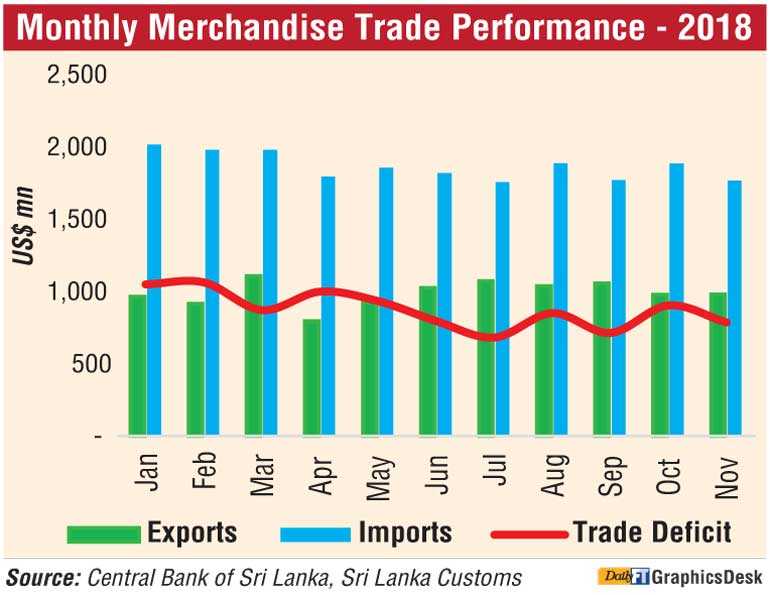

Expenditure on imports in November down 9.1% to $ 1.76 b

Personal vehicle imports drop 34.8%

Exports in November up 4.1% to $ 980 m

Twin development helps significantly narrow trade deficit

First 11 months imports top Rs. 20 b; Exports near $ 11 b mark

Restrictions and depreciation have triggered imports to report first ever decline in 17 months in November and help significantly narrow the trade deficit with exports improving by a modest 4.1%.

The Central Bank said yesterday expenditure on merchandise imports declined by 9.1% (year-on-year) for the first time since June 2017 to $ 1.76 billion in November 2018.

“The decline in consumer and investment goods contributed to the decline reflecting mainly the impact of restrictions on personal vehicles and non-essential consumer goods imports, while the relatively larger depreciation of the rupee may also have contributed to curtailing imports,” the Bank added.

Earnings from merchandise exports increased moderately by 4.1% (year-on-year) to $ 980 million in November 2018. The growth in exports was driven by industrial exports while agricultural exports continued to decline. The twin development saw trade deficit narrow significantly in November to $ 785 million as against $ 999 million a year earlier.

Exports in the first 11 months grew by 5% to $ 10.85 billion whilst imports were up 8.3% to $ 20.5 billion, resulting in the cumulative deficit expanding to $ 9.64 billion in comparison to $ 8.59 billion in the corresponding period of 2017.

Limits...

Terms of trade, which represents the relative price of imports in terms of exports, improved by 1.6% (year-on-year) to 112.8 index points in November 2018 due to an increase of export prices supported by a marginal decline in import prices.

In November under industrial exports, export earnings from textiles and garments increased notably in November 2018 mainly driven by exports to the USA. In addition, garment exports to non-traditional markets such as India, Canada and Australia as well as the EU market increased along with textile and other made up textile articles.

Earnings from petroleum products increased significantly in November 2018 reflecting higher bunker and aviation fuel prices despite a slight reduction in export volumes in comparison to that of November 2017. Export earnings from machinery and mechanical appliances also increased substantially during November 2018 due to improved performance in all sub-categories therein.

Further, export earnings from food, beverages and tobacco, rubber products and base metals and articles rose in November 2018, contributing towards the increase in industrial exports. However, export earnings from printing industry products, gems, diamonds and jewellery and leather, travel goods and footwear declined in November 2018.

Earnings from agricultural exports recorded a decline during the month due to poor performance in almost all sub-categories except the categories of unmanufactured tobacco and vegetables. Reflecting lower average export prices and exported volumes, export earnings from tea declined in November 2018.

Export earnings from spices also declined during the month due to the lower volumes in most categories of spices. Further, earnings from coconut exports declined due to the drop in both kernel and non-kernel products. Earnings from seafood exports also declined in November 2018 while in cumulative terms, seafood exports rose with higher exports to the EU market.

The export volume index in November 2018 increased by 2.9% while the export unit value index increased by 1.1%, implying that the growth in exports was driven mainly by the increased volume, rather than the price, compared to the volume and unit value indices in November 2017.

Import expenditure on consumer goods declined (year-on-year) notably in November 2018 due to lower expenditure on food and beverages driven by rice, vegetables, dairy products and sugar imports. Such reduction in imports on food and beverages can be attributed to the combined effect of lower import volumes due to higher domestic production and lower commodity prices in the international market. Expenditure on non-food consumer goods such as telecommunication devices and home appliances decreased in November 2018 on a year-on-year basis, partly due to measures taken by the Central Bank to restrict certain categories of non-essential consumer goods imports.

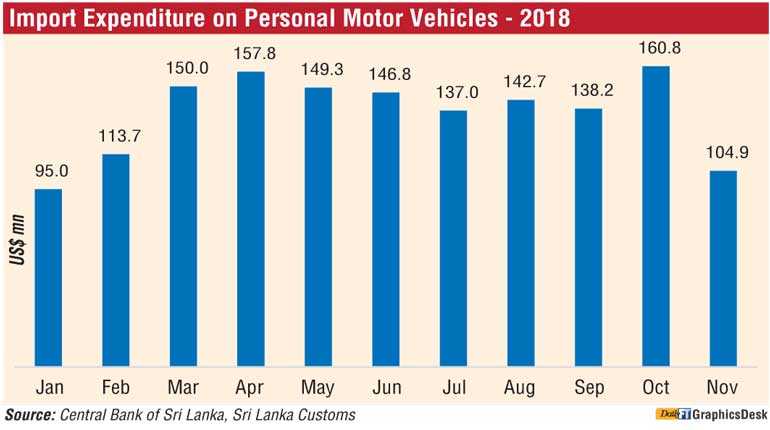

“Expenditure on personal vehicle imports showed a significant decline of 34.8% in November 2018 from the previous month, reflecting the impact of policy measures put in place to curtail personal vehicle imports. It is expected that the importation of motor vehicles and non-essential consumer goods could decelerate further in the coming months,” it said.

Expenditure on the importation of investment goods also decreased in November 2018 mainly due to lower imports under many sub-categories. Specifically, a significant decline was seen in expenditure on the importation of cement and vehicles for commercial purposes compared to November 2017.

In contrast, import expenditure on intermediate goods increased, albeit marginally, driven by fuel, base metals and fertiliser imports.

Expenditure on fuel imports increased with the combined effect of higher import prices and volumes of both refined petroleum products and coal, despite a reduction recorded in the import volume of crude oil. Meanwhile, expenditure on base metal imports increased driven by iron and steel. However, expenditure on gold imports continued to decline significantly in November 2018, reflecting the impact of customs duty imposed on gold in April 2018.

Expenditure on wheat and maize also dropped during the month mainly due to lower imported volumes. Import expenditure on mineral products and textiles and textile articles also declined during the month, contributing to mitigate the pressure on import expenditure.

Both import volume and unit value indices decreased by 8.6% and 0.5%, respectively in November 2018. This indicates that the decline in imports during the month was driven by the reduction in volumes imported despite lower prices of imported goods in comparison to the corresponding period of 2017.

http://www.ft.lk/top-story/Limits--depreciation-trigger-first-import-dip-in-17-months/26-671880

ruwan326

ruwan326- Posts : 1744

Join date : 2016-09-29

Age : 46

Location : Horana

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

January 30, 2019

The Sri Lankan spice sector is looking at expanding the sector with technological collaborations and investments following the Global Spice Road Symposium in Colombo in June.

The industry sources said, the spice industry representatives envision that Sri Lanka as a main spice country and the growers and the exporters will be able to benefit through technological collaborations and knowledge sharing sessions during the symposium. The main objective of this event is to create an upheaval in the main segments of spice, namely, Agronomy, Post Harvesting, Primary Processing, Technological Intervention and Value Addition, Export and Commercials.

Along with product quality, the hygienic factor of low quality spices augmented through the use of health hazardous chemicals, which in fact has been a negative factor contributing to the diminishing demand for Sri Lankan Spices.

According to the Global Spice Road Symposium Secretariat, the main challenges and constraints confronted mainly by producers and exporters will be addressed in the forum to secure a holistic approach to identify the most feasible solution.

The symposium despite being a private initiative has managed to gather sufficient momentum from the government sector, mainly the endorsements from President Maithripala Sirisena and Ministry of Agriculture.

Further collaboration with the main public agencies such as the Spice Council, Spice and Allied Product Producers’ and Traders’ Association, Export Agricultural Department, United Nations Food and Agricultural Organization and many academic leaders will be a part of the external committee to drive the main strategies and formation of the event towards its envisioned success.

The Global Spice Road Symposium will be held at the Bandaranaike International Memorial Hall from July 10 to 13.

The members of the Strategy and Planning Committee of the Global Spice Road Symposium Secretariat include Dr. Heenkende, Director General of Export Agricultural Department, Gulam Chathoor, Chairman of Saboor Chathoor Pvt Ltd, Manju Gunawardena, Chairman of The Spice Council, Prins Gunasekara, Chairman of The Spice and Allied Product Producers’ and Traders’ Association and Professor Buddhi Marambe, Chairman, Board of Study in Crop Science, Postgraduate Institute of Agriculture (PGIA), University of Peradeniya.

http://www.dailynews.lk/2019/01/30/business/175950/spice-sector-eyes-techno-collaborations-fresh-investments

nihal123Top contributor

nihal123Top contributor

- Posts : 6327

Join date : 2014-02-24

Age : 58

Location : Waga

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

ජෝන්සන් සහ ජෝන්සන් ට ශ්රී ලංකාවේ දොර වැසෙයි?

January, 31, 2019

ජොන්සන් ඇන්ඩ් ජොන්සන් ළදරු පුයර නිෂ්පාදිතවල පිළිකාකාරක ඇස්බැස්ටෝස් අඩංඟු බවට පසුගිය කාලයේ දී ඉන්දියාව ඇතුළු රටවල් කිහිපයකින්ම වාර්තා විය.

ජාතික ඖෂධ නියාමන අධිකාරියේ ප්රධාන විධායක කමල් ජයසිංහ විසින් රොයිටර් පුවත් සේවය වෙත පවසා ඇත්තේ මෙම ආනයන අත්හිටුවීම පිළිබඳව අධිකාරිය විසින් ජොන්සන් ඇන්ඩ් ජොන්සන් ළදරු පුයර මෙරට බලයලත් බෙදාහරින්නා වන ඒ. බවර් සහ සමාගම වෙත දැනුම් දී ඇති බවයි. එහි සඳහන් වන්නේ මෙම නිෂපාදිත මෙරටට ආනයනය සඳහා පිළිකාකාරක ඇස්බැස්ටෝස් අඩංගු නොවන බව තහවුරු කිරීමට තවදුරටත් පරීක්ෂණ කළ යුතු බවයි.

මේ අතර මෙම නිෂ්පාදිතය ආනයනය සඳහා ඒ. බවර් සහ සමාගම වෙත තිබුණු බලපත්රය පසුගිය දෙසැම්බර් මාසය අවසානයේ දී කල් ඉකුත් වී ඇති බව රොයිටර් පුවත් සේවය වැඩිදුරටත් වාර්තා කර සිටී.

මෙම තහනම පිළිබඳව ජොන්සන් ඇන්ඩ් ජොන්සන් ඉන්දියා සමාගම වෙත දන්වා ඇති බවත් නියාමන ගැටළුවලට අදාළ සියලු කරුණු ඉන්දියානු සමාගම විසින් සෘජුව මෙහෙයවනු ඇති බවත් මේ සම්බන්ධයෙන් අදහස් දක්වමින් ඒ. බවර් සහ සමාගමේ පාරිභෝගික භාණ්ඩ අංශ ප්රධානී ශාලුත පෙරේරා විසින් රොයිටර් පුවත් සේවය වෙත පැවසූ බව මෙම වාර්තාවේ වැඩිදුරටත් සඳහන් වේ.

ruwan326

ruwan326- Posts : 1744

Join date : 2016-09-29

Age : 46

Location : Horana

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

1 February 2019

Central Bank Governor Dr. Indrajit Coomaraswamy last week expressed confidence that Sri Lanka can manage the unprecedented debt repayment challenge, owing to a wide range of initiatives taken, but the long term solution is boosting export earnings and Foreign Direct Investments.

In his remarks at the American Chamber of Commerce (AMCHAM) Sri Lanka-organised fireside chat, the Central Bank Chief said that of the $ 5.9 billion foreign debt repayment outstanding in 2019, of which $ 2.6 billion is due in the first quarter, $ 1.7 billion was paid in January. Of the full year figure, $ 1.2 billion is on account of Sri Lanka Development Bonds (SLDBs), which would be rolled over, and a further $ 1.5 billion can be settled via the pipeline of bilateral and multilateral funding, whilst new sources of funding was required only for the balance.

In terms of new funding arrangements, Dr. Coomaraswamy listed a $ 400 million SAARC Swap with Reserve Bank of India with an option to enhance to $ 1 billion. A $ 300 million arrangement with the Bank of China with option to extend it to $ 1 billion as well as $ 1 to $ 1.5 billion facility from the China Development Bank. Additionally, the Cabinet has approved raising $ 2 billion via Sovereign Bonds, with a Panda Bond and/or Samurai Bond being among options.

He noted that that the 50-day political impasse in the country derailed the previously lined-up borrowing program and a more favourable pricing, as it was just after Sri Lanka managing a staff-level agreement with the IMF in terms of the Enhanced Fund Facility (EFF) program.

"The medium term challenge can be managed, though I would say we are actually buying time. The real solution is enhancing exports and Foreign Direct Investments," Dr. Coomaraswamy emphasised at the AMCHAM event, moderated by Stax Managing Director Dr. Kumudu Gunasekara.

He also said that apart from the foreign debt servicing, Sri Lanka's other challenge was growing domestic debt, with Rs. 980 billion raised by the Central Bank on behalf of the Government. This heavy borrowing by the Government, according to the Central Bank Chief, also prevents a reduction in interest rates.

The Central Bank directly lent Rs. 310 billion to manage its cashflow during the political impasse. However, the Government will repay the amount to the Central Bank by end February.

He said that the Government is renegotiating the IMF program to secure greater flexibility, keeping in mind the State's social commitments.

An IMF team is due on 14 February for a fresh round of negotiations, based on Sri Lanka's macroeconomic achievements as at 31 December 2018, as opposed to previous assessment capturing data only up to 30 June 2018.

According to the Governor, the Parliament’s approval of the Active Liability Management Act last year is a potential "game changer" , when it comes to managing the debt challenge going forward.

With regard to a question on the ballooning foreign commercial borrowing of Sri Lanka, the Governor responded saying it was owing to Sri Lanka progressing towards a middle-income nation, as previously, as a low income country, it benefited heavily from bilateral and multilateral concessionary loans, which were as high as over 60% of the total foreign debt. From 2008, the commercial borrowings have taken that share.

Dr. Coomaraswamy also clarified that the Central Bank is not artificially propping the exchange rate, nor defending any particular rate. However, it will not allow a disorderly movement either way.

Focusing on the prospects of the economy, the Governor said that favourable weather and relatively low oil prices, which have always been "feel good factors" for Sri Lanka, augurs well for the economy. He also stressed that under the previous regime, the country suffered owing to its anti-export bias, whereas the current Government is focused on a more export and FDI-oriented policy framework, with an aggressive push on Free Trade Agreements.

He also said that the Government wasn't keen to create artificial growth. "Sure we can create a boom, but it is usually followed by a crash, and this is evident from the fact that Sri Lanka todate has had 16 programs with the IMF," Coomaraswamy recalled, adding that creating a more robust growth framework was more important.

"The Government vision is clear, though implementation remains a challenge," he opined.

Nevertheless, the Central Bank Chief said 2019 GDP growth forecast is over 4%, and noted that the Sri Lankan private sector needs to step up, which is a pre-requisite for FDIs to follow suit.

Given the fact that 2019 is an election year, Dr. Coomaraswamy emphasised the need for fiscal prudence. "We are much closer to the precipice today than before," he added.

Panellist at the AMCHAM Fireside Discussion and Hemas Holdings CEO Steven Enderby in his comments also emphasised that drawing more FDIs is key, for which the economy needs to meaningfully open up with greater private sector role. He cited success in this regard by India and Bangladesh, who liberalised their economies long after Sri Lanka. "India and Bangladesh have succeeded in overcoming their challenges to boost exports and attract more FDIs. I personally feel there are lot more internal issues to resolve to be truly competitive," Enderby pointed out.

He said that THE sharp depreciation of the rupee in the last quarter of 2018 caused a huge impact on the private sector enterprises dependent on imported inputs, and consumer demand was dampened during and following the political impasse.

"When you talk to foreign companies or those in Singapore as to why would they want to relocate in Sri Lanka, the emphasis is That lower cost isn't a convincing argument but investors prefer political stability, policy consistency and greater efficiency which are strengths of Singapore," Enderby emphasised.

ned during and following the political impasse.

“When you talk to foreign companies or those in Singapore as to why would they want to relocate in Sri Lanka, the emphasis is That lower cost isn’t a convincing argument but investors prefer political stability, policy consistency and greater efficiency which are strengths of Singapore,” Enderby emphasised.

http://www.ft.lk/business/CB-Chief-says-debt-challenge-manageable-but-proper-fix-is-higher-exports-and-FDI/34-672068

ruwan326

ruwan326- Posts : 1744

Join date : 2016-09-29

Age : 46

Location : Horana

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

2 February 2019

From left: Essar Project UAE CEO Ramjee Ram Rajnandan, Managing Partner Riemersma Management Co. UAE Kier Riemersma, Megapolis and Western Development Minister Patali Champika Ranawaka, and Development Strategies and International Trade Minister Malik Samarawickrama at the ceremony yesterday – Pic by Chamila Karunarthne

Land leased for 99 years for Rs. 1.4 billion to investors from UAE

Rs. 30 billion mixed development project with office complexes, apartments and Light Rail Transport system

Battaramulla to be gazetted as a separate Municipality to promote it as administrative capital

In the latest effort to upgrade Battaramulla as the administrative capital, the Ministry of Megapolis and Western Development yesterday launched a Rs. 30 billion mixed development project in the heart of the town.

The venture aims to integrate a multi-modal transport centre that plans to locate all major administrative functions in the capital with investment from Riemersma Management Company (RMC)’s Essar Project on a public-private partnership basis.

The project will initiate its plans in a 415-perch land plot, with the Koswatta to Kaduwela main road running behind it and the Battaramulla to Rajagiriya main road running in front. It proposes to build two towers with 35 storeys and 26 storeys, the first allocating a net space of 20,000 square metres for government and private offices, and the latter with 250 standard apartments and 100 hotel apartments.

The project will also be part of a Light Rail Transport (LRT) system which will run from Kaduwela to Fort. In addition, the apartments will be priced targeting the employees in the area. The entire project is expected to be completed within the next five years.

“This mix development project, which was launched as a public-private partnership project, is an important milestone project for our Ministry. This project proposes to locate all major administrative functions within municipalities of Kaduwela, Sri Jayawardenapura Kotte, Urban Council of Maharagama, and Pradeshiya Sabha of Kotikawatta-Mulleriyawa, and integrate these identified areas of the administrative capital, and gazette and declare it as separate Municipal Council in the future,” the Minister of Megapolis and Western Development Patali Champika Ranawaka stated at the launch.

The lease declaration for the land plot, which was leased to Essar Project for a 99-year lease for Rs. 1.4 billion, was handed to the investors at the launch by the dignitaries. Speaking at the launch, RMC’s Essar Project Managing Partner Kier Riemersma voiced their gratitude for the opportunity given to participate in the development of Sri Lanka and detailed the plans the project holds.

“The most important aspect of this project in our perspective is the job creation and the economic development. We have long looked at Sri Lanka as a strong area for foreign direct investment. This project is the first step in that process,” he stated.

Speaking to Daily FT, Riemersma said the time frame for this development will be three and a half years with 12 months of design and engineering, which will be followed by the construction cycle of two and a half years. He explained that they are the development manager of this development project.

“We oversee the entire project, which includes putting the investment consortium together, procuring the design team, the engineering team, the construction company, the hotel operator as well as sales, leasing, and management for the project,” he added.

The project declaration of investment for the lease was handed over by the Minister of Megapolis and Western Development to the investors at the ceremony.

The Minister of Development Strategies and International Trade Malik Samarawickrama, Ministry of Megapolis and Western Development Secretary Eng. Nihal Rupasinghe, Ministry of Megapolis and Western Development Administrative Cities Development Project Director Srimantha Fernando, and other Ministry officials were present at the event.

http://www.ft.lk/front-page/Rs--30-b-mixed-development-project-for-Battaramulla/44-672175

spw19721Active Member

spw19721Active Member

- Posts : 683

Join date : 2015-08-22

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

ruwan326

ruwan326- Posts : 1744

Join date : 2016-09-29

Age : 46

Location : Horana

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

4 February 2019

To ensure the independence of every citizen, they must have economic independence in every segment of society, University of Colombo Emeritus Professor of Sociology Prof. Siri Hettige said recently.

Addressing a public forum on Sri Lanka’s independence last Tuesday and how it can be improved at the Centre for Society and Religion (CSR) organised by the Democratic Social Alliance, he said an individual could not be independent with an unstable economic background and such an individual would constantly struggle to economically stabilise himself.

“If people are hampered by debt and live in an unstable economic situation, we cannot call that particular person an independent individual,” he said.

He pointed out Sri Lankan citizens had to face challenges such as traffic congestion and an inadequate healthcare service, which raised questions about the independence of the citizens of Sri Lanka. Prof. Hettige noted that due to ever-increasing economic challenges, uncertainty had arisen over the happiness and self-fulfilment of the citizens of the country.

“If people are to enjoy economic independence, their economic challenges should have been resolved, but we don’t have such an economy in the country. We can observe that the Sri Lankan economy is distorted. The agriculture sector faces many challenges and sometimes farmers even tend to commit suicide due to the challenges they face.”

Prof. Hettige pointed out Sri Lanka had recently experienced internal migration from rural areas to urban and this trend should be taken into consideration when making policy adjustments to attain economic goals. He noted the driving force of the internal migration was economic independence and job opportunities in the urban sector of the economy.

Prof. Hettige argued that Sri Lankans had been facing economic challenges due to the lack of industrial diversification and export-oriented industries.

“When we consider the industrial sector, we do not produce most of the essential household goods. Therefore, we have to rely on imported industrial goods,” he added.

He said Sri Lanka had to break free from relying on the apparel sector as the only industrial product that has been successfully produced throughout the country’s history.

“We need to have a balance between the main three segments of the economy. We mostly rely on remittances to resolve issues pertaining to the trade deficit, but that has to be changed if we want to move forward,” he added.

Prof. Hettige raised concern over the lack of the research and development in Sri Lanka. He pointed out that investing in research and development would open more opportunities for Sri Lanka to develop its economy.

“Sri Lanka allocates a very small proportion of GDP for research and innovation. Therefore we have to increase the allocation to encourage research and development for new industries,” he said.

[url=http://www.ft.lk/front-page/Economic-independence-needed-for-true-freedom/44-672222]http://www.ft.lk/front-page/Economic-independence-needed-for-true-freedom/44-672222[/url]

ruwan326

ruwan326- Posts : 1744

Join date : 2016-09-29

Age : 46

Location : Horana

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

Feb 01, 2019

Sri Lankan banks have high credit risks due to slow economic growth, high credit growth and lax lending standards, ratings agency Standard & Poor (S&P) said in a report.

"The Sri Lankan banking sector's resilience is weak and is affected by the country's low income levels, with an estimated per capita gross domestic product of about US$4,050 in 2018," it said.

"Credit risk is high, in our opinion, given relaxed lending and underwriting standards as well as evolving risk management practices," S&P said.

"The credit risk is accentuated by high growth in credit in the past and a recent slowdown in GDP growth."

Bad loans increased to 3.6 percent of total loans in September 2018 from 2.5 percent at the start of 2018.

Weather disruptions which affected agriculture and related industries, along with bank's aggressive growth increased bad loans, S&P said.

The ratings agency is expecting bad loans to grow and remain around 4.5-5 percent of total loans over the next 12-18 months due to slower economic growth.

S&P said local banking regulations and supervision is lower than international standards.

Disclosures by banks are low but improving, it said.

However, industry risk is stable, S&P said.

https://economynext.com/Credit_risks_high_in_Sri_Lankan_banks__S_P-3-13325-17.html

ruwan326

ruwan326- Posts : 1744

Join date : 2016-09-29

Age : 46

Location : Horana

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

Tuesday, 5 February

The Government has increased the import tax on one kilogram of potatoes by Rs. 30 whilst increasing the import levy on one kilogram of maize by Rs. 20.

Accordingly, the total import levy imposed on a kilogram of potatoes is Rs. 50, while that of a kilogram of maize is Rs. 20.

Minister of Agriculture P. Harrison said the levy on imported potatoes was increased to help the local farmer as potato crops from Jaffna and other districts will enter the market soon.

http://www.ft.lk/front-page/Govt--hikes-tax-on-imported-potatoes--maize-to-help-local-farmers/44-672285

Ethical TraderTop contributor

Ethical TraderTop contributor

- Posts : 5568

Join date : 2014-02-28

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

ruwan326

ruwan326- Posts : 1744

Join date : 2016-09-29

Age : 46

Location : Horana

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

Feb 05, 2019

Ceylon Guardian Investment Trust and Ceylon Investment have announced they are considering winding up The Sri Lanka Fund, based in the Cayman Islands tax haven, whose aim was to attract foreign investments to the island.

The two firms hold 43.34 percent each of the dollar denominated fund, managed by Guardian Fund Management Limited.

A stock exchange filing said the decision was taken as “this investment vehicle is no longer an attractive structure.”

The Cayman Islands is considered a leading location for investment funds, estimated to house more than two-thirds of the world’s offshore hedge funds and nearly half of the industry’s estimated US$1.1 trillion of assets under management.

The stock exchange filing said The Sri Lanka Fund, an open-ended fund started in October 1993, was re-launched in August 2010 under the management of Guardian Fund Management Limited to attract foreign investors to the Colombo Stock Exchange.

The fund size was given as 2.23 million US dollars as at end-August 2018.

The top holdings were Cargills, Hatton National Bank, Ceylinco Insurance, Nations Trust Bank and Dialog Axiata.

About 43 percent of the fund was invested in the Colombo Stock Exchange’s banking, finance and insurance sector with 14.4 percent in conglomerates and 11 percent in the food, beverage and tobacco sectors.

As the fund is registered in Cayman Islands, which is a tax haven, capital gains and dividend income are not taxed.

https://economynext.com/Cayman_Island_based_The_Sri_Lanka_Fund_to_be_wound_up-3-13342-3.html

ruwan326

ruwan326- Posts : 1744

Join date : 2016-09-29

Age : 46

Location : Horana

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

6 February 2019

- Highest allocation of Rs. 393 b given to Defence

- Education Ministry Rs. 105 b, Health Ministry Rs. 187 b, Agri Rs. 114 b

- President’s Office given Rs. 14 b, higher by Rs. 3 b than 2018

- PM Office Rs. 2 b but National Policies Ministry allocation increased from Rs. 89 b to Rs.95 b

- Parliament approval sought to raise Rs. 4.5 trillion, budget deficit to be 3.5%

The Government moved the Appropriation Bill 2019 yesterday in Parliament, seeking House approval to raise and spend Rs. 4.47 trillion during the year. The motion seeks permission to meet capital as well as recurrent expenses of the Government, setting the borrowings limit at Rs. 2.16 trillion. The highest recurrent allocation of Rs. 393 billion is for the Ministry of Defence and the lowest of Rs. 185 million to the Non-Cabinet Ministry of Public Distribution and Economic Reforms. The Ministry of Education will receive Rs. 105 billion. The Highways and Road Development and Petroleum Resources Development Ministry has been allocated Rs. 176 billion, Health Ministry Rs. 187 billion, Agriculture Ministry Rs. 114 billion, Education Ministry Rs. 105 billion, Public Administration and Disaster Management Rs.263 billion, Provincial Councils and Local Government Ministry Rs. 292 billion, Megapolis and Western Development Ministry Rs. 50 billion and City Planning and Water Supply Rs. 127 billion.

The President’s Office has been given Rs. 14 billion, which is Rs. 3 billion higher than in 2018. The Prime Minister’s Office has remained the same, given an allocation of Rs. 2 billion, but the allocation for National Policies and Economic Affairs Ministry has been given a significant hike from Rs. 25 billion in 2018 to Rs. 98 billion in the latest Appropriation Bill. The Finance and Media Ministry was given Rs. 89 billion, which is a reduction from Rs. 95 billion from last year.

Accordingly, this year’s annual State expenditure will be Rs. 4.5 trillion and State revenue Rs. 2.4 trillion. State revenue which was 11.5% of GDP in 2014 has gradually increased after the Coalition Government came into power and is expected to be raised to 15.12% of GDP in 2019.

The National Budget for 2019 will be prepared under the Medium Term Fiscal Framework (MTFF) by adopting the performance-based budgeting approach with the aim of strengthening the ongoing fiscal consolidation programs, the statement added. The Government is also aiming to achieve the target of increasing State revenue to 17% and limiting recurrent expenditure to 15% of GDP by 2021.

Finance Minister Samaraweera’s second Budget will have some ambitious targets including maintaining the debt to GDP ratio to just 70% and limiting recurrent expenditure to 15% of GDP. Capital expenditure will also be limited to only 3.5% of GDP.

Sri Lanka’s debt to GDP ratios are likely to be closer to 80% as the Government will have to borrow to repay about $ 2.9 billion in 2019. Ratings agencies had earlier indicated that Sri Lanka’s debt to GDP ratios will remain higher than its peers in the short term as high debt repayments are likely to continue till 2022. Currently Sri Lanka’s debt to GDP is about 78%, according to the Central Bank.

The Appropriation Bill will be presented to Parliament by Finance Minister Mangala Samaraweera on 5 February and the Budget will be presented on 5 March. After the third reading the Budget vote will be taken on 4 April.

The Appropriation Bill 2019, gazetted on 11 January to provide for the service of the financial year 2019, seeks passage to authorise the raising of loans in or outside Sri Lanka, for the purpose of such service; to make financial provision in respect of certain activities of the Government during that financial year; to enable the payment by way of advances out of the Consolidated Fund or any other fund or monies of or at the disposal of the Government, of monies required during that financial year for expenditure on such activities; to provide for the refund of such monies to the Consolidated Fund and to make provision for matters connected therewith.

Appropriation Bill 2019 presented

ruwan326

ruwan326- Posts : 1744

Join date : 2016-09-29

Age : 46

Location : Horana

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

8 February 2019

The LMD-Nielsen Business Confidence Index (BCI) climbed 11 notches to register 101 in January, according to the latest edition of LMD.

This puts the index only one basis point shy of its average of 102 for the last 12 months. Nielsen’s Managing Director Sharang Pant explains: “Following two months of uncertainty, stability seems to be returning to the Sri Lankan political scenario. This has had a certain impact on [business] sentiment.”

Furthermore, he notes that “the rupee continues to slide due to dollar pressure but inflation is under control. Sentiment regarding the tourism industry is positive as well – this despite the short-term impact on tourist arrivals late last year.”

LMD reports that the economy, politics and corruption are considered to be among the main concerns for the nation. Meanwhile, the value of the rupee and inflation are the notable sensitivities in corporate circles.

“Sri Lanka is currently in a debt trap and the depreciation of the rupee is pushing the country further into debt. The authorities should act first on strengthening the value of the rupee; or else the economy will be adversely impacted,” observes one corporate executive.

Regarding the outlook for the index, a spokesperson for Media Services, the publisher of the leading business magazine, says: “It is anybody’s guess as to what the future holds for business and the BCI, given that the pre-constitutional crisis status quo has been restored to some degree, and that we may witness one or more elections this year.”

Media Services says the latest edition of the magazine will be released to leading bookstores and supermarkets on 8 February (for the full BCI report, visit www.LMD.lk).

http://www.ft.lk/front-page/Biz-confidence-improves-post-Supreme-Court-ruling/44-672479

nihal123Top contributor

nihal123Top contributor

- Posts : 6327

Join date : 2014-02-24

Age : 58

Location : Waga

Re: Thread for News on CSE and SL Economy

Re: Thread for News on CSE and SL Economy

මූල්ය සමාගම් දෙකකට කොටස් වෙළෙඳපොළ තහනම්

February, 8, 2019

2018 මාර්තු 31 න් අවසන් වර්ෂය සඳහා වන මූල්ය වාර්තාවෙහි වෙනස් කරන ලද ස්වාධීන විගණන වාර්තාව ඉදිරිපත් නොකිරීම, ද ෆිනෑන්ස් සමාගමේ කොටස් ගනුදෙනු අත්හිටුවීමට හේතු වී තිබේ.

මේ අතර නියමිත ආයතනික පාලන අවශ්යතා සපුරාලීමට අපොහොසත් වීම පීපල්ස් මර්චන්ට් ෆිනෑන්ස් සමාගමේ කොටස් ගනුදෙනු තහනම් කිරීමට හේතු වී ඇති බව කොළඹ කොටස් වෙළෙඳපොළ දැනුම් දී සිටී.

මෙහිදී කොළඹ කොටස් වෙළෙඳපොළ වැඩිදුරටත් කියා සිටින්නේ 2019 පෙබරවාරි 15 දිනට පෙර අදාළ අවශ්යතා සපුරාලීමට මෙම සමාගම් අපොහොසත් වන්නේ නම් 2018 පෙබරවාරි 19 දින සිට මෙම සමාගම්වල කොටස් ගනුදෙනු අත්හිටවනු ලබන බවයි.

Home

Home